Analyst firm Dell’Oro Group published its new forecast for the mobile radio access network (RAN) market that predicts a positive five-year compound annual growth rate—the first time the firm has predicted a rise in that metric in the past seven years.

The firm said its forecast assumes “healthy growth” in the space in 2021 and 2022.

“The combination of the successful completion of the first 5G NR standard, accelerated 5G roadmaps in China, and more operators coming to terms with the fact that the eMBB use case is enough to justify the 5G NR business case form the basis for the renewed optimism about the potential RAN growth in the outer part of our forecast,” said Stefan Pongratz, senior director at Dell’Oro Group, in a statement. “While we are not suggesting that 5G will fix the underlying demand challenges that characterize the industry, capital intensities have a tendency to deviate from the norm during the coverage phase and it is highly probable that there will be some aberrations in the capex/revenue ratio towards the outer part of the forecast as operators accelerate their 5G NR investments.”

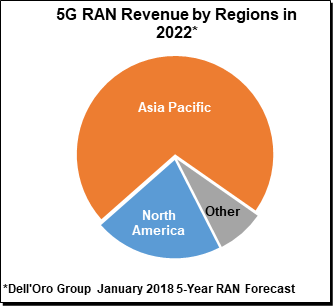

Dell’Oro also said that 5G base station shipments will overtake LTE base station shipments by 2022, and that the small cell market would account for fully a fifth of total RAN infrastructure revenues by 2022.

Added Pongratz: “Because at the end of the day, mobile data traffic is expected to grow six-to-seven fold over the next five years. And the 10x to 15x reduction in cost per bit since the inception of LTE is starting to resonate with the finance departments.”

Importantly, Pongratz also provided FierceWireless with some of the firm's North American forecasts. He said that North American RAN investments were down about 35% in 2016 relative to the sector's peak in 2011 -- but he said that Dell'Oro predicts that total RAN market investments in North America are set to grow at a 2% compound annual growth rate over the coming five-year forecast period.

Although Pongratz noted that AT&T and Verizon haven't committed to a nationwide 5G buildout, he said the firm continues to expect 5G momentum to accelerate in North America. "Our forecast assumes AT&T and Verizon will respond and both operators will have around 75 K 5G macro sites by the end of the forecast period," he said.

The news from Dell’Oro—which closely tracks the global mobile market for network equipment—likely comes as a major relief to Huawei, Ericsson, Nokia, Cisco and other major infrastructure vendors. Those vendors have generally been suffering from sluggish sales in recent years as wireless network operators across the globe put the finishing touches on their LTE network buildouts and work to recoup those investments before jumping into 5G spending.

That’s not for lack of trying among vendors, of course. For example, Nokia just this week announced its new ReefShark chipsets, which the company said can “dramatically reduce the size, cost and power consumption of operators' networks.” The announcement was clearly geared to goose the company’s 5G sales momentum.

Moreover, recent signals from U.S. market leaders haven’t offered much in the way of sunshine for expanded 5G revenues for network equipment vendors.

For example, Verizon last week confirmed that its consolidated capital spending in 2018 would be between $17 billion and $17.8 billion, a figure that includes the commercial launch of 5G—causing worries that it wouldn’t boost its capex due to 5G. And the CEO of tower company Crown Castle, Jay Brown, said that “we're at the conversation stage around 5G, so we don't believe hardly any of the activity that we're currently seeing is really 5G-related.”