Recently, my news feed has been filled with stories about smartphones connecting via satellite. Rumors are circulating about Apple’s iPhone 14 including a satellite link. Elon Musk has just announced his project with T-Mobile to develop smartphone connectivity on second-gen Starlink network.

I can hear the peanut gallery now….this sounds great! Forget about working from home…we will take Zoom calls from the tent in Yosemite! We can watch old re-runs of "Gilligan’s Island" from, well, Gilligan’s Island!

But wait a minute, let’s think about this before we get too excited. We'll face at least two major challenges with the idea of “mobile broadband via satellite”:

On the technical side, a phone-to-satellite link is very challenging. For now, let’s ignore Doppler shifts and other details to focus on the difficulty of the long-distance link. Consider the satellite phones that exist today. They have evolved since the late ‘90s, from gigantic antennas to little knobby antennas, and a few models have emerged recently with embedded (hidden) antennas, so they look like a 3G phone today. But the data performance is much lower than 3G or even 2G. Iridium achieves 2.4 Kbps on a good day, and GlobalStar can get to 9.6 Kbps peak.

The big challenge with Iridium and GlobalStar phones is that, in a smartphone form factor, the antenna is not directional enough to establish a great link with a satellite. People use gigantic dish antennas for a reason.

Musk plans to connect with existing smartphones, so he will be dealing with antennas that are even less optimized than Iridium or GlobalStar. With T-Mobile, he will have access to a much wider RF band (90 MHz instead of 10 MHz), and he has a much cheaper launch platform so that he can consider some huge antennas on the satellite itself.

All in all, it seems reasonable to achieve 2 Kbps per user for 1,000 users in each cell.

Never bet against smart engineers. In fact, Lynk has already demonstrated satellite-to-phone technology, and for the team at SpaceX, it’s a relatively small step from the Lynk demo to a commercial satellite with higher performance.

My word of caution is that this service will look very different than the services that either SpaceX or T-Mobile provide today. Customers are accustomed to broadband speeds, and the industry needs to set expectations carefully. In a standard smartphone, we won’t achieve video calls and streaming services. Instead, T-Mobile and SpaceX will be offering text messages in remote locations (read the T-Mobile release carefully and you will see that it’s about “text coverage”).

The second major challenge is related to economics, which Mobile Experts has covered in one of our INSIGHT reports. In simple terms, the cost of launching and maintaining a satellite network is higher than the cost of a 5G network on the ground.

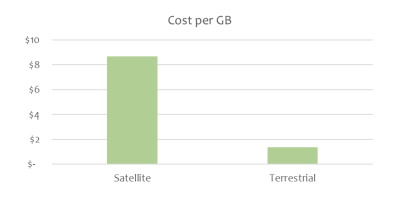

Many of you have seen our calculations of cost per GB for 3G, 4G, and 5G network ideas over the years. When we apply the same kind of analysis to the satellite world, we find that the cost of delivering data ($6 to 11/GB, depending on your assumptions) is higher than the $3.50 retail price for each GB of data on the market today.

So, let’s consider the business proposition for SpaceX. They can’t viably offer a video streaming service — but they can make money by selling text messages.

What if they cover the globe with 20 different operator partnerships, offering text messages and limited email only? They could reach a billion customers and pull in ARPU of $1 per customer per month. A billion bucks per month? That’s a winner.

Joe Madden is principal analyst at Mobile Experts, a network of market and technology experts that analyze wireless markets.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of FierceWireless.