-

Worldwide spending on wireless LAN equipment is expected to fall in 2024

-

Dell'Oro Group argued the AI boom could help soften the blow as enterprises look for ways to simplify network management

-

AI could eventually become part of WLAN standards

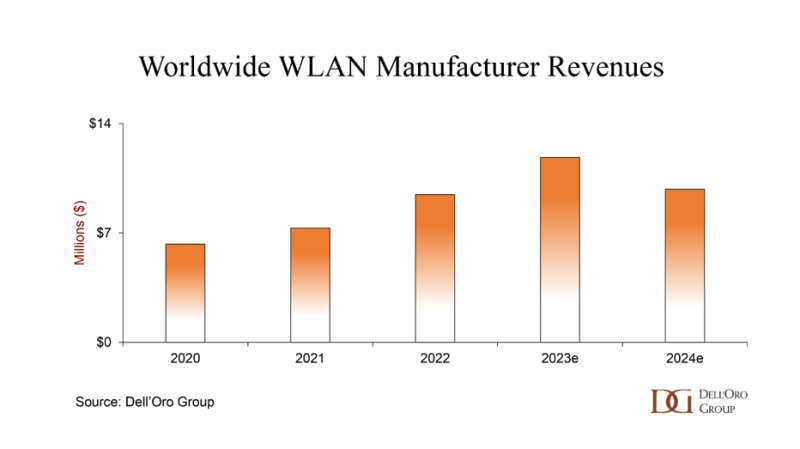

Worldwide spending on enterprise-class Wi-Fi equipment has shot so high recently, it feels like we’re approaching the other side of a roller coaster. Revenues to enterprise-class Wireless LAN (WLAN) manufacturers jumped by an astounding 47% Y/Y in the first half of 2023. With 2023 worldwide GDP growth expected around 2%, this WLAN expansion is not just about organic growth.

To support their post-pandemic operations, organizations are building out new use cases that put Wi-Fi at the center of their networks. Universities are installing Wi-Fi instead of Ethernet ports in dorm rooms. Retail operations are converting to “scan as you go” operations. In their new office configurations optimized for hybrid work, enterprises are blanketing patios and parking lots with Wi-Fi coverage.

Supply constraints have also played a role in the increased revenue, by compressing orders into a tsunami of product shipments. Dell’Oro Group is predicting a slowdown, or digestion period in 2024, as the market absorbs the high volumes of product deliveries that came out of backlog.

We are also in the midst of an artificial intelligence (AI) revolution. Leaders are under pressure to demonstrate how AI is going to propel their business forward – and a mere AI chatbot won’t suffice. With pressure on executives to jump on the AI bandwagon, the industry may well start to see a shift in spending from the network connectivity layer, which is now table stakes for most operations, to AI applications that promise to revolutionize the business.

However, there is a compelling reason to believe that AI spending will help to soften the upcoming downturn in WLAN purchases by enterprises.

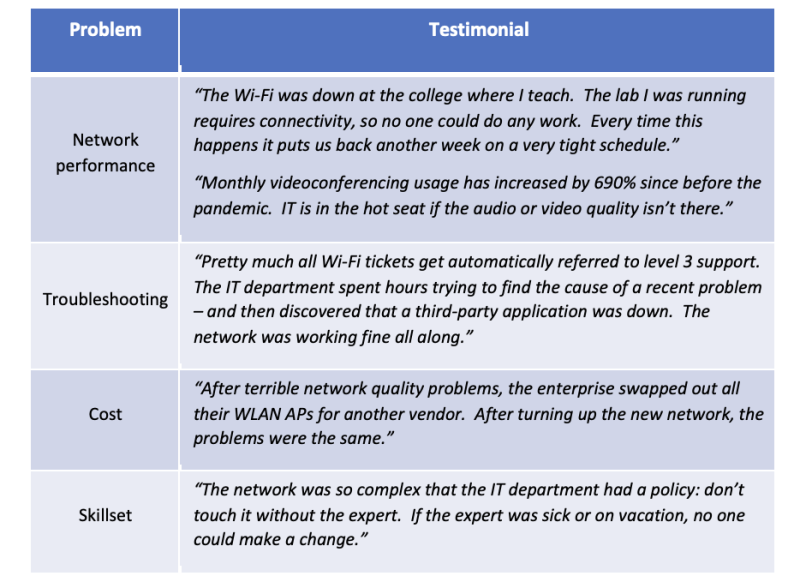

Enterprise leaders may find the AI revolution they seek in the form of AIOps (Artificial Intelligence for IT operations) that promises to solve the complexity of enterprise network management. Network management problems can have real business impacts, as evidenced by testimonials we’ve collected in discussions with industry leaders.

Solving for complexity

The newest WLAN technology available is further complicating network design and operations. Wi-Fi 6E and Wi-Fi 7 standards operate in a third, new frequency band (6 GHz), as well as in the two traditional Wi-Fi bands (2.4 and 5 GHz). This adds more variables in the planning of channels, bandwidth and power levels in the radio layer of the network.

