In April 2018, after many tries to come to an agreement, T-Mobile and Sprint announced their intention to merge. The $26 billion merger would leave Deutsche Telekom in control of the company with a 42% ownership, with Softbank owning 27% of the company (with Softbank’s voting rights permanently assigned to Deutsche Telekom) and small shareholders owning the remaining 31%. The New T-Mobile will be run by current T-Mobile CEO John Legere and most of his team.

To justify the merger, the New T-Mobile promises lower prices, outstanding service, greater value and even more competition. Furthermore, the company positions its commitment to rolling out 5G post-merger as second to none, claiming that the country won’t have nationwide 5G without the two companies merging.

Most merging entities tend to use hyperbole when trying to convince a regulator that their deal should be approved, but the T-Mobile/Sprint claims about their post-merger 5G network deployment merits a closer look. Not surprisingly, both Verizon and AT&T have a somewhere different perspective on the state of 5G deployment in the U.S.

Reviewing the merger website, I was surprised —and flattered—to discover that some of my research around 5G deployment was cited by the companies in their application for approval to the Federal Communications Commission. While I am generally in favor of consolidations that improve industry health, it is nevertheless important to look critically at the assertions the companies are making to determine if they are credible.

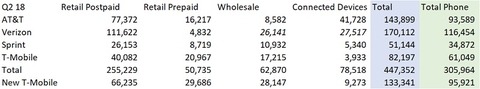

Q2 2018 Subscriber Numbers

As we can see from the table above, having three operators that are within 20% of phone subscribers compared to one another is a good thing. Consumers should benefit if three strong companies fight for customers with intense rivalry.

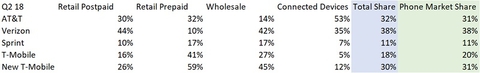

Lets look at the same numbers from a market share perspective.

In retail postpaid, the New T-Mobile has 26% market share, up 2% from the first quarter of 2018—the least of the three surviving nationwide operators. The combined entity will continue to trail AT&T and Verizon, but most likely will continue grow substantially faster than both competitors. Thus, it is conceivable that the New T-Mobile could surpass AT&T in postpaid subscribers in approximately one year.

Furthermore, the New T-Mobile would have 59% market share among carrier-branded prepaid subscribers. While I don’t think 59% market share is per se a problem, many anti-trust experts are likely to view such a dominant market position postmerger as problematic, especially given how hard it will be for the existing two competitors to grow their market share, and the virtual impossibility for a new market entrant to scale up.

In the wholesale market segment, the New T-Mobile would also instantly become the Number 1 player with a 45% market share compared to Verizon’s estimated 42% share. We’d have two strong competitors in the wholesale market, with AT&T a distant third. It’s reasonable for MVNOs to be concerned about the impact of one fewer facilitates-based network operator with whom to do business, and with the Top 2 operators (post-T-Mobile/Sprint merger) having a combined 87% market share. If New T-Mobile is not interested in working with MVNOs post-merger, the impact on the MVNO market would be significant.

Consider the Herfindahl-Hirschman Index (HHI), a popular modeling tool used by government regulators to assess the potential impact of a merger on competition. According to the Federal Trade Commission’s horizontal merger review guidelines (PDF) any merger in a highly concentrated market (HHI above 2,500) with an increase of the HHI between 100 and 200 points “raises significant competitive concerns and often warrant scrutiny.”

Mergers that increase the HHI by more than 200 points will “likely enhance market power.” According to HHI, calculations for the wireless segment (which is wireless voice, not the broader market of broadband), the HHI post T-Mobile/Sprint merger, with the exception of connected devices, will increase by more than 200 points. In Retail Prepaid, the HHI increases by 1,420 points.

Some points are also difficult to reconcile in the companies’ justification of the merger. On one hand, they claim that only the combined entity can bring 5G to America, but T-Mobile committed already to having a nationwide 5G network by the end of 2019. The 600 MHz spectrum that is going to be used for it is owned only by T-Mobile. Also, the company pledged to increase employees, lower prices, increase capital expenditure by roughly three billion dollars and increase profitability—all within one year.

At a gross profit of $40 per customer, a billion dollar gross profit is achieved by gaining 2 million customers, which is the low end of T-Mobile’s 2018 guidance. In order to be EBITDA-neutral, the New T-Mobile would have to grow by six million customers in 2019, roughly twice the rate at which T-Mobile and Sprint, combined, grew in 2017. The new T-Mobile may be able to hit some of its goals, but it will be very hard-pressed to make them all. For example, how will it lower prices simultaneously with increasing its network spend?

Clearly the proposed merger will increase concentration in the industry, with prepaid subscribers being especially vulnerable should the merged entity fail. There also seems to be a possible concentration problem in the wholesale market.

These are good and valid issues that the regulatory authorities need to review in depth. It is also imperative for the reviewing authorities to ignore the merging parties’ hyperbole and mischaracterizations around current and scheduled 5G network deployments. Instead, the FCC and any other reviewing authority should take a close look at what’s possible given market conditions and the track record of the merging parties to estimate precisely how much more 5G build-out consumers can reasonably expect from them.

Roger Entner is the founder and analyst at Recon Analytics. He received an Honorary Doctor of Science from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger on Twitter @rogerentner.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless. They do not represent the opinions of our editorial staff.