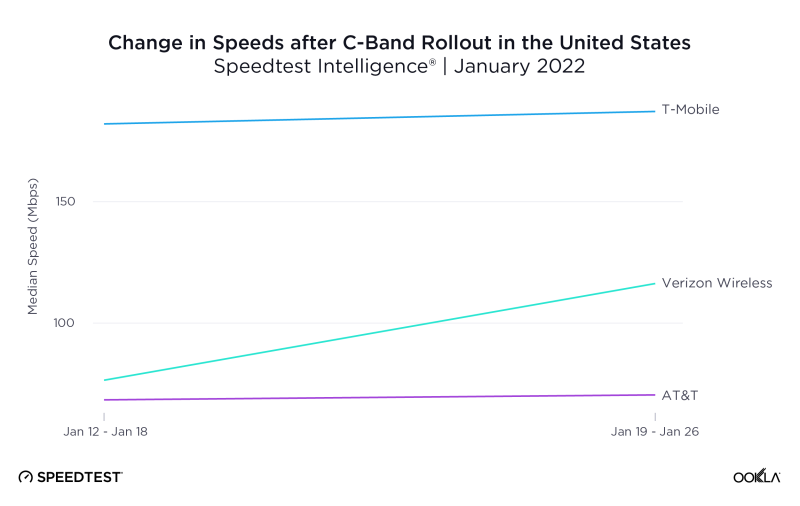

Ookla analyzed early 5G Speedtest results following recent rollouts of C-band and found major speed increases for Verizon as the carrier came out strong just a week after activating the new spectrum.

Overall, 5G median download speeds of operators combined jumped 13% week over week following the deployment of new mid-band spectrum. That was largely seen by a massive 50% boost to Verizon speeds following the January 19 launch, which resulted in median download speeds of 116.29 Mbps, up from 76.51 Mbps prior, according to Ookla.

T-Mobile and AT&T on a nationwide basis stayed relatively the same. That makes sense given AT&T’s limited C-band deployment in eight markets and T-Mobile which hasn’t turned on new spectrum (although it did add carrier aggregation capabilities). Even without new spectrum, it’s worth noting T-Mobile’s median download 5G speed increased 1% and at 187.11 Mbps was still faster than Verizon. AT&T’s similar 1% drove speeds to 70.46 Mbps.

“This massive improvement in speed shows the power of Verizon’s widespread deployment of C-band spectrum and C-band’s ability to deliver fast speeds,” wrote Ookla, adding that if the trend continues it could lead to the carrier challenging T-Mobile on the metric in the next report based on quarterly data.

Ookla pointed out that the testing company did see a spike in Speedtests initially, (noting that’s why reports usually have at least one quarter of data), particularly for Verizon and those who could see an Ultra Wideband icon show up on their phone for the first time.

RELATED: Verizon, AT&T get FAA clearance for more towers to deploy C-band

Ookla also looked at week on week performance in five cities where AT&T and Verizon both turned on new mid-band in the 3.7-3.8 GHz range. Verizon download speeds saw double-digit increases in two cities: Fort Worth, Texas, up 21 %; and Jacksonville, Florida, up 28%. AT&T saw 5G download speeds jump 12% in Austin. The other two cities of Chicago and Houston didn’t record bumps, and the latter actually decreased from a high for Verizon the prior week. T-Mobile still significantly outpaced AT&T and Verizon in all five cities.

Verizon has already expanded its C-band coverage, announcing Monday that it hit 100 million PoPs, up from 95 million the week before.

In Chicago, testing from PCMag showed AT&T’s C-band activation tripling average speeds (reaching 302 Mbps) compared to the carrier’s performance in the rest of the city. Granted, that was based off of one site located on Chicago’s South Side – the only one the outlet could track down driving across the city.

PCMag testing in New York City neighborhoods the week of C-band launches showed Verizon peak download speeds of 733 Mbps, with a median of 534 Mbps in the best performing areas and medians of around 100 Mbps in the worst performing.

AT&T, T-Mobile played smart at mid-band auctions – analyst

For Verizon, the almost immediate speed increases show that the carrier’s bid to obtain a greater amount of early A-block C-band licenses is paying off for those paying attention to speed tests.

Roger Entner, principal and founder of Recon Analytics, wasn’t surprised by the quick improvement Ookla showed, noting much of the carrier’s base was already seeded with 5G phones capable of tapping C-band as recent generations of iPhones and flagship Samsung phones support the airwaves.

