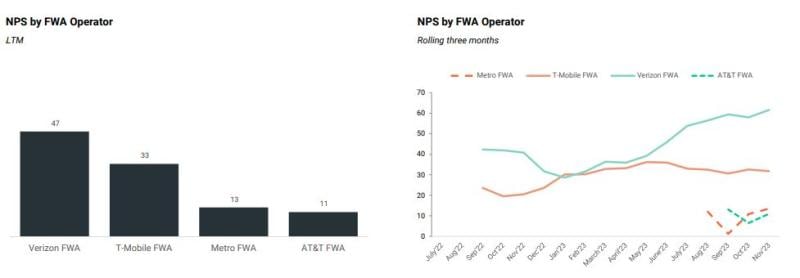

Verizon leads the pack when it comes to net promoter scores (NPS) for internet service using fixed wireless access (FWA), overtaking T-Mobile in the past year, according to analysts.

Verizon’s FWA NPS was in line with T-Mobile’s a year ago, but Verizon’s score has doubled as T-Mobile’s remained stable, according to a New Street Research (NSR) report based on data from Recon Analytics.

“This supports Verizon’s claim that they are growing more slowly because they are being more careful. It also supports their $10 price increase for new subs,” wrote New Street’s team of analysts led by Jonathan Chaplin.

There are a few surprises in the data, the analysts note. For example, FWA leads the pack with twice the NPS of the next closest competitor – fiber – and FWA NPS is improving. Satellite broadband NPS is now in line with fiber, likely driven by Starlink.

NPS scores are a big deal. They’re closely tracked by management teams, driving the compensation of mid- and senior-level executives. As such, it drives product, pricing, marketing and investment decisions of operators, with these decisions ultimately driving market shares, the report noted.

To be sure, T-Mobile CEO Mike Sievert for several quarters has mentioned NPS scores during his earnings calls, usually pointing out that T-Mobile has higher NPS scores than any cable provider. Most of T-Mobile’s FWA internet customers are coming from cable.

During the Q4 2022 earnings call in February, Sievert said T-Mobile’s NPS scores are 10 points higher than fiber and 30 points higher than cable, according to a Seeking Alpha transcript. In a separate report, T-Mobile cited PC Mag Readers’ Choice 2022, where T-Mobile’s home internet service had a NPS of 47, which was higher than any cable provider on the list.

All four of the major cable operators tracked by Recon Analytics have negative aggregate NPS scores, although all of them have improved over the last year, the New Street report said.

NPS drivers

The NSR report noted that Verizon’s lead in FWA scores is surprising, given that a meaningful portion of Verizon’s FWA base is still on lower frequency LTE spectrum while substantially all of T-Mobile’s base is on 5G 2.5 GHz spectrum.

“Looking at the drivers of NPS, T-Mobile is lower on every metric,” NSR wrote. “The gap is widest on customer service metrics and closer on product and price. T-Mobile’s residential FWA base is 110% larger than Verizon’s and they have been growing much faster; these may be factors.”

T-Mobile has been adding about 500,000 FWA customers each quarter and has about 4.2 million FWA customers versus 2.7 million FWA customers at Verizon.

Wireless-only households decline

Interestingly, wireless-only households grew rapidly from 2016 through 2019, likely due to the proliferation of 4G smartphones and unlimited plans, according to the report. “We believe that wireless-only households have declined sharply during the pandemic. We assume wireless-only households continue to decline,” the analysts said.

Wireless-only penetration was around 6% at the end of 2019 and while they had expected that to rise gradually, penetration actually dropped to an estimated 4% during the pandemic, and they now expect it to fall to about 2% by 2027.