Fixed wireless access (FWA) has secured better customer perception within the home broadband industry while cable, DSL and fiber have continued to struggle on that front, according to analysts at Evercore ISI Research.

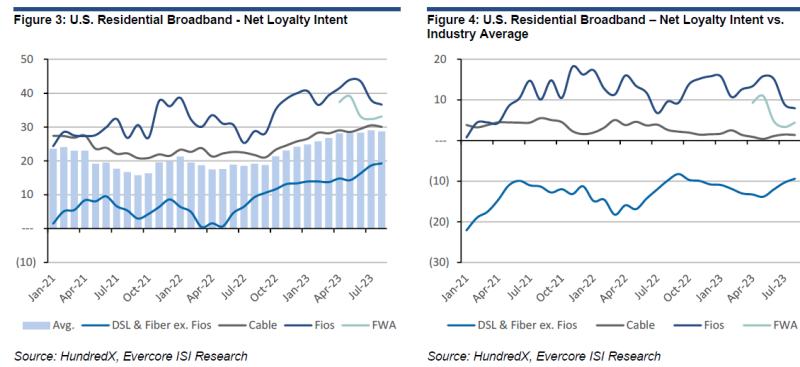

However, Verizon’s fiber-optic service, Fios, seems to be the exception. In a new report Evercore said Verizon Fios has “meaningfully better” net promoter scores (NPS) and net loyalty intent (NLI) than most DSL and fiber operators.

NPS is a metric used to measure customer satisfaction and loyalty, ranging from -100 (very bad) to +100 (very good). NLI measures the difference between the percentage of customers who say they plan to keep the service over the next 12 months and the percentage who say they plan to switch providers.

So far this year, Fios’ average NPS has broken even at zero, indicating the number of promoters (those who would recommend it) is roughly balanced with the number of detractors (those who would not). On the other hand, the negative NPS scores for most other cable, DSL and fiber providers suggest that customers using those services are generally less likely to recommend them.

Evercore’s research was founded on consumer survey data from HundredX, which started doing surveys in mid-2020 on customer satisfaction, NPS and NTI in U.S. postpaid wireless. FWA has only been included in HundredX’ data since the second quarter of 2023 with an average NPS at around 10, better than “any other product in the industry,” the research firm wrote.

Fios and fixed wireless also lead in customer retention, while cable aligns with the industry average and DSL operators migrating to fiber fell “meaningfully below” the industry average. With customer satisfaction still low across the home broadband industry, the “large bulk” of customers reported they don’t plan on changing providers in the next year. The average loyalty intent across the industry has actually been increasing for the past year.

The report highlights that AT&T has seen the most improvement over the past two and a half years with NPS increasing by 17 points from 2021 to now, and its NLI improving 11 points.

Cable providers in the data included Astound, Cox, Mediacom, Optimum, Sparklight, Spectrum and Xfinity. Among the fixed wireless providers are T-Mobile and Verizon’s Home Internet brand, and CenturyLink, Frontier and Kinetic round out the fiber and DSL providers.

Evercore noted that Frontier’s scores have “regressed somewhat since April” with NPS declining 7 points, and its NLI declining 12 points, however this reflects scores combining the company's copper and fiber services while it has been focused on decommissioning copper.

In the cable sector, Comcast leads in consumer perceptions, followed closely by Charter. Altice fell below the industry average as its Suddenlink and Optimum products received low NPS and NLI.

Evercore research indicated the past two years have seen an improvement in NPS scores across the home broadband sector, with the average rising from 30 in 2021 to 13 this year, but there hasn’t been much change in the “relative performance” of players in the space.

What do home broadband customers care about?

Broadband customers prioritize price and speed above all else, according to the report, with about 75% of respondents indicating that they care about price and two thirds indicating they care about speed. Reliability, service/support and billing completed the top five most important product features.

In general, consumers seem to have a “net negative” perception of the broadband industry’s pricing, though Evercore said this trend is modestly improving. As of now, FWA and some DSL operators are the only products with a net positive percentage.

Operators are enhancing their networks, resulting in an improved perception of speed.

Cable providers have made notable strides in this area compared to DSL and fiber players. Historically, DSL customers were less concerned about speed, but their priorities now align with industry standards. Fios leads in speed, with Comcast, Verizon's FWA, and Charter following suit.

Although cable excels in “quality metrics” like setup, content, features, interface and app, only around 30-40% of respondents expressed high interest in those features. Price metrics include price, value and billing.

It's expected that operators excel in either price or quality metrics, Evercore said.

This holds true for Fios, Comcast, Charter, as well as Frontier and other DSL operators. Fios, Comcast, and Charter perform well in quality but less so in price. On the other hand, Frontier and other DSL operators tend to excel in price but lag in quality. AT&T falls in the upper-middle range for both metrics, while FWA generally fares reasonably well in both categories.