Verizon is now the nation’s only major wireless operator that’s pursuing a fixed service strategy in 5G.

Sprint’s CTO said this week that the carrier has long tested fixed wireless technologies. (Indeed, way back in 2014, Dish launched a fixed TD-LTE service with Sprint in Texas, offering 10 Mbps for $30 per month.) But those results didn’t push Sprint’s CTO into the fixed camp for 5G: “We have no plans to launch fixed wireless at the moment,” Sprint’s John Saw said this week. “Right now I think our focus is on mobile broadband; the economics are so much better.”

T-Mobile’s CTO too has blasted fixed 5G as uninteresting. “This approach makes total sense if you are Verizon trying to ignore your troubles in wireless,” wrote T-Mobile’s Neville Ray last year. “But, it breaks down the second you want to leave your home.”

And AT&T recently joined the mobile 5G bandwagon with an announcement that it would launch the technology in a dozen cities by the end of this year—a notable shift from the fixed 5G tests it had been conducting.

To be clear, Verizon has been working on its fixed 5G plans for years. The carrier gathered together a group of vendors in 2015 to create the 5G Technology Forum, designed specifically to create “a common and extendable platform for Verizon’s 28/39 GHz fixed wireless access trials and deployments.” And last year, Verizon showed off a prototype device designed to potentially allow customers to install their own fixed 5G receivers outside their windows. Shortly after that, Verizon outlined plans to launch its fixed 5G residential broadband in 3-5 cities by the end of this year.

(Although fixed wireless probably won’t be the only 5G thing Verizon will do, at least according to the carrier’s own CTO, who recently described fixed service as just one possible “slice” of a broader 5G buildout.)

Lots and lots of traffic

Nonetheless, it’s worth looking at what Verizon can expect in the fixed 5G world. And based on recent comments from other fixed wireless players, Verizon should expect to handle lots and lots of traffic. Like, 1.6 TB per month per customer, for example. At least, that’s what startup Starry found in its tests last year in Boston. Founder Chet Kanojia said that Starry’s median monthly traffic per customer was around 480 GB per month, but that the top 20% of users consumed an average of around 1.6 TB per month.

That’s mainly due to customers watching high-quality video on big screen TVs, Kanojia said. "If you've got a 4K device, on average you're burning 150 GB per device or more,” he said.

In order to handle that much traffic, Kanojia said Starry leverages 802.11ac transmission technology, massive MIMO and beamforming, with base stations backhauled by unlit fiber—that allows Starry to offer uncapped 200 Mbps services. “It's not fixed wireless of yesteryear,” he said.

To be clear, Starry’s traffic figures are much higher than what some other fixed wireless players are seeing. For example, Common Networks’ Zach Brock said the operator’s average customer consumes around 200 GB per month, while Rise Broadband’s Jeff Kohler said his customers consume an average of around 160 GB per month.

(Interestingly, 160 GB is the monthly usage cap AT&T has placed on its own fixed wireless service, which it expects to build out to 1.1 million mostly rural locations by 2020. And to be clear, AT&T’s current fixed wireless efforts do not use 5G.)

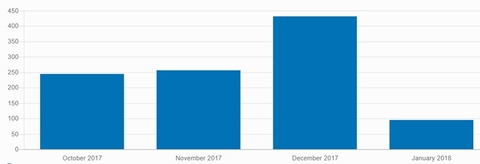

Curious, I checked my own personal data usage through my home ISP, and found that I’m much more in line with Starry users than Rise users. In December, me, my wife and my two young kids together consumed close to 450 GB during the month of December, a figure I would attribute to all the Netflix we watch (we don’t subscribe to cable or satellite TV):

Our monthly mobile data usage typically hovers well below 10 GB per month.

Coverage economics

Now, I have no doubt that Verizon is well aware of how much data people chew through each month; after all, the operator is the nation’s fourth largest wired broadband provider with around 7 million customers. And it’s clear that Verizon is carefully evaluating where its fixed 5G service will make the most economic sense: The operator has said its initial 5G residential broadband services would eventually reach only 30 million households nationwide—or just 24% of the total addressable market. That figure tells me that Verizon only plans to go after locations that are best suited to the coverage and capacity it can supply. After all, Verizon executives have made clear that its millimeter-wave 5G fixed service can only travel a few thousand feet, which is nothing compared to the miles and miles of geography that low- and mid-band spectrum can cover.

But that’s the key here: Low- and mid-band spectrum signals can’t handle the bandwidth (think 1.6 TB) that millimeter-wave transmissions can support.

And that all leaves Verizon’s engineers with one final calculation: Will the operator’s fixed 5G service provide speeds similar to those of wired internet providers—at lower costs?

According to fiber supplier Corning, it costs around $1,153 to deploy fiber to the U.S. average household in a “dense” area, defined as roughly 880 households per square mile. Starry’s Kanojia said that in modestly dense areas, or 1,000 homes per square mile, it costs the company $25 per home to offer its fixed wireless services. And in very dense areas that price drops to $12 per home. "You really only need 20 customers to break even on that sector,” Kanojia said.

Presumably, it’s those kinds of numbers that’s driving Verizon’s fixed 5G ambitions. — Mike | @mikeddano