New unicorns in the public cloud market are becoming rarer, a sign the industry is maturing and investors are tightening their fists, analysts say.

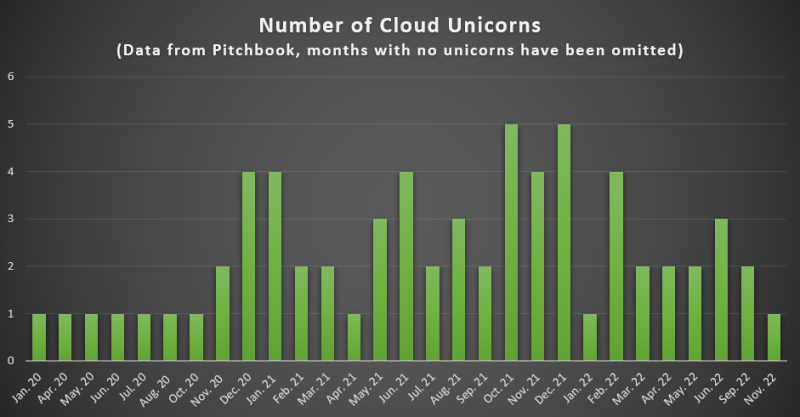

A new unicorn — a startup valued at more than $1 billion — was created in the cloud infrastructure space just about every month from January to 2020 to November 2022, according to data from PitchBook, which tracks company valuations. In 2021 alone, 37 new unicorns in the cloud or software-as-a-service space were created. In 2022 there were 17.

However, none have been created since Island IO, an enterprise browser, went unicorn in November and before that Wasabi, a cloud storage company, in September.

Tech executives and analysts say venture capitalists aren’t writing massive checks to startups in the cloud space, unless they’ve got game-changing technology in a space where funds are eager to place investments. Investors are being more cautious amid rising interest rates that make raising capital a bigger challenge.

“It’s that better mousetrap that really drives huge valuations in companies,” Andrew Casey, the chief financial officer of Lacework, which went unicorn at the beginning of 2021, said.

Casey pointed to investments in artificial intelligence like ChatGPT, where investors are eager to invest in a technology that could raise productivity and cut costs but isn’t easily replicated. He also puts his own company into that space.

Public cloud startup valuations increased in recent years as the public cloud market grew and matured. Companies that are well-positioned to capitalize on the growing demand for cloud services and that offer innovative products and services are particularly attractive to investors, resulting in higher valuations.

Public cloud startups that have gone public in the past two years have seen a significant increase in their valuations. For example, Snowflake’s initial public offering in 2020 valued the company at $35 billion, making it the highest-valued software company ever at the time of its initial public offering (IPO).

Similarly, Databricks’ IPO valued the company at $28 billion, and Zoom’s IPO valued the company at $36 billion. These valuations are much higher than traditional tech companies, such as Oracle, which has a current market capitalization of $182 billion.

That market is contracting a bit, but Casey said cloud businesses with strong fundamentals can take advantage of relatively steady growth (the public cloud spending is expected to reach $600 billion by year’s end and is projected to have a compound annual growth rate of nearly 20% through 2024).

Some say it’s time to rethink the unicorn model — focus less on company valuation and more on recurring revenue. Bessemer Venture Partners, for example, uses the milestone centaur, companies with $100 million or more in annual recurring revenue. That model values profit-making in the short term over promises of huge windfalls somewhere in the future.

“There may be an era ending in which valuations are valued over profits,” Lee Sustar, an principal analyst at Forrester, said.

Got something to share with us? Send an email to the editors here.