The 5G Americas analyst conference held in Dallas this month brought together dozens of subject matter experts representing 17 wireless companies, including network operators, equipment manufacturers, tower and infrastructure companies and networking software providers. Also present were “92 top-tier wireless analysts from across the Americas,” per 5G Americas.

A complete list of 5G Americas member companies is here, but officials from AT&T, T-Mobile, Telefonica, Rogers, Liberty Latin America, Samsung, Nokia, Ericsson, Qualcomm, Crown Castle, and Ciena were at the conference.

One key insight about 5G Americas is that this is not a U.S. event. The telecom companies and telecom analysts come from all over the Americas, including companies and analysts based in or operating in the U.S., Canada, Latin America and the Caribbean. Dallas is a logical venue for the conference, as the Dallas airport is within easy reach of cities throughout the Western Hemisphere.

5G adoption is high in N. America and China, but low elsewhere

A highlight from 5G Americas was the keynote presentation by 5G Americas Chair Ulf Ewaldsson. Ewaldsson also serves as president of technology for T-Mobile. He provided good insights about the uneven progress of 5G in various countries.

He also touted T-Mobile's current talking points about the company's nationwide deployment of standalone 5G and its recent news about network slicing.

On yesterday's Q3 2023 earnings call Ewaldsson said, "We have now 70% of the payload is 5G on the network. As we continue to see more and more 5G traffic, that means we can move over frequencies that are used for LTE into 5G." He added, "We have this enormous spectrum asset in mid-band, which is where the home Internet products are residing that we can continue to leverage. We have more spectrum than anyone else has on mid-band as a potential. By the end of the year, we are approaching 200 megahertz that we will have dedicated for 5G products."

Ewaldsson also talked yesterday about T-Mobile's great cache of spectrum. He noted that T-Mobile still has C-band spectrum to deploy as well as 3.45 GHz. "Those will need capital next year, and we're looking into a precise deployment of those. But we also have more LTE spectrum, as we said earlier, to put at work, more 600 with a current or a newly announced lease with Comcast that we are putting to work as well. But those actually don't need capital because we have smartly built this network in a way that we can just with commands upgrade the network to make use of those into next year."

International 5G

To me, the most interesting aspect of the conference was its international perspective. My firm, Wave7 Research, thoroughly covers wireless competition, but only in the U.S. For many reasons, the telecom market is vastly different in other countries.

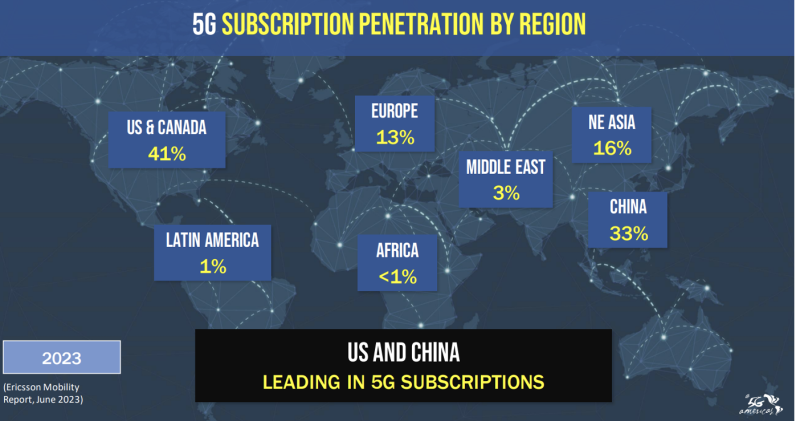

One slide in particular caused my eyebrows to rise. The U.S./Canada region leads the world in terms of 5G subscription penetration at 41%, compared to only 1% for Latin America and <1% for Africa. China also has high 5G subscription penetration of 33%, while Europe is only at 13%. Penetration is 3% in the Middle East and 13% in Northeast Asia. Ewaldsson also stated that while 33% of devices in the U.S. use 5G, 51% of data traffic is 5G.

