What’s the best business model to encourage Industry 4.0 and enterprise automation using 5G technology? That’s an open question in the market right now, and there are two major market segments that are taking completely different approaches.

In Western markets, we have a trend toward open network architectures, open platforms for edge computing, and a fluid marketplace for applications to run on the MEC server. The idea is to drive the cloud down to the local level and to allow the enterprise to choose the best solutions.

The development of this full market ecosystem takes time, but it’s underway. This year, we’ve seen some very encouraging milestones with hundreds of private networks deployed by companies like Nokia, Fujitsu, Ericsson and Airspan. We have edge cloud solutions that fit into multiple different business models, so that the server can be deployed on premises or in a local network site. Each vertical market will likely choose a slightly different compromise between full control vs. cost-sharing between multiple users and apps.

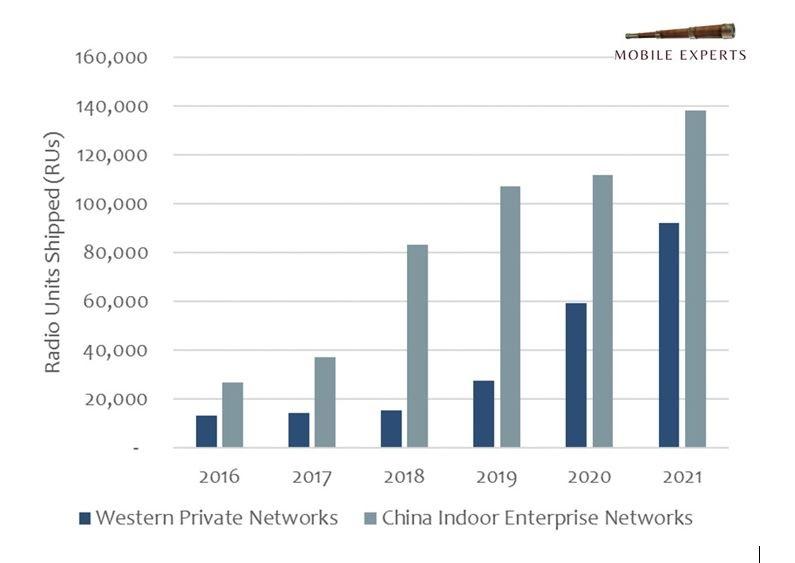

And the Western market is taking off. We’re tracking about 100,000 radios to be deployed this year for private cellular networks. That’s a huge jump. Just three years ago, the annualized run rate was about 15,000 radios per year.

In China, we have a completely different model. In fact, this is one case where China is positioned well ahead of the Western market. The state-owned mobile operators in China have been deploying private LTE and 5G networks in coal mines and seaports and hospitals and retail stores all over the country for the past five years.

We estimate that the Chinese operators have deployed more than 4 million indoor radios during the past five years, to cover a combination of public spaces (shopping malls, airports and office buildings) and private areas (coal mines and seaports). If we cut out the shopping malls and office buildings (which benefit the enterprise but also serve the general public), and focus on networks dedicated to private spaces like coal mines, seaports and railway controls, we are left with about 500,000 radios over the past five years.

In our Private LTE/5G research, we count very few of these Chinese radios as “private networks” because the units are controlled by the operator and the enterprise data flows through the operator. In fact, it’s difficult to distinguish between a radio that covers a China Mobile subscriber in the shopping mall and a radio covering an automated forklift in a warehouse. In both cases, the data flows through the operator and their edge cloud. SIM cards and other provisioning is done through the operator. The operator has control over the entire process.

The advantage of the Chinese business model is that they can move fast at scale. Indoor radio deployment is higher in China because the state-owned operators have no constraints on investing more money, and the private enterprises that they’re covering don’t need to invest money or do anything … they just open the door and let the government/operator in.

The downside of China’s approach is that the enterprise doesn’t get to choose very much about their solution; the devices, network, spectrum and edge computing are set by the network vendor and the state-owned operator. It may not be the right solution, but the enterprise has no choice.

The Western model works differently. In the USA, generally the operators expect the enterprise to pay for a private wireless service. The service can be dedicated radios on a private frequency band, or it may be a slice of the operator’s network. In either case, we expect the enterprise to have ultimate control of user access, not the operator. Also, the edge computing platform will be a separate decision for the enterprise. In many critical business verticals, we don’t expect the network vendor or the operator to have any access to the enterprise data.

Most importantly, the enterprise will have much more control over the edge computing platform that is chosen and the applications that run on the computing stack. In the West, we expect edge computing evolution to result in a freewheeling platform with a lot of apps to choose from. In the end, cost is likely to be much lower in the Western approach.

All of this fits a pattern that we have seen before: In China we have a state-controlled process. The benefit is that they can move fast, and state funding can directly benefit businesses for quick results. In the West, we have a grassroots market growing that will use a Darwinian approach to develop the best solutions. It will take a bit longer, but in the end it looks like the Western model will offer a more innovative and business-friendly approach.

Joe Madden is principal analyst at Mobile Experts, a network of market and technology experts that analyze wireless markets.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not represent the opinions of FierceWireless.