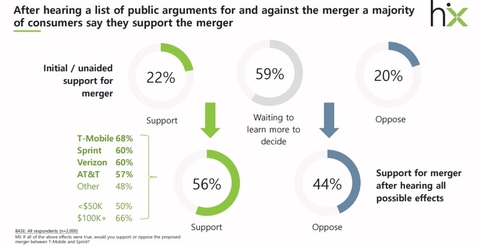

A new survey from market research and consulting firm HarrisX found that 22% of Americans support a merger between Sprint and T-Mobile, while 59% said they needed more information to decide on the topic.

And, when the firm presented a list of arguments for and against the merger that have been used publicly, fully 56% of respondents came out in favor of the deal.

“Importantly for the deal, over half current T-Mobile and Sprint customers believe the merger will result in a more reliable network, better value, and lower prices,” the firm wrote in a post on the survey. “Close to half of current subscribers also support the deal without government review.”

The firm’s full survey results are available here (PDF).

HarrisX said its results stem from an online survey of 2,000 U.S. adults over the age of 18 from May 4-5, the week the proposed transaction was announced. The firm said that it conducted the survey without financial compensation from any outside company, and that it conducted oversamples of Sprint customers (to reach a total of 539) and T-Mobile customers (to reach a total of 532).

RELATED: Sprint and T-Mobile to merge: Complete coverage

“Perhaps the strongest case for the merger comes from directly impacted T-Mobile and Sprint customers, who are also the most price conscious among post-paid subscribers. T-Mobile and Sprint are price leaders and can make a credible claim about using the merger to the benefit of their customers,” said Dritan Nesho, CEO of HarrisX and a researcher in the poll, in a post by the firm. “What we see from the findings is U.S. consumers are open to the benefits of a T-Mobile and Sprint merger, and the two companies have a real opportunity at convincing us of its merits. But consumers want more information and need to better understand the impact of new technologies like 5G. And, above all, consumers want prices to stay low.”

The results are noteworthy considering T-Mobile and Sprint executives are working to garner support from regulators and legislators for the transaction. The FCC, Department of Justice and CFIUS must sign off on the transaction for it to be consummated. Carrier executives have said they expect final approval for the deal by early next year.

Most Wall Street analysts don’t give Sprint and T-Mobile good odds to get their merger approved. For example, BTIG’s Walter Piecyk gave the deal a 40% chance of happening shortly after it was announced, while MoffettNathanson analysts gave it 50% odds. But the analysts at Oppenheimer gave it an 80% approval probability.