-

The analysts at TD Cowen surveyed consumers about cable's wireless offer and also about the demise of ACP

-

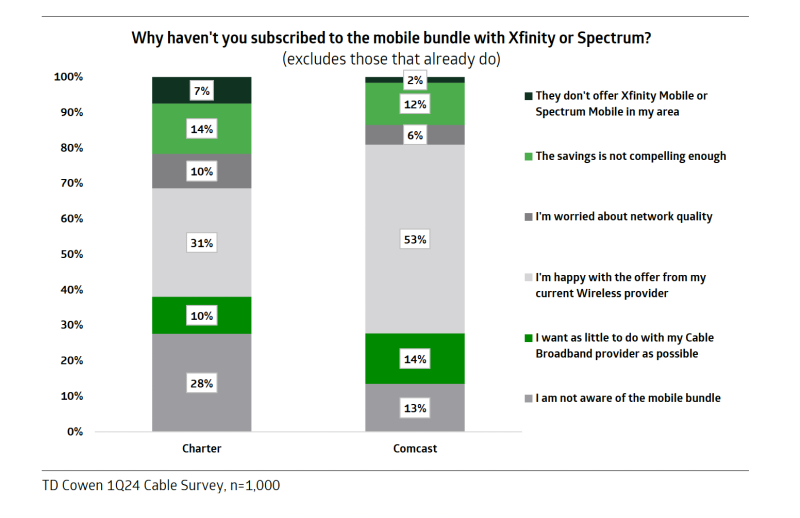

The main reason cable internet subs don't switch to cable's mobile service is that they're happy with their current wireless provider

-

TD Cowen thinks there’s an opportunity for Charter and Comcast to gain about 7.5 million more mobile subscribers

Cable companies Charter and Comcast have been wooing subscribers to their mobile virtual network operator (MVNO) services. But they can’t convince all their internet customers to include wireless in their plans.

The stumbling block seems to be inertia. According to a new survey of 1,000 respondents conducted on April 8, 2024 by the analysts at TD Cowen, those holding out on cable mobile are primarily doing so because they like their current wireless provider.

The survey asked Comcast and Charter subscribers “why haven’t you subscribed to the mobile bundle with Xfinity or Spectrum?” Excluding respondents who already subscribe to cable mobile, the most common response for Charter subs (31%) and for Comcast subs (53%) was “I’m happy with the offer from my current wireless provider.”

Meanwhile 28% of Charter subs and 13% of Comcast subs were not aware of the mobile bundle. The TD Cowen analysts interpreted this as “meaning the companies have mostly done well spreading awareness of the offering.”

Interestingly, 10% of Charter respondents and 14% of Comcast respondents said they want as little to do with their cable provider as possible.

Fierce Network asked Wave7 Research analyst Jeff Moore if he thought inertia was a big stumbling block to get people to subscribe to a cable wireless plan.

“I think inertia is a major factor. Also, many customers are locked in on installment plans and cannot switch without incurring a penalty," Moore said.

He added "the carriers have successfully brought churn down in recent years by bundling wireless with other services, such as tablet plans, smartwatch plans, and streaming video services, such as Netflix. T-Mobile has strong loyalty efforts, such as T-Mobile Tuesdays and Magenta Status.”

As of the first quarter 2024, Charter has 8.3 million MVNO lines, and Comcast has 6.9 million lines. All of these subscribers ride on Verizon’s wireless network, so they’re getting a pretty good experience. And the prices of the mobile lines are competitive with many prepaid wireless offerings and generally much cheaper than high-end wireless offerings.

Moore said, “In my opinion, the unlimited family price plans of about $30/month per line is highly affordable.

TD Cowen determined that there’s still plenty of opportunity for Charter and Comcast to convince about 7.5 million more subscribers to switch to their wireless services.

“With additional marketing and compelling promos, we believe the cable providers still have many years of runway remaining in wireless,” they wrote.

ACP

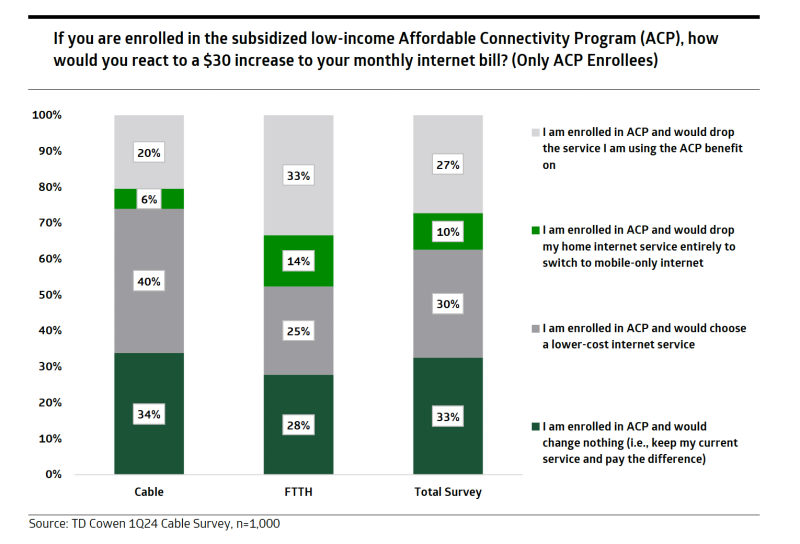

The analysts also surveyed respondents about the Affordable Connectivity Program (ACP), which will run out of funding in May. They asked respondents how they would react to a $30 increase in their monthly internet bill.

Among the 127 cable subscriber respondents who were enrolled in ACP, 40% said they would choose a lower-cost internet service. But 34% said they would change nothing. And 26% of cable ACP subs said they would drop the service, which includes migrating to another ISP or dropping home broadband entirely.

Aside from losing customers, the TD Cowen analysts said the main risk to cable operators is related to average revenue per user (ARPU).

Remember that the government reimburses cable operators for the $30 per month discount. So, they have been benefiting from new subscribers without having to pay any discounts themselves. When the subsidy goes away, the people who stick with the cable provider will likely opt for a lower-priced tier, affecting ARPU.

Charter has noted it has more than 5 million ACP customers, and Comcast has 1.4 million ACP customers.