With the radio access network (RAN) market recording its first quarterly year-over-year decline in more than two years and 5G RAN growth decelerating during 2Q 2022, it is more salient than ever to understand where we are in this 5G journey so we can better assess future growth prospects. And since not all 5G is the same, adoption is varying widely across the various 5G opportunities.

From a coverage rollout and consumer adoption perspective, the 5G enhanced mobile broadband (eMBB) ascent has surprised on the upside with 5G new radio (NR) tracking two to three years ahead of LTE.

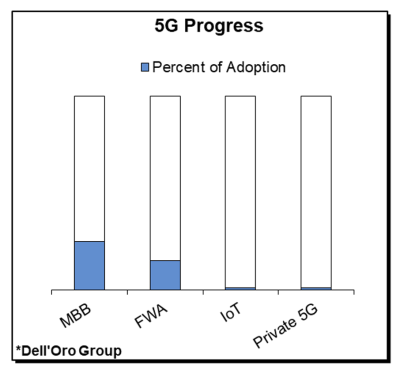

Yet, even with 5G now driving the lion’s share of the RAN capex, it is still early days from a global coverage perspective with 5G covering around 25% of the global population (Ericsson). Cumulative 2019-2021 5G NR shipments relative to the projected 2026 5G NR macro installed base is also around 25%.

In addition, more investments will be needed beyond the initial coverage layer to support all of the bands, including sub-1 GHz, 2 GHz, 2.5 to 6 GHz, 6 to 7 GHz, and mmWave. So far, operators have mostly focused their efforts on the upper mid-band. The upside with the other four bands remains significant, extending the longevity of the 5G investment cycle.

Beyond MBB, the fixed wireless access (FWA) use case is also developing at a healthy pace contributing to the 5G ramp. 5G FWA is currently in the early adopter phase, with around a third of the 200+ commercial 5G networks offering 5G FWA services (GSA).

Even with the expectation that the 5G FWA business case will gradually become more challenged as the ratio between mobile and dedicated FWA capex evolve to address the inherent capacity constraints with the mobile networks, there is still a lot of runway. 5G FWA subscribers are projected to comprise nearly 6% of global broadband connections by 2026, up from <1% in 2021 (Ericsson, Dell’Oro). The baseline scenario is for the FWA RAN market to roughly double over the next five years.

Not surprisingly, private 5G and NR IoT are not contributing much to the broader 5G RAN revenues at this juncture.

While the 5G RAN opportunity remains significant for both public and private NR IoT, the markets are still nascent. And it will take some time before they rise above the noise and start moving the larger RAN needle (private LTE+5G small cells are projected to reach $0.8 B to $1.0 B by 2026).

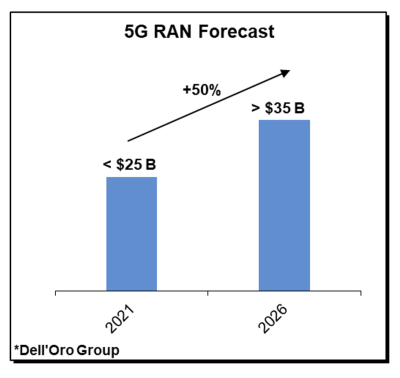

Putting it all together, we are not overly concerned about the recent growth deceleration. 5G is still in the second inning, and the message we have communicated for some time now, namely that the 5G phase will be longer than previous technology cycles, still holds.

In other words, the days of exponential 5G capex increases are in the past, however, 50% potential growth over the next five years for the combined 5G RAN MBB, FWA, and IoT markets should be a cause for celebration.