AIOps makes use of advanced analytics and machine learning algorithms to support the complex tasks of network operations. Most of the major brands of enterprise-class WLAN equipment on the market today tout AI-driven management, and some enterprises using AI-based WLAN management are providing compelling feedback.

One company we spoke with told us they had reduced their trouble tickets by over 90%.

The most desirable AIOps features will depend on the specific vertical and configuration of the enterprise, but here are a few that are particularly apt to justify additional spending:

- By aggregating and analyzing billions of data points, both from end clients and from the network equipment, the network management application can create a baseline image of how users behave and how the network usually performs, then it can adjust alarm thresholds accordingly. Many alarms received by network operations teams are not indicative of real problems and end up drowning out real problems. For instance, an alarm may be raised at noon every day when a large batch of phones disconnect from the network – only because so many employees are leaving to grab lunch.

- By analyzing baseline network behavior in distributed and complex networks, algorithms can automatically detect network configuration issues. We have heard from enterprises that installed AI-Ops applications and discovered network problems that had been affecting end-user performance for years.

- AIOps can suggest solutions to the configuration problems that were detected, prompting the operator to initiate the fix. It can also use LLM algorithms to summarize technical documentation, with the aim of making it easier to make configuration changes.

- The networks in venues such as stadiums or auditoriums handle a huge variability in traffic load. With analysis of network activity and performance data, a network management tool can proactively identify bottlenecks in specific areas, for example, indicating that foot traffic is particularly bad at one exit or at one concession stand.

- In an office scenario, integration of data from videoconferencing platforms can help AIOps applications uncover the root cause of bad video quality. After learning from the problems over time, an AI operations application could begin to predict the conditions for optimal video quality, helping to reduce employee frustration.

With the potential for measurable results in the form of cost savings, efficiency improvement, and a solution to skilled labor shortage, the vision of AIOps will be compelling to executives and their shareholders.

From a manufacturer’s perspective, these new functions can help win new business for their WLAN, switching, Access Control, and WAN infrastructure solutions. They can also help cushion the blow during an industry-wide slowdown in new equipment purchases.

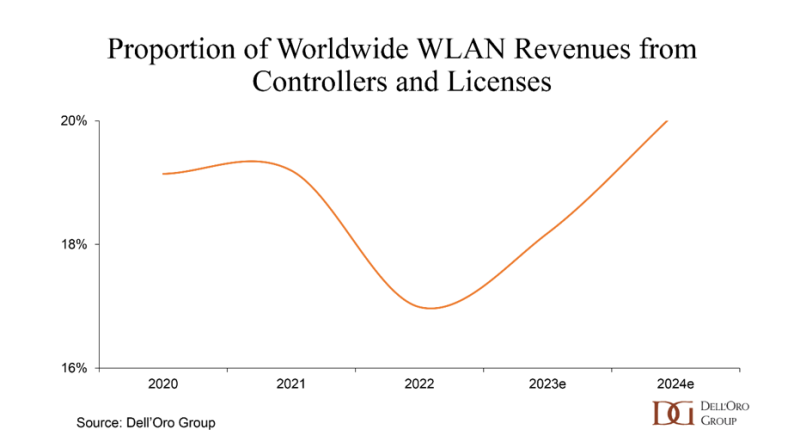

Most of the AIOps features are subscription based. The enterprise pays on an ongoing basis and receives access to frequent software updates and security patches. For the past ten years, the proportion of enterprise-class industry revenues going to centralized management functions such as controllers and licenses has been slowly declining. However, with the potential from AIOps features, we see this proportion beginning to rise this year. Manufacturers are moving to a model of recurring revenues that continue to grow, even if there is a slight slowdown in new equipment shipments.

Looking even further ahead, we may start to see AI and machine learning integrated into the standards. In July, the IEEE 802.11 AIML Topic Interest Group held a meeting to consider various proposals on AI/ML use cases and features that could be included in future generations of the WLAN specifications. A decision will be made this month on whether to continue efforts on this analysis. Should the standards body continue with its work in this area, AI will eventually become baked into the standards, forcing manufacturers to be even more creative in order to differentiate their solutions.

With leaders in the hotseat to show that they are making the best use of AI technologies, and with a “Wi-Fi First” vision espoused by many IT departments, AIOps is poised for success. The pressure these two trends create may just be enough to convince enterprise leaders to adopt the much-maligned recurring payment structure.

Siân Morgan is responsible for the enterprise class Wireless LAN research program at Dell’Oro Group. She has over 25 years of senior management experience in telecommunications and networking, focusing on the business impacts of complex technologies. Morgan has Bachelor’s and Master’s in Electrical Engineering, an MBA, and a Graduate Certificate in Management Accounting. She is a member of both the Order of Engineers the Order of Chartered Professional Accountants of Quebec.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Silverlinings staff. They do not represent the opinions of Silverlinings.