Industry Voices are op-eds from industry experts or analysts invited to contribute by Fierce staff. They do not represent the opinions of Fierce.

In what looks like an effort to overcome the inertia and lack of visible progress around releasing spectrum for full power, commercial use, Senators John Thune, Ted Cruz and Marsha Blackburn on Monday unveiled a new spectrum bill, the Spectrum Pipeline Act of 2024.

The bill would require the National Telecommunications and Information Administration (NTIA) to identify at least 2,500 MHz of mid-band spectrum that can be made available for use in the next five years, including 1,250 MHz for commercial use in the next two years. It renews the FCC’s spectrum authority and requires the agency to auction at least 1,250 MHz for full-power commercial wireless service, with 600 MHz of this to be auctioned in three years. It would allocate another 125 MHz to unlicensed use, with the remaining 1,125 MHz to be allocated for either licensed or unlicensed use.

Furthermore, it removes the requirement that auction proceeds could only be used to purchase new state-of-the-art equipment, making the funds more usable for the federal users who would have to give up the spectrum.

Next steps to bring this bill to reality?

The Democrats need to step up and get serious about rectifying the licensed-unlicensed spectrum imbalance in the U.S. and giving the commercial broadband industry the spectrum it needs to intensify competition against cable for home broadband.

The NTIA today released its National Spectrum Strategy Implementation Plan. The plan details the timeline, milestones and responsible agencies for study of the 2,786 megahertz of spectrum identified in the strategy to determine suitability for potential new uses. That includes studying the potential for relocation of federal systems in the lower 3 GHz to allow for commercial use.

The federal government’s decisions on how much spectrum to make available for full power, commercial use could have a dramatic impact on intensity of competition in the telecommunications space.

Consider the following:

Verizon’s purchase of spectrum from Spectrum Co, a joint-venture between Comcast and Charter Communications, created a quasi-nationwide fourth broadband competitor using Verizon’s network. Comcast and Charter - operating as virtual network operators - are offering lower cost mobile service to consumers, and consumers are responding. The wireless subs of both companies are growing faster than what the traditional licensed-spectrum mobile network operators (MNOs) are signing up.

At the same time, more mid-band, licensed full-power spectrum allows incumbent MNOs to provider better and faster service to compete with what cable is offering. Further, access to more mid-band, full power spectrum is enabling the MNOs to offer Fixed Wireless Access (FWA) services in competition with cable’s offerings. FWA subs are growing even faster than what the cable companies are signing up with their mobile offerings.

WifiForward and Spectrum for the Future, two industry groups with ties to the cable industry and its suppliers, have asked the NTIA to focus on spectrum sharing instead of clearing for exclusive use because “clearing of those bands is questionable” and “long delays are untenable.” These reasons could also be summed as “too hard because we don’t want to figure it out, don’t want to deal with complexity, and others if they have the spectrum could compete with us.”

The interesting part of these admittedly self-interested lobbying groups is that of all the coalition members, only Cox and Comcast have launched their own commercial consumer networks. And Cox shut its network down after about six months.

Data usage outside the home on licensed, full-power MNOs will continue to increase at 20% to 30% per year. We either allocate more spectrum to licensed, full-power use or data speeds will decrease. We are going to diminish competition in the home internet market by hobbling the service that customers love the most in favor of technologies that customers told us they like less.

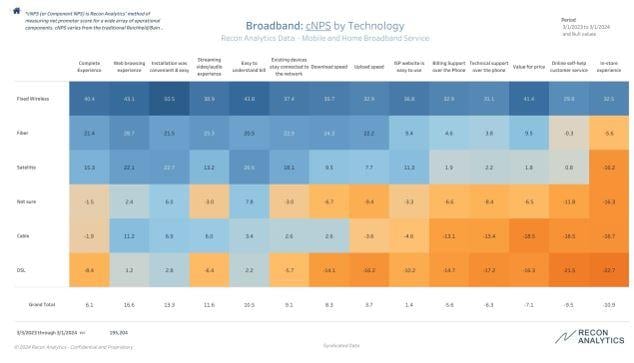

Based on almost 200,000 respondents over the last 12 months, the satisfaction winner is clear: Fixed wireless access has by far the highest satisfaction scores as it brings choice at competitive prices to Americans. A decision for a shared spectrum regime with low power output favors the providers at the bottom of the satisfaction rating.

Roger Entner is the founder and analyst at Recon Analytics. He received an honorary doctor of science degree from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger @rogerentner.