Two different reports have recently sized the cell tower infrastructure in the U.S.

A report from the Wireless Infrastructure Association (WIA) said there were 142,100 cellular towers in operation in the U.S. at the end of 2022. WIA’s report was based on research from the consulting company iGR, led by industry analyst Iain Gillott.

The 142,100 cell towers comprise towers only and does not include outdoor small cells. WIA defines a tower as being any free-standing tower structure over 50 feet in height. And these towers support cellular networks only. The number does not include towers used exclusively for municipalities or other government services.

The report said that in 2022 the majority of towers in the U.S. were owned and operated by independent tower companies, with mobile operators owning a small minority. Prior to the late 1990s and early 2000s, most U.S. towers were owned by the wireless operators. But they have since largely divested their tower assets, and the independent tower companies have grown significantly. “This model has benefited carriers as it freed up capital to invest in their businesses, including expanding their networks,” stated the WIA report.

Cowen report

Separately, the analysts at Cowen, led by Gregory Williams, recently published a report about U.S. towers.

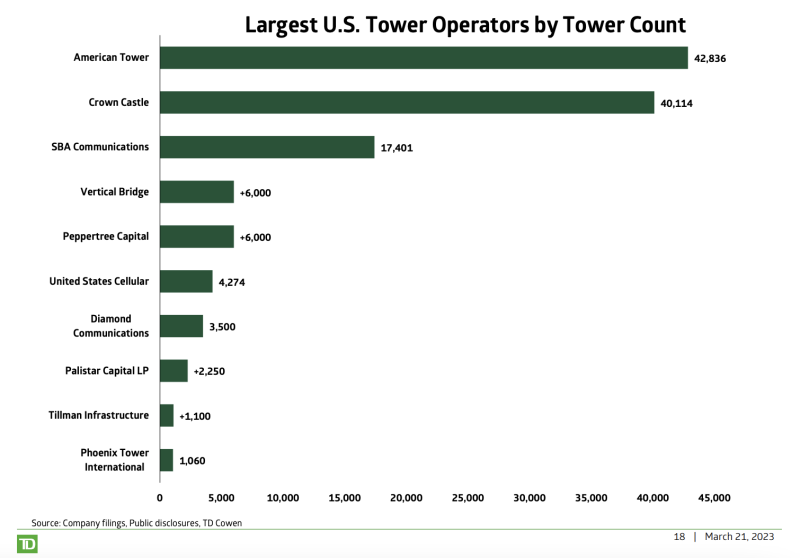

Of the top three independent tower companies — American Tower (AMT), Crown Castle and SBA — Cowen said it expects new leasing at AMT to accelerate in 2023, with modest growth at SBA and growth decelerating at Crown Castle.

Cowen named the top 10 U.S. tower companies by tower count, with these top 10 accounting for 124,535 towers.

Cowen noted that now that Ericsson dual-band radios are finally ready the radios will allow technicians to climb a tower once for two purposes. The analysts expect T-Mobile and especially AT&T to deploy these dual-band radios starting in mid-2023.

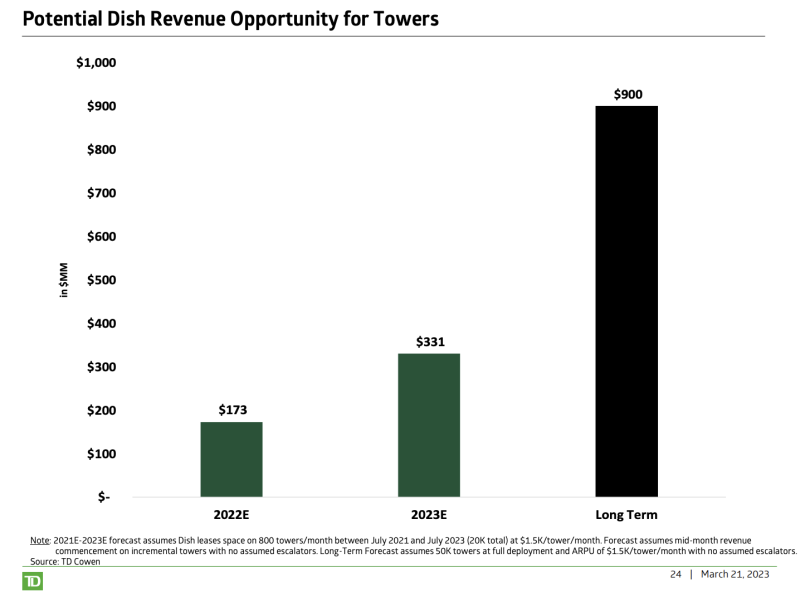

While all of the big 3 carriers reduced their capex guidance for 2023 which could affect their tower spend, Cowen predicts long-term tower opportunity with Dish Wireless, especially after 2023.