One of the hottest topics in the wireless industry right now is whether fixed 5G will be able to replace wired connections like DSL, DOCSIS or fiber. The motivation behind this question is obvious: 5G operators might be able to beam high-speed wireless services into wired rivals’ homes (literally going over the top) to steal broadband internet customers away from providers like Charter and Comcast.

A wide range of tests and reports by wireless carriers and vendors have found plenty to get excited about in 5G—there’s lots of slideware featuring blazing fast speeds and limitless potential. But a new report from two leading players in the cable industry offers a decidedly more pragmatic picture of the fixed 5G space.

The new report, available in full at the end of this column, was authored by executives at Arris (one of the top equipment vendors in the U.S. cable industry) and CableLabs (the research consortium for the global cable industry). It’s tantalizingly titled “Can a Fixed Wireless Last 100m Connection Really Compete with a Wired Connection and Will 5G Really Enable this Opportunity?”

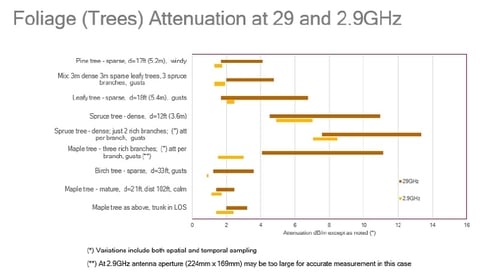

In roughly 50 pages, the report looks at a wide range of fixed 5G scenarios, including spectrum bands ranging from the 3.5 GHz CBRS band to the 70 GHz millimeter wave band, as well as line of sight (LOS), near line of sight (nLOS) and non-line of sight (NLOS) deployments. It even has a section on different kinds of trees and how they affect transmissions in various spectrum bands (pine is much more lenient toward wireless than spruce, turns out).

I’m going to dig into some of the more interesting findings, including a cost comparison between fiber deployments and fixed 5G deployments, a little later, but first let’s cut to the chase: “We have come a long way in the drive to 5G—but as the saying goes—there is still a long way to go,” concludes the report. “As cable operators move Fiber Deeper going to an all passive coax network, the ability to deliver multiple Gbps of capacity to a single home, seems an easier path than building out a FWA [fixed wireless access] millimeter wave architecture.”

Basically, the report concludes that fixed 5G can deliver pretty fast speeds, but that it’s significantly hampered by interference issues, coverage challenges and backhaul and deployment obstacles. It predicts that fixed 5G services might initially be used to deliver services into apartments and other so-called MDUs (multi-dwelling units), and that cable operators might consider using it to reach specific locations more quickly while they build out fiber connections. But Arris and CableLabs definitely don’t present fixed 5G as the panacea that some in the wireless industry have—and they’re not recommending that cable operators immediately switch over to 5G.

The vagaries of 5G spectrum

Although the millimeter wave spectrum bands (generally those above 28 GHz) were initially targeted for 5G deployments, T-Mobile, Sprint and others are now pushing to deploy 5G in bands 6 GHz and below. Indeed, T-Mobile has said its 5G deployment, kicking off in 2019, will go all the way down to 600 MHz.

However, lower spectrum bands generally transmit less data across farther geographic distances, while higher spectrum bands transmit more data across shorter geographic distances.

For cable players specifically, the 3.5 GHz CBRS band has generated a significant amount of attention, with Charter detailing its wide range of fixed wireless tests in the band. In their report, Arris and CableLabs noted that the 3.5 GHz band can provide “100s of Mbps of broadband capability” in NLOS conditions at distances up to 800 meters—and those speeds could be raised to up to 10 Gbps through channel aggregation of the full 70 MHz available in a licensed scenario.

Despite the burgeoning possibilities in the 3.5 GHz band, the report concludes that lower spectrum bands like 3.5 GHz simply won’t be able to keep pace with consumers’ growing demands for data, and will likely be used for backup connections. “For Fixed Wireless Access to be able to compete with Wired Solution, it has to be able to provide Gbps peak rates on both the Downlink and the Uplink. To achieve these peak data rates in a Wireless Access network the only wireless bandwidth available with sufficient contiguous spectrum to meet 3+ Gbps SG [service group] downstream service—if the spectral efficiencies remain under 10 bps/Hz—lies well into LOS-delivered (and near millimeter wave) frequencies (28 GHz, 37 GHz, 39 GHz, 60 GHz and 64-71 GHz). These frequencies offer huge amounts of bandwidth (the unlicensed bands alone in the 60 GHz range can deliver 128 Gbps),” the report states.

“But these frequencies present some clear technical, operational, and aesthetic challenges,” the authors add.

Millimeter-wave opportunities and obstacles

Although they have been long neglected, millimeter-wave bands have gained substantial notoriety in recent years. Indeed, Verizon and AT&T have spent several billion dollars this year acquiring millimeter-wave spectrum licenses.

