When unlimited mobile data plans were introduced, many people saw the move as a big risk for mobile operators. Can they really handle a heavier data load at a fixed price?

We’re looking into this question in detail, with a comprehensive analysis coming out in a month. Our short conclusion is that yes, the operators can pull through.

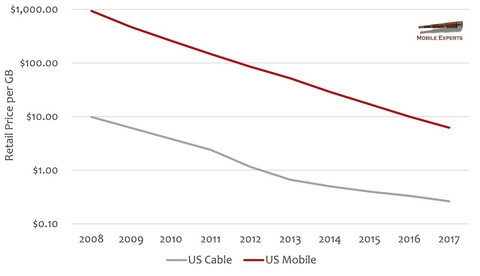

First, we’ve examined the retail pricing of broadband data. People generally pay between 20X and 100X higher prices for each GB of data via mobile, compared with fixed broadband. That’s normal, and the mobility premium has stayed pretty constant for the past ten years. These two curves are not likely to cross anytime soon.

Fred the Cable Guy might be patting himself on the back, thinking that his business is safe from competition. But I believe that things will change. Let’s look at a few “unlimited” mobile examples outside of the USA:

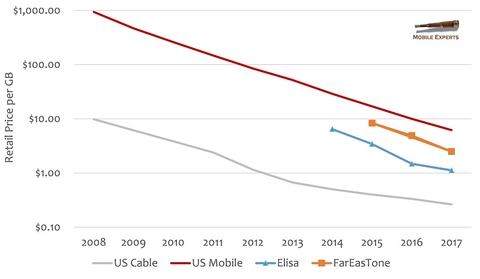

- Elisa is a leading operator in Finland that serves its mobile customers an average of 18 GB per month, almost triple the usage in the USA. Elisa’s mobile ARPU is only about $20, compared with the typical American mobile ARPU of $40 or more. So Elisa’s price per GB is only $1.12. The amazing part is that Elisa earns EBITDA in the 35% range.

- FarEasTone in Taiwan is another good example. With ARPU of $30 and 12 GB/month average data usage, their retail pricing comes out to only $2.50/GB. FarEasTone makes EBITDA of 25% or more.

It’s not really fair to compare American operators to their counterparts in Finland and Taiwan. I understand that the American legal environment makes everything cost 2x-3x as much as it should. But these companies provide a good example of the business model that lies in the future. The mobile network must handle higher levels of traffic without a corresponding increase in revenue.

What are these people in Finland and Taiwan doing with so much data? It’s video. They are watching TV shows and movies on their phones. Americans are starting to behave the same way, with Netflix on T-Mobile, Hulu on Sprint, and DirecTV on AT&T. This is an important case study, because video is growing to 75% of network traffic or more.

So, the question really comes down to this: Can mobile operators make a profit, delivering HD video content?

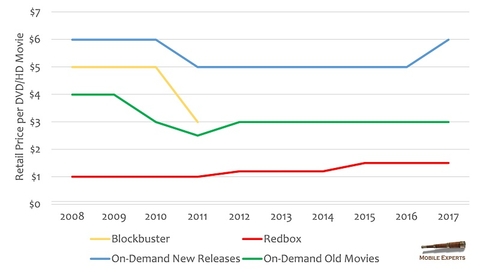

Here’s a simple example: Let’s say that we sit down on the couch together and decide to watch an HD movie. The cost to rent our movie will be about $3 for an older movie or $5-6 for a new release. This cost is not likely to change in the future, because unlike tech markets, media companies do not suffer from a suicidal urge to reduce prices every year.

Our on-demand movie requires roughly 5 GB of data and costs about $5. The operator needs to pay at about $1.50 for the movie content, so to make a profit, they need to deliver the whole movie for less than $1.20, or less than $0.24 per GB.

Some operators can support this kind of cost structure now. Sprint and T-Mobile have excess capacity on their networks due to low numbers of subscribers, so they’re offering this kind of video. Elisa and FarEasTone are very good at placing sites to maximize network utilization, so they can achieve very low cost. But most LTE operators spend at least $1.50 per GB to deliver data now, and need a 90% cost reduction to make this business case work.

Our analysis predicts that an all-new 5G NR network will cost between $0.10/GB (28 GHz) and $0.40/GB (3.5 GHz). Assuming that 5G NR can reuse some existing infrastructure, we can see a clear path to supporting the on-demand business case.

Yes, a cable operator has lower cost than the mobile operator and can reduce pricing on movie rentals. But cheaper doesn’t win in the movie market. Blockbuster went out of business, and Redbox is starting to lose share to the convenience of on-demand options. Below $5, convenience is more important than price. What’s more convenient than your smartphone?

My conclusion: When mobile operators can hit a cost target of $0.25/GB, they will reach a tipping point where they can steal the entertainment market.