A merger of T-Mobile and Sprint would give the combined carrier a huge weapon to take on Verizon and AT&T in rural markets, according to data from the network-tracking firm Mosaik.

The nation’s two smallest major nationwide carriers have long been vulnerable outside densely populated regions, while Verizon and—to a lesser degree—AT&T have leveraged their low-band spectrum advantages to build out their networks across the country.

“Historically, T-Mobile and Sprint have lagged in rural coverage when compared to AT&T and Verizon because the bulk of their spectrum is in the higher frequency bands, which require a significantly denser deployment of sites for the same footprint,” Andrew Miceli, vice president of global sales and marketing at Mosaik, said in a statement emailed to FierceWireless.

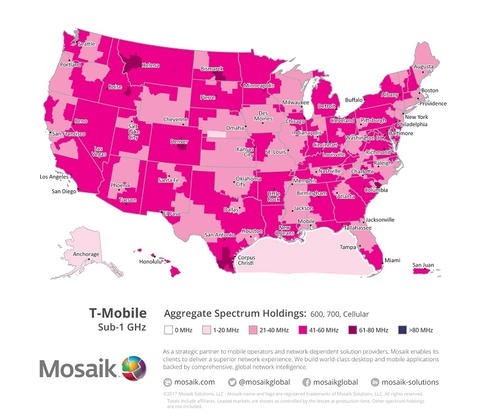

But T-Mobile has invested heavily to amass low-band airwaves in recent years. It spent more than $1 billion last year on 700 MHz A Block licenses from a handful of companies in specific markets, and earlier this year it dropped $8 billion on 600 MHz licenses in the FCC’s incentive auction. Those moves have bolstered the carrier's low-band holdings in a significant way, as evidenced by this map from Mosaik:

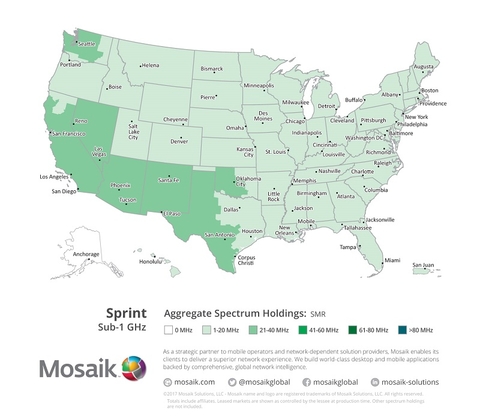

And while Sprint's 2.5 GHz airwaves are particularly compelling, the carrier also owns sizable chunks of 800 MHz and 1900 MHz spectrum:

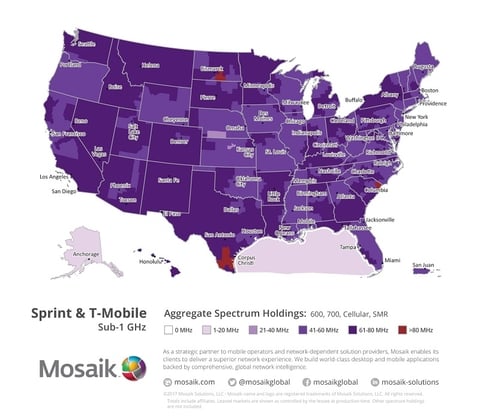

Coupling those spectrum assets would provide a formidable weapon for the potentially combined carrier to compete in rural markets that have previously been dominated by Verizon and T-Mobile, Mosaik data indicated.

"The new T-Mobile and Sprint company will have the combined holdings of Sub 1GHz spectrum, which is a significant advantage to effectively cover rural markets," Miceli concluded. "This includes the former SMR bands of Sprint, 700 MHz and the newly acquired 600 MHz bands. Given the favorable propagation characteristics of these bands, they’ll also require far fewer sites for the same coverage. There’s no doubt this merger can significantly improve their competitive position in previously coverage-limited rural areas.”