According to a new forecast from research and consulting firm Strategy Analytics, global wireless service revenue will peak in 2021. “There is limited growth left in connectivity revenue for service providers,” the firm noted.

The firm’s prediction stems from its conclusion that wireless service providers have essentially squeezed all they can out of mobile subscribers, and that past the year 2021 there won’t be any way for such providers to raise customers’ monthly bills.

“Competitive pressure has defined the revenue growth of many countries in recent years, including France, India, and the USA, and wireless service providers are having to work increasingly hard to identify growth opportunities in wireless,” explained Strategy Analytics’ Phil Kendall, director of service providers for the firm and author of the report, in a release. Kendall noted that the launch of 4G LTE services—and the increased speeds they provided—allowed wireless network operators to charge more for their services, thus raising their revenues.

But, the firm said, that situation may not play out in 5G.

“With significant service provider focus on 5G, there are many unanswered questions relating to infrastructure costs and deployment strategies, and to how well service providers can unlock new revenue streams beyond basic connectivity services,” added Strategy Analytics’ Susan Welsh de Grimaldo in a release. She added though that China’s serious push toward 5G technology would help drive down the cost of 5G equipment globally earlier than is typical with new wireless technologies, which she said “will be encouraging for operators looking to execute on a clear vision of 5G consumer service opportunities.”

Nonetheless, the firm said that global wireless service revenue will peak in 2021 at $881 billion, which Strategy Analytics said is just 3% above its level forecast for 2018. The firm added that it expects a total of 9 billion wireless subscriptions by 2023—one for virtually everyone on the planet—up from 7.7 billion today. But the firm said that 5G will remain a small percentage of those totals—specifically, Strategy Analytics said that 5G connections will grow from 5 million in 2019 to 577 million in 2023 (excluding fixed wireless applications and industrial IoT). “These will account for 10% of connectivity revenue in 2023,” the firm said.

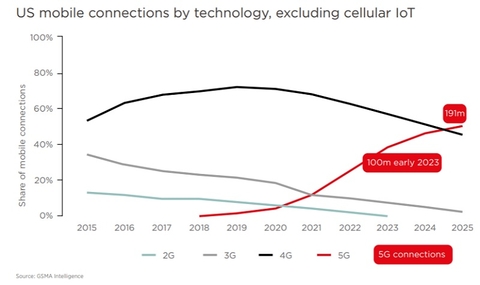

The relatively dour forecast on 5G from Strategy Analytics contrasts notably with the one recently provided by the GSMA’s research service, which specifically targeted the U.S. market for 5G and predicted that the country would lead in the conversion from 4G to 5G technology. “We forecast 5G adoption in the U.S. to grow as fast as 4G adoption did. The country will reach 100 million 5G connections in early 2023, about four years after launch. By 2025, 5G will become the lead mobile network technology in the U.S. with more than 190 million mobile connections, accounting for around half of total mobile connections. This forecast does not include 5G-based fixed wireless connections,” wrote the association in a new report. The GSMA advocates for the wireless industry globally and also hosts Mobile World Congress trade shows around the globe.

Part of the GSMA’s relatively rosy 5G outlook for the U.S. market stems from the outfit’s belief that 5G will allow wireless operators to derive more revenues from adjacent opportunities like the automotive industry and smart cities. “5G networks combined with IoT solutions could generate significant cost savings while opening up opportunities for new, innovative services,” the GSMA’s report stated.

Importantly, Strategy Analytics said its own 5G forecast largely ignores areas like fixed wireless and industrial IoT.