The open RAN movement has come a long way in just a couple of years, surprising both proponents and skeptics. With early adopters embracing the openness concept and open RAN now on track to account for more than 5% of global RAN revenues in 2022, the early majority operator wants to understand if open RAN can deliver the same performance and total cost of ownership (TCO) as proprietary RAN. Or even better, can open RAN improve the TCO? And if so, how can open RAN save money or introduce cost efficiencies if the RAN is just a small part of the overall TCO?

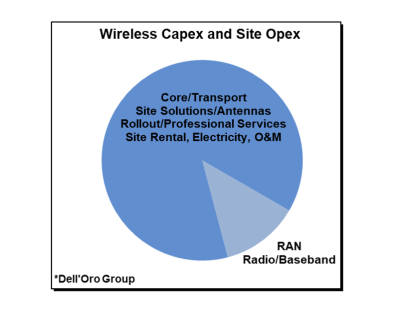

Based on our quarterly tracking of the broader mobile infrastructure market and telecom capex, we estimate RAN accounted for nearly a fourth of total wireless capex in 2021. This ratio was averaging closer to a fifth in the LTE era. But it is trending upward due to a confluence of factors. The reality is that cement, steel, services, and other equipment in aggregate are driving the majority of the capex. Meanwhile, cumulative site opex to support recurring costs such as transport and site leases, electricity, O&M, and other services are collectively fairly comparable in size to the capex component. Consequently, we estimate that RAN as a share of the combined capex and site opex is in the 10% to 15% range on average.

Can O-RAN compatible radios introduce any cost savings?

Factoring in the volume-discount sensitivity rates and conversations with a variety of participants in the RAN ecosystem, we believe it is unlikely that the 7.2x radio BOM will be smaller than the non-O-RAN compliant radio BOM with similar functional splits. Short-term and long-term cost savings are still possible, but they will be more driven by margin reductions than BOM savings.

Open RAN using traditional baseband does not change the DU cost structure much relative to proprietary RAN solutions (assuming all else equal), however Open vRAN based implementations do change the economics. Not surprisingly, the direct cost synergies with vRAN are at this juncture limited at best. If anything, there is still an expectation that the baseband portion relying on general purpose processors (GPPs) or hybrid GPP and accelerator line card combos will increase the RAN compute costs relative to purpose-built baseband. This gap was rather significant just a few years ago – some of the equipment vendors estimate it was closer to 10x in the 4G era (operators have also been open about the cost and energy benefits with ASICs).

This cost gap is now shrinking. New silicon solutions and accelerators, such as the ones announced by Intel, Marvell and Qualcomm, are promising cost (and performance) parity with purpose-built RAN. Since it is early days from a vRAN perspective with virtual RAN comprising a single digit share of the broader RAN market, operators are still learning about the tradeoffs.

Initial cost saving estimates shared by Rakuten are encouraging, spurring more operators to explore the potential long-term efficiency gains that virtualization and cloud-native architectures combined with automation can offer beyond the RAN equipment itself. They envision that increased site automation and crew reductions combined with the platform synergies enabled by leveraging the same hardware across various network functions will offset any integration cost increases and ideally not just deliver cost parity but maybe even some long-term savings.

Another cost saving opportunity is the consolidation insurance provided by open RAN. Open architectures can help to reduce the barrier-to-entry. However, they do not change the fact that RAN remains a scale game, and global suppliers still need double-digit RAN shares to maintain competitive portfolios. Given the consolidation activity over the past 20 years, one might be forgiven for thinking the M&A days must be in the past. But with the first “rip & replace” bill approaching $2 billion to swap out the Huawei equipment at a few thousand sites, operators will clearly need to consider the likelihood of more merger activity when estimating total investment requirements. Although there is still more work to be done to improve the plug-and-play aspects with O-RAN, it is safe to assume O-RAN compliance can help to simplify any potential swaps down the road.

With energy costs rising and electricity comprising 10% to 20% of the overall TCO, features that can improve the energy efficiency will be increasingly important going forward. On top of all the existing efforts to better align power consumption with traffic usage (Ericsson estimates the average cell site is only used 10% to 25% of the time), one aspect of the RIC vision is that it could play a role orchestrating energy saving features across the network, though the exact gains here from the RIC relative to other Intelligent RAN implementations remain uncertain at this point.

In short, expectations are different in the early adopter and the early majority phases. In order for open RAN to reach a broader audience, the architecture needs to deliver comparable or better TCO than proprietary and purpose-built RAN. Taking into consideration the extreme regional 5G BTS pricing disparities as evidenced by some of the rumored Massive MIMO pricing in the Indian 5G market, it is more salient than ever to understand the cost of the RAN and the potential efficiency gains beyond the RAN. Because anyone looking to just the upfront open RAN equipment capex to produce meaningful TCO savings might end up disappointed.

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.