“You had [C-band support] in your phone, you just didn’t know it because the network was missing,” he said.

Seeding the base with C-band capable smartphones was something Verizon executives had planned for with earlier 5G upgrade promos as they geared up for the rollout.

RELATED: Verizon 5G phone promo good opportunity ahead of C-band, Dunne says

However, when it comes to competition with AT&T and T-Mobile – Entner believes T-Mobile is still feeling good about its mid-band head start, having also secured spectrum at both the C-band and recent 3.45 GHz auction (though not as much as its competitors at either) to not let the gap with AT&T and Verizon close too much. AT&T also bought 3.45 GHz licenses, an average of 40 MHz nationwide, spending around $9 billion. In addition to 3.45 GHz, AT&T holds around 40 MHz of the “A-block” C-band licenses.

From that perspective, “I thought both T-Mobile and especially AT&T played these two auctions very very smartly,” Entner said. “Whereas Verizon went for simplicity and paid the price for it.”

Verizon went big on A-block C-band licenses, which are the first available across the top 46 partial economic (PEAs) areas. It holds 60 MHz of the first C-band tranche, and spent over $45 billion for its total C-band winnings.

RELATED: AT&T, Dish top list of FCC’s 3.45 GHz auction winners

Eventually Verizon will have around 100 MHz of C-band in top markets and sometimes 200 MHz in rural markets, the latter which “will bode really well” for the carrier and its fixed wireless ambitions, Entner said.

“Whereas AT&T by not going gangbusters, probably saved $10-15 billion dollars” or in that neighborhood and still going to get 80 MHz nationwide from A-block C-band and 3.45 GHz “…so mission accomplished.”

Need for speed?

It’s also worth considering different motivations behind strategies, with Entner calling out Verizon’s desire to maintain its network leader standing and perception.

He highlighted that Verizon has been competing on perception (and often times fact) of best network for the last 10-15 years, and its “something they were desperate to get back through the C-band auction.” And while its C-band winnings gets Verizon close to what T-Mobile had from a mid-band spectrum perspective, customers already still feel Verizon has a top notch network.

Based on a monthly survey that Recon Analytics conducts of 3,000 wireless, “the network perception of Verizon is still head above shoulders that of the other two nationwide providers,” Entner said particularly among the carrier’s own customers. “And Verizon will continue to play at that.”

AT&T on the other hand, was looking at which use cases actually require the kinds of speeds now possible with additional spectrum (as Ookla results showed for Verizon), of which Entner said there aren’t that many that need more than 25 Mbps other than streaming 4K video. He sees two different goals of playing to speed test audiences and being competitive overall.

“Just like T-Mobile has shown for a really long time, and AT&T is showing now, you don’t need to have the fastest network to win the most customers,” Entner said.

RELATED: T-Mobile’s 5G head start shows in latest Opensignal report

AT&T has been posting big subscriber figures for several quarters, including the most recent Q4 where it added 884,000 postpaid net phones. Verizon’s added 558,000 net postpaid phones in Q4 while preliminary metrics from T-Mobile put net phone adds at 844,000.

As for 3.45 GHz and C-band deployment strategy, AT&T has said its going to deploy both spectrum bands simultaneously using one tower climb once dual-band radios are available later this year. That pushes its timeline out somewhat farther than Verizon which already covers significantly more people with C-band than AT&T.

But Entner said AT&T’s one climb strategy makes a lot of sense because the carrier is already winning customers without having the fastest network.

“[AT&T] is doing well as it is and there’s no app right now that actually demands all these speeds,” he commented. “So you can do things fast or you can do things smart and they’re doing it smart.”

RELEASE: AT&T plans to deploy 3.45 GHz, C-band with ‘one-climb’ tower strategy

He said it means AT&T could launch with 80 MHz and end up having more mid-band 5G spectrum online nationwide before Verizon, potentially having a faster network in much of the country for a short period of time before Verizon’s additional C-band is ready to be activated.

And when it comes to using one tower climb to deploy both 3.45 GHz and C-band, Entner said T-Mobile can do exactly the same thing, where the equipment or spectrum will just become activated a little bit later once the second tranches of C-band, not expected until 2023, are ready for use.

That is unless, of course, drama with the FAA that preceded the initial C-band launch kicks up again before that round of deployments.