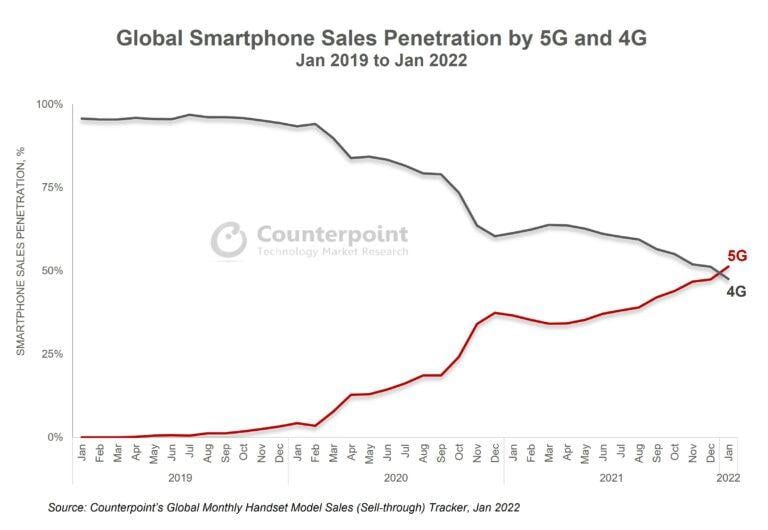

After a tepid start when 5G launched in earnest in 2019, 5G smartphone sales have ticked up and at the start of 2022 surpassed 4G phones for the first time, according to Counterpoint Research.

Samsung was first out of the gate for early 5G smartphones, with Apple waiting until October 2020 to release its first 5G-capable iPhone. And the iPhone-maker’s debut boosted adoption in North American (where it commands over 50% sales share) and Western Europe, according to Counterpoint, regions expected to keep substantially adding to global 5G sales with ongoing demand for 5G upgrades across the Apple smartphone user base.

“This demand is also fueled by iPhone users who are ready for new devices after years of holding on to their older iPhones,” wrote Counterpoint research analyst Karn Chauhan. “For many, holding periods are nearing four years, the average replacement cycle for iPhones.”

While 5G’s share of phone sales are up globally, inching past 4G to reach 51% globally in January, penetration was particularly high in North America where it reached almost three-quarters (73%), only slightly outdone by Western Europe at 76%.

Still, China’s 5G adoption leads the globe, standing at 84% in January. Counterpoint attributed this to both 5G pushes from operators and the availability of competitively priced 5G smartphones.

U.S. operators have been building out their 5G networks for the last few years and getting 5G-capable devices in consumers' hands continues to be a priority.

During recent investor events, executives from the three major carriers discussed 5G traffic, adoption, and upgrades.

T-Mobile President of Technology Neville Ray, speaking at Morgan Stanley March 9, said over 40% of its postpaid smartphone base is on 5G. And unsurprisingly, as more devices can leverage the network, the amount of traffic on 5G has also ticked up.

Ray said that T-Mobile is “very, very close to crossing 50% of our total traffic being 5G,” noting that just a year ago that figure was likely close to just 10%. He also suggested it’s much more than what rivals are seeing, saying if competitors (aka AT&T and Verizon) were asked, “I’d be intrigued by their responses on how much 5G traffic they have on their networks.”

During Verizon’s Investor Day, the carrier reported that consumer 5G postpaid phone penetration was at 34% the end of 2021, compared to just 9% a year prior. By the end of 2023 Verizon expects more than 60% of postpaid phones to be 5G – higher than its previous target of 55% – and grow to reach more than 80% by the end of 2025.

And so while it may have taken a few years for 5G phone penetration to overtake 4G globally, Verizon Consumer Group CEO Manon Brouillette pointed out that 5G represents “the fastest adoption of new technology for any G so far.”

On the business side 5G phone uptake wasn’t as strong for Verizon, but the carrier anticipates a large increase in the next few years.

“Our baseline for overall 5G phone adoption in 2021 was 18%, and we expect to see it jump to 80% by the end of 2025,” said Verizon Business CEO Tami Erwin, during the event.

Coinciding with 5G adoption is a targeted uptick in higher-tier unlimited plans that help drive revenues.

“5G helps to drive premium unlimited penetration as subscribers with a 5G device at 2.5x as likely to take a premium plan,” said Verizon CFO Matt Ellis during the investor day, according to a transcript.

Speaking at Morgan Stanley this month, Ellis didn’t disclose how much overall traffic is on its 5G network but said that with 60 MHz of C-band deployed in the initial 46 markets, the carrier is seeing good activity on the C-band portion where the spectrum is activated. Verizon is “seeing 5% to 15% or so of network usage already getting on the C-band,” he said.

He noted that customers who have a C-band-supported device in hand can tap the spectrum and are on a 5G plan that includes access. Before launching C-band, Verizon introduced competitive 5G smartphone promos, which in part was to help seed its base with phones ready to take advantage of the new frequencies.

Ellis also pointed to a second advantage of more customers on C-band 5G, saying “they’re using that [C-band], and that frees up more of the LTE capacity for other customers there. They’re getting a better experience. It also reduces our need to add LTE capacity as well.”

AT&T has been focused on attracting and retaining wireless customers with a pricing and aggressive promotional strategy. While executives didn’t discuss 5G adoption metrics specifically during its recent Investor Day, Jennifer Roberts, EVP and general manager at AT&T Mobility, said engaging in the upgrade cycle provides the chance to move customers to higher tier plans and sell add-on services like mobile insurance while customers move to the latest 5G devices.

“And we do this with affordable installment plans. In exchange, we gain value for trade-in devices, and we better insulate our base for market variables like price changes and the timing of network updates,”

She said with about 80% of postpaid voice base on installment plans, the carrier “increased upgrade rates to comparable industry levels” while delivering lowest postpaid voice churn of 0.76%.