Everyone else has it all wrong — Wi-Fi and 5G must work together. That is what Cisco said when it introduced its private 5G offering at MWC 2022. And Cisco is not alone thinking the private 5G puzzle remains unsolved. AWS launched its private 5G service because it is not easy to set up a private 5G network with the existing solutions.

The entire private 5G RAN ecosystem has evolved rather significantly over the past year as new and existing RAN suppliers announce new solutions and services aimed at simplifying private 5G. With activity firming up both from a trial and ecosystem perspective, the timing is right to review the current market status and the private 5G RAN ecosystem.

The Asia Pacific region dominated the private wireless market in 2021, underpinned by China’s ambitious industrial 5G goals. Helping to explain this increased focus on private 5G in China are several key national directives: (1) The Made in China 2025 Initiative, which pushes for greater usage of industrial robotics and automation in 10 key strategic sectors, (2) The Internet Plus Plan, an initiative to transform, modernize, and equip traditional industries with more advanced technologies, and (3) Set Sail Action Plan for 5G Applications, which targets 3,000 private industrial networks and a 35% 5G penetration rate in large industrial enterprises by 2023.

Although the bottom-up approach in the U.S. market is not spurring as much growth at the moment resulting in lackluster enterprise CBRS investments, there are still reasons to be optimistic. Trial activity is trending in the right direction, and preliminary estimates indicate North America was the second largest private wireless RAN region in 2021, reflecting progress with industrial, non-industrial and public safety opportunities.

Meanwhile, the private 5G RAN ecosystem is expanding.

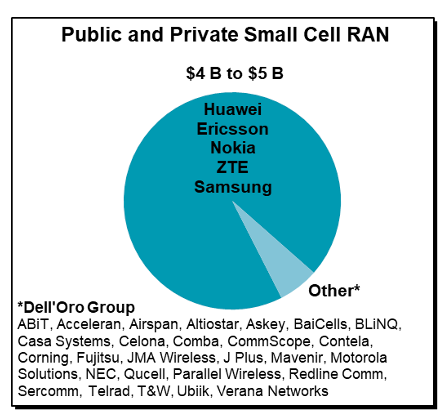

In addition to the existing RAN players announcing tailored private 5G solutions and services, new non-traditional RAN vendors, system suppliers and integrators are entering the space. For the RAN piece alone, there are now some 30+ vendors coming from different backgrounds targeting the private RAN vertical. Although the broader small cell vendor landscape remains concentrated with the top 5 vendors driving more than 90% of the market, the collective share of the top 5 suppliers is smaller with low-power base stations relative to macros, implying operators are more willing to use non-traditional RAN suppliers when it comes to small cells.

One of the principal questions going forward is if the small cell market will become more or less concentrated as the private component increases. One theory is that the expanded scope, the variety of use cases, and the plethora of private opportunities taken together with the reduced reliance on the existing macro site grid should provide an improved entry point for non-traditional suppliers, especially for the non-industrial segment.

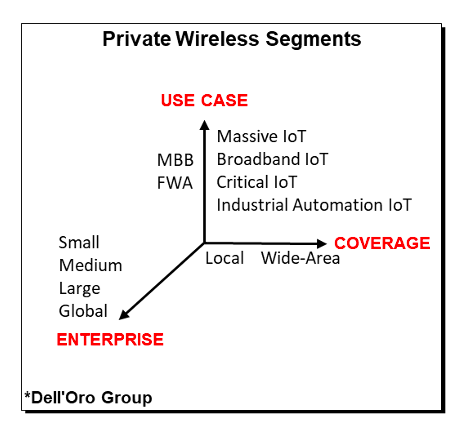

Diverging trends between the various private segments will also shape the vendor dynamics. After all, there is no one private 5G market. Instead there are multiple private 5G segments with vastly different coverage, performance and customer requirements.

Private wireless vendors

Though it is too early to draw any broader conclusions given that the private market is still in its infancy, it is of course interesting that multiple larger operators have already announced that they believe some of the new suppliers are ahead when it comes to bringing connectivity into the mid-market, targeting smaller enterprises. Verizon has explored multiple solutions and found that Celona’s 5G LAN technology is easy to scale downward, could be setup in hours, and straight-forward to integrate with the existing LAN.

Still, the traditional vendors are well positioned with high performance and larger private networks including mission critical and industrial deployments. Preliminary readings support this narrative as well - Huawei, Ericsson, and Nokia are all reporting some initial success with private industrial opportunities.

And perhaps more importantly, the RAN is just one piece of the private 5G puzzle. While there is limited data at this juncture to suggest that the average private RAN network as a share of total cost of ownership (TCO) will be materially different than the public RAN share (10% to 15% of total TCO), it is safe to assume that the value, the role and the importance of the RAN will differ significantly depending on the segment and the use cases.

In short, it is still early days when it comes to private 5G. But the opportunity is large and private 5G is projected to surpass $1 billion by 2025. Optimized private solutions and services will play an important role simplifying and accelerating private LTE and 5G. And if Cisco and AWS are right, it will be interesting to see how the private 5G ramp will impact the RAN vendor dynamics.

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.