I had not realized that 5G penetration was only 13% in Europe, 1% in Latin America, and <1% in Africa. This provides perspective, as T-Mobile now covers 98% of the U.S. population with 5G and has 70% of its traffic now moving via 5G. Verizon and AT&T may be behind T-Mobile on 5G, but both are miles ahead of most carriers around the world. This is good for competition and convergence. It was a pleasure to spend two days in Dallas with the companies who are making this happen and to gain international insights about the 5G state of the union.

Carrier panel: AI likely to improve network performance

Another highlight from the event was the carrier panel, which was moderated by 5G Americas President Chris Pearson. It featured executives Rob Soni of AT&T, Ron McKenzie of Rogers, Ana Valero of Telefonica and Karri Kuoppamaki of T-Mobile. Challenges and opportunities have many similarities from country to country, but there are also many differences, particularly with regard to regulatory issues and spectrum allocations.

The panel had a lightning round, with Pearson asking questions and getting rapid answers. The most interesting question was whether AI would play a major role in improving network performance. The answer was a fast and affirmative "yes" from all four carrier executives.

Carriers update their 5G coverage numbers

T-Mobile this week announced that it now has 5G coverage of 330 million people in the U.S., which amounts to 98% of the population. Also, T-Mobile now has Ultra Capacity 5G coverage of 300 million people. Ultra Capacity 5G is a reference to mid-band spectrum. The carrier has a dragon’s hoard of mid-band spectrum, which makes for very high download speeds.

Verizon, meanwhile, is planning to cover 250 million people with 5G Ultra Wideband by the end of 2024, having covered 200 million people during Q1 2023. 5G Ultra Wideband is mostly a reference to 5G via Verizon’s mid-band spectrum, although the term is also inclusive of Verizon’s mmWave coverage. AT&T CEO John Stankey, during the company’s Q3 2023 earnings call, said: “We’ve expanded our nationwide 5G network and are on track to reach 200 million people or more with mid-band 5G spectrum by the end of the year.”

Why does 5G matter?

Use cases for 5G are still being debated, but I think the killer app for 5G is internet access for homes and businesses. Via their fixed wireless offerings, T-Mobile and Verizon combined for 893,000 broadband additions in Q2 2023 and 941,000 broadband additions in Q3 2023. For Q2 2023, this was more than 100% of U.S. broadband additions, based on information from the Leichtman Research Group.

There are two main technical factors behind the massive success of fixed wireless broadband from T-Mobile and Verizon. One is the rising speeds due to 5G. The other is spectrum. In buying Sprint, T-Mobile gained access to a massive amount of mid-band spectrum. Verizon and AT&T in 2023 also gained access to a large amount of mid-band spectrum, but this was done via a major auction of C-band spectrum.

In December, I wrote that 2022 was the year of telecom convergence. With more than 100% share of broadband additions in Q2 2023, T-Mobile and Verizon are clearly taking a large amount of broadband share. Meanwhile, Charter and Comcast had nearly a million postpaid wireless additions in Q2 2023, gaining significant wireless share. Finally, there is inter-sector competition, and it gets even better, as wireless carriers and cable cos are now both offering robust wireless/wireline bundles. Without 5G and increased spectrum, the cable cos would just be poaching customers from Verizon, AT&T, and T-Mobile, without the wireless carriers being able to respond in an adequate way.

Spontaneous reunion of analysts

A pleasant surprise at the even was a reunion of 13 veteran analysts from Current Analysis/GlobalData. Current Analysis was acquired by London-based GlobalData and now operates as part of GlobalData, which is a data analytics and consulting company. I tweeted a picture of this reunion before leaving Dallas, as seen here, joking about a “herd” of Current Analysis veterans “roaming the plains of Texas.” The number of veteran analysts from the firm was actually 14, but Kagan analyst Lynnette Luna was not in the picture.

Jeff Moore is Principal of Wave7 Research, a wireless research firm that covers U.S. postpaid, prepaid, and smartphone competition. Moore has 25 years of telecom industry experience, including 13 years of competitive intelligence work for Sprint. Follow him on Twitter @wave7jeff.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Wireless staff. They do not necessarily represent the opinions of Fierce Wireless.