The invention of the wheel is often cited as one of the hallmarks of mankind’s ingenuity. The wheel is believed to have been invented around 3500 B.C. It has certainly made things easier for mankind since then to transport people and things.

While the early instance of the wheel probably was made of a tree trunk, it has gone through many iterations over the ages – in various forms of materials and more exacting roundness to make the wheel roll lighter and faster. For example, the Henderson Paddle Wheel in Hood River, Oregon, (pictured right) was part of a steamer tow boat to push ships along the Columbia River during the first half-century of the 20th century.

The metaphor of the wheel is apropos of what’s happening in the private 5G market. Solution vendors, system integrators, managed service providers and operators are all vying to partake in the 5G market growth beyond the core mobile broadband services for smartphone use into enterprise businesses that seek more “precise” connectivity services to handle operational technology (OT) workloads beyond “best effort” services. Today, the private 5G “readiness” wheel is not entirely smooth and round to make the ecosystem hum.

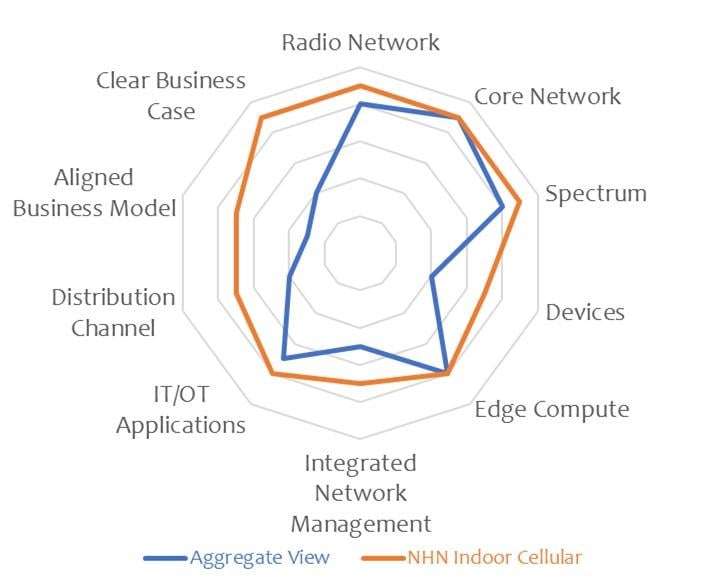

The Private 5G readiness wheel comprises the following technical and business factors that reflect the maturity of the broader Private 5G ecosystem.

- RAN – robustness and maturity of radio access network infrastructure that can support various spectrum bands allocated for industrial 5G use

- Core Network – robustness and maturity of converged or standalone 4G and 5G core networks that can be scaled for small to large standalone private networks

- Spectrum – availability of low-cost spectrum that can be used by enterprises and managed service providers for a private network

- Devices – wide availability of industrial cellular devices with integrated 4G and 5G capabilities

- Edge Compute – robustness and maturity of edge computing infrastructure and services to run industrial applications

- Integrated Network Management – integrated network management to operate private network across multiple technologies

- IT/OT Applications – maturity of IT and OT applications that can operate over private networks

- Clear Business Case – well-defined business cases with positive return on investment for leveraging private networks

- Distribution Channels – well-formed go-to-market channels and ecosystem partners of system integrators, service providers and vendor solutions

- Aligned Business Model – well-understood business models for enterprise customers and channel partners

Adoption of private cellular is following the “Crossing the Chasm” model introduced by Geoffrey Moore in his famous book. Across the 13 vertical industries we track, many vertical sectors are at the “pre-chasm” stage of market adoption, as highlighted in our recent market studies on Industrial Private Cellular and Enterprise Private Cellular.

At a high level, market readiness is lacking in some areas, as highlighted in our “readiness” wheel, as depicted below. The blue outline illustrates our aggregate view of the market today. For example, industrial end devices for low latency 5G applications like computer vision are not widely available today, and enterprises are resigned to using “bridge” devices to interconnect end devices to private 5G networks. Some enterprises are still trying to figure out a clear business case to deploy private 5G networks versus upgrading to Wi-Fi 7 networks.

On the other hand, some use cases like neutral-host network (NHN) indoor cellular have a more well-formed “wheel” regarding readiness, as highlighted in the orange outline. In the U.S., we estimate that the installed base of CBRS-capable smartphones has reached a critical juncture and that NHN private networks can be leveraged for economical indoor cellular solutions in many “underserved” mid-size venues where enterprises seek a low-cost indoor cellular coverage solution. In our forecasts, we’ve identified a few vertical markets and applications that have “crossed the chasm” already, and our wheel model looks pretty round.

As the private 5G ecosystem matures, we expect the market players to fill in the spokes on the wheel, refining it to become more well-rounded. Subsequently, the market will “roll” faster over the coming years and decades. Just as the Henderson Paddle Wheel pushed many ships along the Columbia River, we expect a more well-formed private 5G readiness wheel to push the market forward. Let’s roll!

Kyung Mun is a senior analyst at Mobile Experts LLC, a network of market and technology experts that provides market analysis on the mobile infrastructure and mobile handset markets.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not represent the opinions of Fierce.