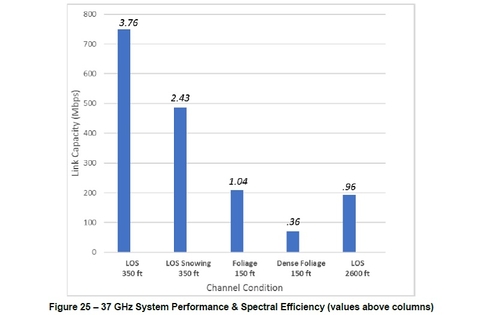

And for good reason: As the report points out, speeds in millimeter wave transmissions can seem almost magical. “Link capacities of approximately 750 Mbps were achievable in LOS conditions, which were degraded to just under 490 Mbps in adverse weather conditions,” the report states, citing CableLabs tests of transmissions in the 37 GHz band. “Also of particular interest was the maximum link length that can be achieved to deliver service where a LOS link extending approximately 2600 feet while delivering nearly 190 Mbps was demonstrated.”

However, the report outlines the significant challenges players face in deploying millimeter-wave systems. In its 37 GHz tests, CableLabs found that speeds decreased to around 200 Mbps at 150 feet if signals have to travel through foliage – and those figures slow to below 100 Mbps at 150 feet in dense foliage.

Rain, snow, wind, window tinting, moving vans and other commonplace objects can all conspire to dramatically reduce the effectiveness of millimeter wave transmissions. “The impact of deciduous and conifer trees (under gusty wind conditions) suggest that the leaf density from the conifer more frequently produces heavy link losses and these, more so at higher carrier frequencies,” the report thoughtfully notes.

The bottomline

But what does this all cost? And is 5G cheaper than fiber?

According to the report, which cites statistics from fiber supplier Corning, it costs around $1,153 to deploy fiber to the U.S. average household in a “dense” area, defined as roughly 880 households per square mile. That figure rises to $2,050 per household less dense areas, where there are 175 households per square mile. And in areas where there are only 72 households per square mile, it costs $2,499 to connect each household to a fiber connection.

In comparison, the report offers two options for 5G:

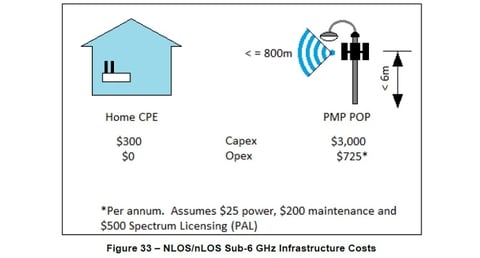

- In a 3.5 GHz deployment, a 6-meter tower broadcasting a signal 800 meters would cost roughly $3,750 plus around $300 for the receiver inside customers’ homes.

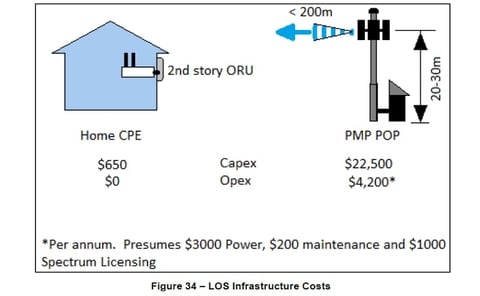

- In a millimeter-wave deployment, a 30-meter tower broadcasting a signal 200 meters would cost roughly $26,700 plus around $650 for the receiver inside customers’ homes. The millimeter wave deployment figures presumably assume a taller tower in order to avoid interfering obstacles like trees that wouldn’t necessarily affect lower bands like 3.5 GHz.

Obviously, the key calculation here is how many customers could be served within the coverage area. “It is important to note that the POP costs may be amortized over the client population targeted by the service group (i.e., if the wireless service group population is 50 clients, the $3,725 annual cost is ~ $75/client),” the report notes.

It’s worth noting here that most wired internet providers that offer 1 Gbps services sell it for around $70 per month.

Now, to be clear, this is just one report out of probably hundreds, or even thousands, on the topic. The reason it’s noteworthy is because Arris and CableLabs don’t necessarily have skin in the game; they’re primarily trying to inform cable companies what their options are in the 5G world. Thus: “given that 5G POP/Small Cells require wired backhaul, the potential for the MSO to leverage its network for mobile 5G seems to be a more complimentary investment. In discussions with MSOs, who are also MNOs, they struggle now to see a FWA solution to deep residential deployments.”

This is also probably why companies like Starry and Verizon appear to be targeting dense urban environments—places where MDUs like apartments are common—for their initial fixed wireless millimeter wave deployments.

But it’s also worth pointing out that a number of companies outside dense urban areas are also moving full steam ahead with fixed wireless. For example, regional operator C Spire recently announced it plans to deploy fixed wireless services to up to 200,000 customers in Mississippi and elsewhere using a variety of technologies and spectrum bands, and is initially selling uncapped 25 Mbps speeds at $55 per month. The company plans to boost those speeds as technologies improve.

Thus, as is explained in the report, it’s still early days in 5G. Fixed applications in millimeter wave bands are some of the first applications of the technology, but that’s certainly not the only application. And advances in MIMO, beamforming, edge computing and other, related technologies may well push 5G calculations into more appealing territory.

Nonetheless, it’s definitely worth looking at 5G with a clear pair of eyes. — Mike | @mikeddano

Article updated Nov. 13 to clarify costs.