Altice USA is making some pricing changes that its Optimum internet subscribers might want to hear about, including big cuts to rack rates for all its broadband speed tiers.

An Altice spokesperson told Fierce Telecom the company is making broader changes to its pricing to “reduce complexity, including reducing rate card pricing on many broadband tiers to provide a more transparent approach to promotional rates.”

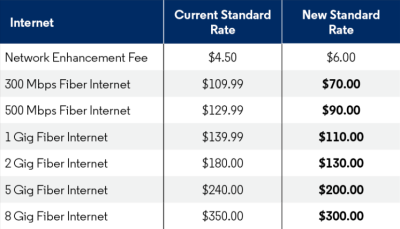

The company reduced non-promotional rates for its fiber internet tiers by $30-$50. Considerably, New Street Research analyst Jonathan Chaplin estimates that less than 10% of Optimum subscribers are currently paying rack rates. He said Altice ceased transitioning customers from promo to rack rates over two years ago due to churn issues, elongating the transition period to possibly five or six years.

While Altice has not confirmed those numbers, CEO Dennis Mathew during third-quarter earnings said the new rate cards on fiber should not have a notable impact on revenue, as a “very small portion” of its fiber customers are close to paying full rate.

The cuts to rack rates will be slightly offset by an increase in Altice’s “Network Enhancement Fee.” Customers not under a promotional rate will see a $1.50 increase, to $6 per month, in their January 2024 bills. Chaplin said in a note the fee increase will provide a small, yet unmaterial boost to Altice’s average revenue per user in 2024 (about 1.3%).

However, the reduction in rack rate pricing is an even larger step in the right direction as he said Altice’s pricing has been “too high” for a while now.

A note from MoffettNathanson Research agreed that after years of price hikes, the company’s broadband rack rates had climbed to levels that were “out of touch with competitive realities,” resulting in a substantial leaking of subscribers that continued through 2023.

In the face of such high subscriber churn, the company has been “forced to offer enormous promotional discounts to others to keep them from leaving,” the note from director Craig Moffett added. He said the move toward lower pricing “should, over the long term, significantly reduce churn as customers roll-off old promotions (or fight to get back onto new ones). That, in turn, should eventually mean lower customer service costs and, well, a generally healthier business.”

During Q3 earnings Mathew told investors that Altice will roll out pricing changes with fiber first, and then for its hybrid fiber-coaxial (HFC) customer base. The company also plans to gift higher speed tiers to align customers' current ARPU with new rack rate prices.

Mathew said Altice “will be moving forward with the speed gifting and making sure that all customers have the right speeds based on their rate cards, and that's going to be a process that we'll undertake over '24 aggressively to really make sure that we've got everybody rightsized.”

Researchers advocate flat pricing

New Street Research’s Chaplin warned that even with the new price drops, Altice will continue to have a gap between its competitive promotional prices and rack rates — a strategy he called “a mistake.”

The research firm has advocated that the telecom industry should adopt flat pricing, as Verizon did in January 2020. Cable companies, Chaplin noted, have been hesitant to follow suit, fearing the impact on ARPU growth. However, he argued that although flat pricing may initially affect ARPU growth, it would significantly enhance EBITDA in the long run.

Despite Altice's broadband ARPU of $76 being higher than cable peers (and “much higher” than its direct fiber competitors), Chaplin said sustaining that premium will be challenging. All told, Altice's price changes may not resolve its “ARPU and valuation problem.”

Chaplin concluded, “The best-case scenario is that Altice maintains relatively stable ARPU while the rest of the industry catches up.”