Most of you on Fierce Wireless have heard about open RAN, but how about OpenWiFi? Some recent announcements and launches have made the industry notice and look seriously at OpenWiFi. It is a Telecom Infra Project (TIP) initiative attempting to disrupt the Wi-Fi industry through disaggregation and open-source software development. It promises to lower the total cost of ownership (TCO), end age-old vendor lock-in, and substantially expand the ecosystem.

What is OpenWiFi?

Today's Wi-Fi network systems are monolithic. All the hardware, software, and cloud components are proprietary and come from the same vendor. That has led to the inevitable vendor lock-in, which has resulted in a higher cost structure, less flexibility and a very high entry barrier.

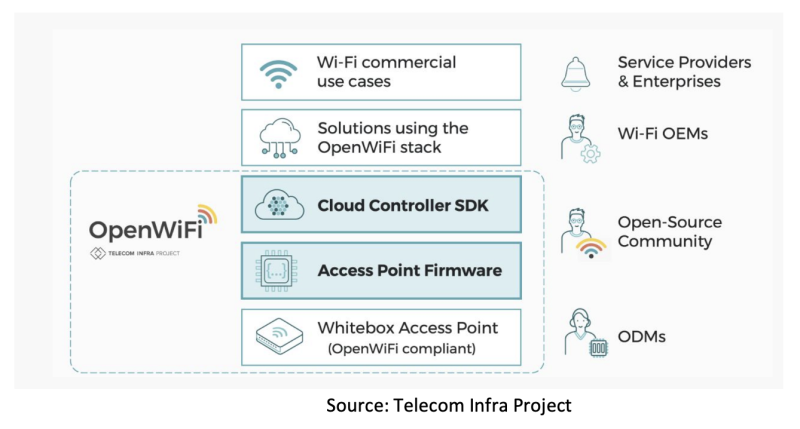

TIP's OpenWiFi is set to change all that through a disaggregated software system approach. As shown in the figure, it includes enterprise-grade access point (AP) firmware, cloud controller SDK, and white-box AP, all designed and validated to work seamlessly together. The software is fully community-developed and offered as a free, open-source stack.

Under the auspices of TIP, the ecosystem partners collaborate, contribute and develop a single code base that becomes the "plumbing" for OpenWiFi systems. Solution providers then integrate this software into white-box APs, offering customers a complete system. Since it is all open-sourced, with open APIs, solution providers, and customers can easily mix and match hardware and software from different vendors without interoperability challenges. They can also deploy their own applications, services and differentiation on the top.

What are the benefits of OpenWiFi?

The biggest allure of OpenWiFi is its lower TCO, mainly because the basic software is open-sourced (free), and open systems create a highly competitive and cost-effective marketplace. The absence of huge R&D spend considerably lowers the entry barrier. Solution providers and customers can mix and match "best of breed" parts to offer the best possible Wi-Fi performance, achieve flexibility, scalability and quick time-to-market.

Since TIP provides basic Wi-Fi plumbing, the ecosystem participants can focus on specific parts of the system in which they have expertise, and solution providers can concentrate on applications and service innovation. Overall, OpenWiFi creates a large ecosystem of diverse players.

