This past quarter was a terrible one for Verizon. While its peers are posting net phone additions, Verizon lost 36,000 postpaid phone subscribers in the first three months of 2022. That was better than several Wall Street analysts had predicted – some estimates had it losing 75,000 or more for the quarter.

It’s a stark reminder that the “elder statesman of the wireless industry,” as analyst Craig Moffett posited, is now trying to preserve rather enhance its reputation. Its “best network” claims are debatable and its prices are relatively high. As Moffett wrote last week: “If ‘less bad’ is the highlight of a report, well, there’s not much sizzle there, is there?”

During Verizon’s earnings call last week, Bank of America analyst David Barden brought up the fact that there was a time when Verizon had the best network, charged the highest prices and took the most market share. They used to talk on these calls about stuff like how to “give a little margin or take a little market share,” he said.

Nowadays, “you guys are now the share donor on every quarter,” he said. “And we’re celebrating how many 5G phones we have and how much C-Band we’re deploying. But it’s not obvious that’s translating into something tangible that investors can celebrate in terms of financial reward,” Barden said. “So can we talk a little bit about that too?”

Verizon CEO Hans Vestberg said that he feels good about the “whole national broadband strategy” that the carrier laid out during its Investor Day in March. Their focus is to grow the business using various levers.

Of course, it’s doing all of this “based on the best network in the nation, no doubt about that,” Vestberg said. They’re just getting started with the C-band deployment, executing on “those levers,” and ahead of plan “on the vectors,” which will translate into good things for both the top and bottom lines, according to Vestberg.

Verizon’s five vectors of growth include 5G mobility, nationwide broadband, mobile edge compute and B2B solutions, the value market (prepaid) and network monetization (MVNOs).

Vestberg pointed out that Verizon is competing on all fields in wireless, from the prepaid to the high-end premium segment, which is different from years past – before it bought TracFone, which continues to lose customers.

Let’s face it. There’s not a lot to be excited about in terms of Verizon’s consumer segment. It kind of sucks, relatively speaking.

Enterprise for the 5G win?

As for the business segment, that’s different and let’s remember, a lot of the pie-in-the-sky benefits of 5G are supposed to come in the enterprise space. Verizon has spent considerable time talking about the growth it expects from the likes of mobile edge compute (MEC) and private networks.

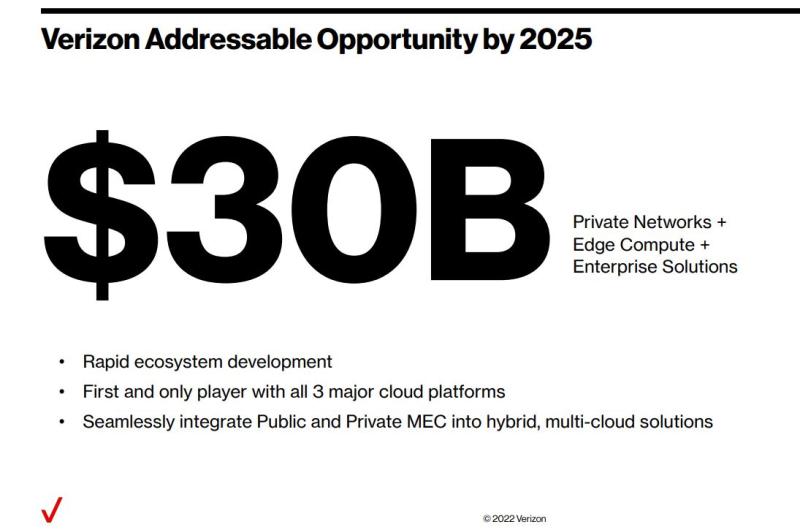

During its Investor Day presentations, Verizon shared a slide showing a $30 billion opportunity from private networks, edge compute and enterprise solutions, all by 2025. The company didn’t break that down further in terms of how much each segment will contribute to that $30 billion. (Believe me, I asked.)

As for the revenue from private networks and mobile edge compute, how much of that are they going to see in the current year? And how much does it contribute to the forecast? Moffett also asked those questions during Friday’s call.

In sum: They’re “just getting started” in terms of the growth they’re going to see there.“This is going to pay off big time the next five to 10 years and I feel really good about how we built the network and seeing also the importance of mobility broadband and cloud in our society for businesses and people,” Vestberg said. “I think we’re so well placed in this, so I feel good about it.”

Vestberg & company spend a lot of time talking about MEC and all that’s to come, but that’s not exactly contributing to the bottom line right now, nor will it be for the foreseeable future.

Who to blame?

It’s tempting to blame Verizon’s problems on its spectrum choices, but that only goes so far. In the U.S., each carrier’s spectrum position largely depends on what spectrum the FCC makes available for auction and what’s for sale on the secondary markets. Then it’s up to the carriers in terms of where they put their money.

It’s worth remembering that the best spectrum licenses are the kind that you currently own.

It so happens, the FCC made a lot of millimeter wave spectrum available, and Verizon bought it up by the truckload. Right now, T-Mobile is sitting on a pile of 2.5 GHz spectrum, and it’s looking to add to it with Auction 108, set to start in July. Before T-Mobile bought Sprint, it too was skeptical of the 2.5 GHz spectrum that it now touts as the bee’s knees.

Verizon doesn’t do a lot of rival-bashing, which T-Mobile is good at. Maybe Verizon should do more.

Patience wears thin

It’s not as if Verizon wasn’t going to invest in 5G, said Recon Analytics analyst Roger Entner. And he raises a good point: All these questions about the source of revenue from the 5G investments start to sound like a bunch of 5-year-olds in the back seat asking, “Are we there yet?”

People also questioned the ROI for previous wireless generations. “We had exactly the same argument with 3G and 4G,” he said. “Look at what happened with 4G.”

At that time, people were asking what Verizon and others were going to do with the faster speeds. Download music faster? Send texts faster? Ha! “No, we’re streaming video now,” Entner said.

“I would argue for patience,” he added, noting that when these networks are actually built out, the best ideas will emerge, something akin to what social networks did with 4G/LTE, but much better. It’s still the beginning of this journey. “I understand the exuberance and the impatience, but it takes a little bit longer,” he said.

At the very least, Verizon should seize the moment with 5G and MEC before T-Mobile makes any significant headway in the enterprise space and eats Verizon’s lunch there as well. Now that would be a travesty for Verizon.

Who knows? Surely a few years from now, when all the mid-band spectrum is built out, we’ll wonder how we ever got along without 5G. It’s just a question of how long investors – and everyone else, for that matter – can wait. — Monica | Twitter: @malleven33

Editor's Corners are opinion columns written by a member of the FierceWireless editorial team. They are edited for balance and accuracy.