Wireless is a good deal for consumers and getting better every year. Since the industry has collectively shifted back to offering unlimited plans, the inflation rate has been meaningfully impacted by the better deals the competition among carriers has created for customers. From April 2015 to April 2017, wireless plan prices have dropped by 12.9%. Perhaps an even more impressive stat is that during the last 15 years, the wireless inflation rate went above zero only five times, and of these five instances the highest increase in price was 1.2% year over year between October 2002 and May 2003. Normally, wireless prices decline between 0.5% and 5.5% per year according to data from the Department of Labor and the Federal Reserve.

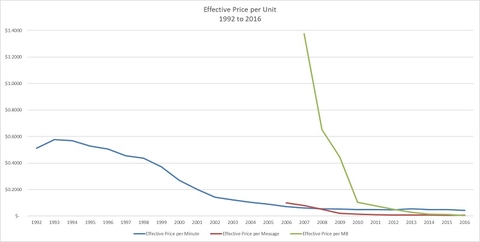

We have tracked this long-term trend of declining prices and calculated the resulting consumer surplus for more than 15 years. We have tried to stay consistent with our methodology by allocating about two-thirds of industry revenue to voice and one-third to data and messaging for the purposes of calculating the consumer surplus. Shifting the revenue split more toward data would decrease the decline in cost per MB while bringing down the cost per minute. Regardless of how we split the revenue, the story remains the same: Prices per unit have decreased dramatically and consumers have profited handsomely through increased power and utility.

Source: Recon Analytics, CTIA

Prices per unit have decreased over time, most rapidly evident with wireless data. The cost per MB has fallen from $1.37 in 2007 to less than half a cent in 2016. Messaging prices fell from 10 cents in 2007 to just over half a cent in 2016. The price of a voice minute has plateaued between 4 cents and 5 cents since 2008, falling from a high of 57 cents per minute in 1993. The advent of bundled unlimited voice, text and a data bucket combined with the advent of iMessage and texting apps such has Whatsapp, along with the fact that carriers no longer report separate revenues associated with voice, text and data, have complicated the calculation.

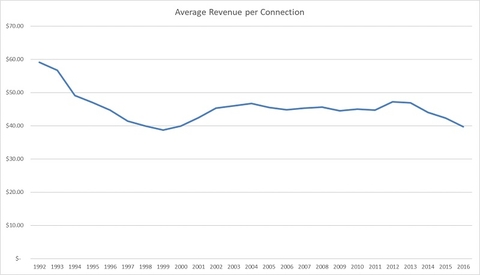

Source: Recon Analytics, CTIA

The price per connection has declined significantly over the last three years due to industry revenues basically staying flat over the last four years while connections, both to people and IoT devices alike, increased.

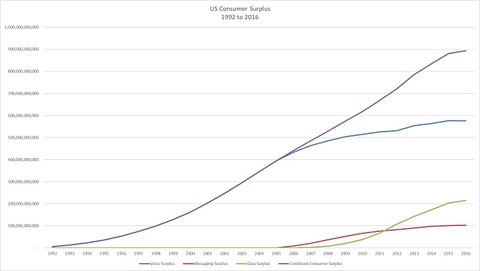

One way to quantify the benefits wireless consumers get from increased usage and falling prices is through something economists call the consumer surplus. The consumer surplus is the difference between how much people paid for a good or service in the past and how much they would have paid if they paid current prices. In the most basic and simplest terms, it’s the amount of money consumers saved due to competition and innovation. As prices decline and usage increases, the consumer surplus increases, too. The vast majority of industries do not have a consumer surplus, because the price per unit of what they are selling is constantly increasing or consumption is declining. Wireless is one of the few industries in which unit prices have generally declined while consumption has increased.

Source: Recon Analytics, CTIA

In 2016, the total wireless consumer surplus was $833.6 billion, an increase of $192.7 billion compared to two years prior. In 2014, the total consumer surplus was $640.9 billion based on a report we wrote on the impact of the wireless industry on the U.S. economy. The voice consumer surplus was $563.5 billion in 2016, compared to $435.5 billion two years prior, an increase of $128 billion. The messaging consumer surplus is substantially smaller at $97.5 billion. Still, it was an increase of $18.6 billion compared to $78.9 billion in 2014. Data consumer surplus was $172.6 billion in 2016, compared to $126.7 billion in 2014, an increase of $45.9 billion.

As video continues to grow on mobile and rampant competition continues unabated across all mobile services, we expect the consumer surplus to increase further. We also expect the intensity of competition to maintain even in the face of additional consolidation. This is because competition in the mobile industry is driven much more by the drive and competitive spirit of the executives in charge of the companies than models like the Herfindahl-Hirschman Index capture. Further, our experience with the U.S. mobile industry for the last 15 years has proven over and over again that intense competition across price, devices and network capabilities/reach continues in the face of consolidation, much to the chagrin of industry critics but much to the benefit of consumers.

Roger Entner is the founder and analyst at Recon Analytics. He received an Honorary Doctor of Science from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger Entner on Twitter @rogerentner.