The current state of OpenWiFi

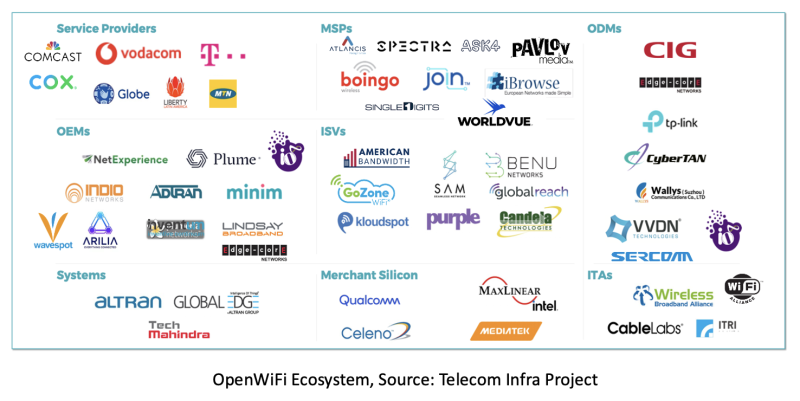

OpenWiFi was conceived and is still managed by TIP. It is one of the groups under TIP's OpenLAN project, started in 2021. Jack Raynor from Meta is the group chair. It includes major service providers, solution providers, chipsets, and ODM/OEM vendors. According to Raynor, as of November 2023, the group counted more than 1,100 representatives from 330 companies as its members. There were over 30 AP and cloud controller vendors. What is more impressive is that over 165,000 APs supporting OpenWiFi have already been deployed in commercial networks across the globe.

"OpenWiFi has grown substantially in 2023 with global deployments across hospitality, multifamily, stadium, senior living, student housing, and stadium verticals," said Raynor. "OpenWiFi's success is a testament to our community and how collaboration creates positive momentum. As they say, a rising tide lifts all boats."

Some notable networks include the Boingo Wireless deployments in U.S. Military base barracks and dorms across the country, Spectra's multifamily and enterprise deployments across India, PMD Group's network in Supersport Cricket Stadium in South Africa, Single Digits' Ronald McDonald House of Greater Charlotte multifamily housing, and many more in Kenya, Pakistan and other countries.

OpenWiFi has found strong initial traction in emerging markets. These are places where robust connectivity is seriously lacking, require highly cost-effective solutions, and are usually greenfield deployments without any legacy systems or business arrangements to support. With low TCO, a large ecosystem hungry for business, and a mission to connect the unconnected, this technology is a perfect match for such markets.

Challenges and opportunities

An undertaking as big and disruptive as OpenWiFi wouldn't be without challenges. And there are a few that technology is grappling with. A handful of large vendors currently control the enterprise and carrier Wi-Fi networking market. All of them have fully vertically integrated proprietary solutions. Obviously, they wouldn't be keen to support OpenWiFi. That means, it will be tough for OpenWiFi to penetrate the established markets.

Wi-Fi has become mission-critical for enterprises and carriers. That means they will be highly risk-averse to anything disruptive that could potentially affect their operations. Unless major vendors they trust jump into the fray, they are unlikely to embrace OpenWiFi. Both segments are accustomed to the "single throat to chock" philosophy. It is difficult to find that "single throat" in open architectures.

Integration is a formidable challenge in any open system. Aligning hundreds of members on a single feature-set and, more importantly, on a common roadmap will not be easy for OpenWiFi. Although TIP manages the overall roadmap of the software stack, there is still a dependency on chipset providers, ODMs, and OEMs for hardware roadmap, evolution, etc.

There are plenty of opportunities for OpenWiFi as well. Since it has found a firm footing in the emerging markets, there is still a vast unaddressed market there. Sustained success there not only provides immediate business opportunities but also proves OpenWiFi's effectiveness and opens the doors to the lucrative enterprise and carrier market in developed countries.

In closing

OpenWiFi is getting notoriety and traction, especially in emerging countries. Its lower TCO and ability to break vendor lock-in is very attractive for enterprise and carrier markets. It has built up a large and growing ecosystem with key players. Some significant challenges remain. It will be interesting to watch its progress, especially in developed regions.

Prakash Sangam is the founder and principal at Tantra Analyst, a leading boutique research and advisory firm. He is a recognized expert in 5G, Wi-Fi, AI, Cloud and IoT. To read articles like this and get an up-to-date analysis of the latest mobile and tech industry news, sign-up for our monthly newsletter at TantraAnalyst.com/Newsletter, or listen to our Tantra's Mantra podcast.

Industry Voices are opinion columns written by outside contributors — often industry experts or analysts — who are invited to the conversation by Fierce Wireless staff. They do not necessarily represent the opinions of the Fierce Wireless editorial board.