The year 2021 was a lackluster one for Reliance Jio, the telecom arm of India's largest company, Reliance Industries. While the company continues to grow, the pace of growth has come down. Further, it needs to come up with a plan to boost its falling Average Revenue Per User (ARPU), let go of inactive subscribers and add high-value subscribers.

Last year, it created history when it acquired funding of more than $20 billion from several technology firms and investors, including Facebook, Intel, Google, Qualcomm and KKR, among others. The company further announced that it was going to come up with its own 5G stack, which it plans to sell in the international market after deploying it at scale in India.

RELATED: Jio tests in-house 5G radios, reaches 410M subs

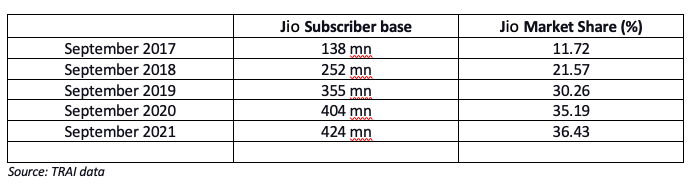

Jio's growth in the first four years of the launch is the stuff corporate dreams are made of. It added more than 100 million new subscribers every year for the first three years of its launch in September 2016. By September 2017, it had 138 million subscribers with a market share of 11.72%; 252 million users on its network by September 2018 (21.57 market share); 355 million subscribers by September 2019 (market share 30.26%); 404 million in September 2020 (35.19% market share) and 424 million in September 2021 (36.43% market share).

There is no denying that the company's growth is exceptional. Within five years of operations, it has become the biggest telecom service provider in the world's second-largest telecom market. Even so, one has to acknowledge that the pace of growth has slowed down. From adding more than 100 million for the first three years of operations, it added only 49 million from September 2019 to September 2020 and, more worryingly, just 20 million from September 2020 to September 2021.

Plummeting ARPU

A cause of bigger concern is the forever drop in ARPU. While its rivals, Bharti Airtel and Vodafone Idea, have stabilized their ARPU, Jio ARPU has been struggling.

As per the last September 2021 results, Jio reported an ARPU of INR 144 ($1.93), much less than its immediate rival, Bharti Airtel's ARPU of INR 153 ($2.09). Airtel recorded an ARPU of INR 146 ($1.93) in the June 2021 quarter, while Jio had reported an ARPU of INR 138.40 ($1.83) in the same period.

It becomes all the more dismal for Jio if one considers that it includes home and enterprise customers also in its ARPU numbers. This is not true for Airtel and Vodafone Idea.

RELATED: Jio made a big splash in India, now what?

One can argue that Jio's focus on adding subscribers is one of the reasons for this sad ARPU story. While Jio launched as a pure-play 4G operator (Airtel and others had limited 4G coverage at the time), it didn't focus on premium or high-paying subscribers. By launching free service in the first six months of the commercial launch, Jio was clearly trying to get as many subscribers as possible quickly. This led to a significant number of people using Jio as a second SIM while continuing with their regular service providers.

This positioning was further cemented with the launch of JioPhone in 2017, a value-for-money device offered practically free with a lock-in period. The main idea behind this was to help 2G subscribers upgrade to 4G as high smartphone price is a key reason why India still has more than 300 million 2G subscribers. JioPhone helped the company add to its growing subscriber base.

After much delay (because of global chip shortages), Jio launched JioPhone Next in early November this year in collaboration with the internet giant Google. While the sales numbers are still awaited, off-the-record conversations with industry leaders indicate that it hasn't set the market on fire like JioPhone.

The Mystery of Inactive Subscribers

Jio has always had a high percentage of inactive subscribers, and this is pulling its ARPU down. The company seems to be addressing this issue by removing inactive subscribers from its network. This is one of the reasons it lost 19 million subscribers in the month of September 2021. Further, Jio has also followed Airtel and Vodafone Idea and hiked the prepaid rates by 21%. These measures are likely to help Jio in boosting its ARPU.

RELATED: Jio hikes prepaid prices, denies interest in BT

However, the rate hike by all telcos also means that at least some percentage of subscribers who were using two SIMs will give up one. It also means that Jio's key unique selling point based on low price is no longer relevant. The company needs to differentiate in some other way to get new and high-value subscribers and boost ARPU.

There are other areas in which Jio has to catch up with the competitors. Bharti Airtel, which has a majority stake in OneWeb, a satellite service company, has taken a leadership position in the emerging satellite space in India, while Jio is conspicuous by its absence.

RELATED: Satellite majors SpaceX, Kuiper, OneWeb head to India to close digital divide

While Jio is working on its indigenously-developed 5G solution, little is known about it. Media reports indicate that it might be based on open RAN, but there is no confirmation from Jio. The delay in 5G spectrum auction in India means that Jio will have to postpone its plans to sell a 5G solution in the global market.

Jio was earlier in the news for the possible acquisition of T-Mobile in the Netherlands and, more recently, BT in the UK. It later denied any interest in acquiring BT. However, Jio has always been vocal about its global ambitions and is also flush with funds, so an international acquisition may be in cards for 2022.