-

Cloud capex was flat sequentially and down year on year in Q2, New Street Research found

-

Networking appears to be a weak spot, but spending on AI infrastructure accelerated

-

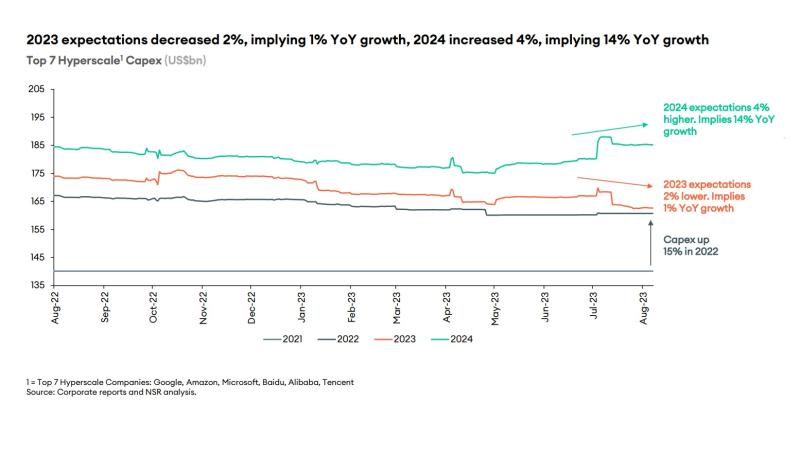

Overall capex spending is expected to return to growth in 2024

Growth for the cloud giants slowed in Q2, but the companies are far from hurting. Still, it seems they pulled back on capex, at least in some areas. Not when it comes to artificial intelligence, though.

According to a fresh report from New Street Research’s Pierre Ferragu and team, revenue for the top seven hyperscale cloud providers – that is, Google, Amazon, Microsoft, Meta, Baidu, Alibaba and Tencent – increased 9% year on year in calendar Q2 2023. Meanwhile, capex dropped 10% year on year, though was fairly consistent sequentially.

A closer look at this figure based on statements made by hyperscale suppliers showed that networking demand has slowed. Arista’s CEO Jayshree Ullal, for instance, stated “One specific cloud titan customer has signaled a slowdown in CapEx from previously elevated levels. Therefore, we expect near-term cloud titan demand to moderate with spend favoring their AI investments.” Juniper made statements to a similar effect.

But that’s not to say spending is falling in all areas. Demand for GPUs (and, to a much lesser extent CPUs and memory) remains high, as evidenced by earnings statements from NVIDIA, AMD, Intel, Samsung, Micron and Hynix.

“Capex will likely be flattish in 2023 after growing 26% 2020-2022 CAGR,” New Street Research’s analysts concluded. “Most describe increased focus on technology. We expect a favorable mix shift. Secular drivers are, if anything, strengthening, with AI use cases being deployed across the board.”

The firm, however, added that capex is expected to ramp back up in 2024. Take a look.

New Street Research’s findings jibe with an earlier report from Counterpoint Research, which also concluded that AI-related infrastructure spending was up across major cloud providers. That report named Microsoft as the spending front-runner, followed by Baidu and Google.

Get your head out of the clouds. Join our Cloud Executive Summit, Dec. 6-7 in Sonoma, Calif.