The fiscal Q3 2022 results of India's largest service provider, Reliance Jio, and third-largest and struggling telco, Vodafone Idea, is a study in contrast and throws up interesting trends.

Vodafone Idea reported a loss of INR 72300 million ($971.7 million) in the quarter ending December 2021 in comparison with a loss of INR 45320 million ($609 million) in the same period a year ago.

On the other hand, Reliance Jio's profit rose by 8.8% to touch INR 3,7950 million ($510 million) in the December quarter on the back of growing data consumption.

Understanding ARPU growth and declining subscriber base

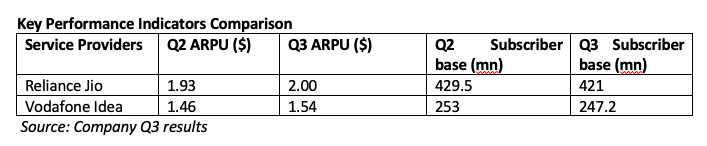

Interestingly, both Jio and Vodafone Idea reported an increase in average revenue per user (ARPU) while recording a loss in subscriber base.

Vodafone Idea's ARPU for the quarter increased by 5.2% to touch INR 115 ($1.54) from INR 109 ($1.46) in the previous quarter. For Jio, ARPU increased from INR 143.6 ($1.93) in Q2 to INR 151.6 ($2) in Q3 on the back of an increase in tariffs. This is mainly because of the rise in rates announced by all service providers in November last year.

RELATED: Jio hikes prepaid prices, denies interest in BT

However, both Vodafone Idea and Jio recorded a drop in subscriber base. Vodafone Idea lost 5.8 million subscribers in Q3 even as its 4G subscriber base increased marginally from 116.2 million in the second quarter to 117 million in the third quarter. "Data usage per 4G subscriber is now at ~14 GB/month vs ~12 GB/month a year ago," said Vodafone Idea in a statement.

Jio reported a fall in subscriber base for the second consecutive quarter even as it launched affordable smartphone JioPhone Next, which was likely to help it to gain new subscribers. Jio's subscriber base dropped by 8.4 million to touch 421 million. "This decline is mainly driven by subscribers with inconsistent engagement and lower-end subscribers," according to the Jio press release.

The reduction in the number of subscribers is not necessarily a negative for Jio and Vodafone Idea. It means that the quality of subscribers is growing since the average earning per subscriber is going up for the telcos.

In the third quarter, Jio toppled state-owned Bharat Sanchar Nigam Limited (BSNL) as the country's largest wireline service provider.

Jio starts 5G journey

Jio is working on 5G coverage planning, which has been completed for almost 1,000 top cities across the country. It is also in talks for trials for use cases in several verticals, including healthcare and industrial automation, as per its press release.

The company is currently running 5G trials in several parts of the country. In addition, Jio is enhancing its fiber network across the country.

The company has initiated partnerships as well as set up technical teams in Europe to develop long-term capabilities, says Jio's President Kiran Thomas.

Jio was in the news recently for partnering with the University of Oulu to advance the development of 6G ecosystem.

Vodafone Idea's debt update

Vodafone Idea is under massive debt and was in the news recently, with the government taking a 36% stake in the country. "Through several initiatives, we have achieved ~90% annualized savings on a run-rate basis by the end of Q3FY22 against the target of INR 40 billion ($0.53 billion). With this, we have achieved the desired cost optimization in line with our operating model," says the Vodafone Idea press release.

RELATED: Indian government takes large stake in Vodafone Idea, giving it some breathing room

As of December 2021, the company's gross debt stood at INR1.98 trillion, which includes deferred spectrum dues, adjusted gross revenue (AGR) liabilities, and bank loans. The company is looking for investors, so it is able to clear dues and regain its lost glory.