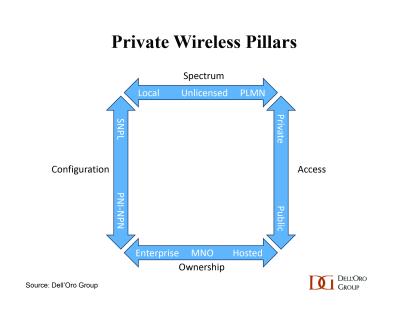

As public investments in mobile broadband (MBB) are slowing and the interest is rising in upcoming growth opportunities such as fixed wireless access (FWA) and private wireless, one central question that still absorbs surprising amounts of oxygen is actually rather fundamental: What exactly is private wireless? What is complicating the situation is that the concept of private wireless isn't tied to a specific technology; instead, it serves as a broader term encompassing a diverse array of technologies, implementations, spectrum allocation and ownership models. Given the numerous approaches to constructing private networks and the wide variation in how private wireless is understood across the ecosystem, ample room for interpretation exists.

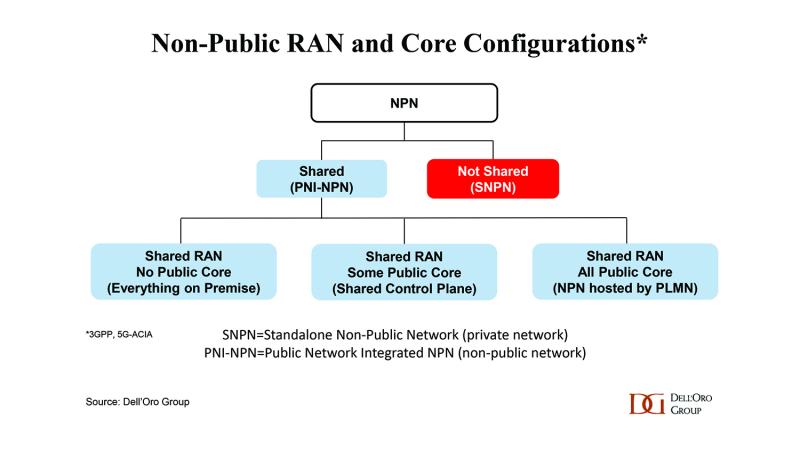

One might be forgiven for thinking this conversation should not be needed anymore. After all, the 3GPP has already developed and defined the Non-Public Networks (NPNs) concept in 5G. According to 3GPP, NPNs are intended for non-public use. NPNs can be deployed in a variety of configurations, utilizing both virtual and physical elements. NPNs might be offered as a network slice of a Public Land Mobile Network (PLMN), be hosted by a PLMN, or be deployed as completely Standalone NPN (SNPN). SNPNs deployed in isolation with no interaction with a public network are referred to as private networks while Public Network Integrated NPNs (PNI-NPNs) are considered non-public networks. And per 3GPP, NPNs are confined to 3GPP based technologies meaning that LoRa, P25, TETRA, and Wi-Fi are not included.

The definition of NPN seems straight-forward at first glance, so where does the confusion arise? While there is a strong consensus that SNPNs are considered private wireless networks, the distinction becomes less obvious when addressing PNI-NPN implementations. Also, determining whether the additional capex required to support enterprises in these hybrid scenarios should be classified as private, public or non-public remains a point of contention.

For instance, the GSA excludes non-public network implementations that solely rely on network slices from its private wireless tracker. Similarly, Nokia describes private wireless as a "standalone network focused on industrial operational assets and users." Some operators market Private 5G as dedicated solutions utilizing only private infrastructure. Meanwhile, certain operators are pursuing hybrid approaches. Telia, for instance, promotes both its local core and access to the macro core as integral parts of its Enterprise Mobile Network portfolio.

China is on track to achieve its goal of reaching 35% 5G penetration in large industrial enterprises by 2023, as outlined in the Set Sail Action Plan. This achievement signals a strong consensus that China is making significant progress with industrial 5G. Nevertheless, due to the scarcity of local spectrum and heavy reliance on the public network, not everybody is on the same wavelength about the most appropriate classification for these MNO-Provided 5G Mobile Private Networks (MPNs).

Another source of confusion is the scope of private wireless technologies. While there seems to be a fairly strong agreement among suppliers that private wireless is mostly confined to 3GPP based technologies, those funding the networks are more likely to adopt a technology-agnostic approach, which is more aligned with ChatGPT's understanding of private wireless than the 3GPP NPN version. According to ChatGPT's perspective, “Private wireless networks can be deployed using various technologies, such as cellular networks (like LTE and 5G), Wi-Fi, and other wireless communication standards." Moreover, some operators and suppliers are using different terms to describe private wireless (e.g., Enterprise Mobile Network, Private LTE, Private 5G, Mobile Private Networks, Private Mobile Networks, Private Cellular Networks).

Increasingly, too, the degree of ownership and access to the network is causing various interpretations. There is general agreement that SNPNs owned and managed by the enterprise/organization should be classified as private.

However, the situation becomes less clear when the network is managed or hosted by a carrier.

The deployment of a neutral host-led shared indoor 5G network by Ericsson and Proptivity prompted neutral host proponents to come out of hibernation, viewing this as a potential catalyst for increased private neutral host deployments.

Celona, for example, is collaborating with U.S. carriers to deliver public carrier services over the CBRS band using neutral host networks. This sounds promising – a third party can improve the performance of a public service across a privately deployed network.

The vastly different ROIs between the carrier and the building owner could change the likelihood of 5G proliferating indoors. Perfect, we can now adjust the private 5G forecast. However, it is not as straightforward as it appears. NPNs, by definition, are intended for non-public use. As the public vs. private neutral host driver ratio is likely to differ due to a variety of factors, not everyone agrees that all private neutral host investments should fall under the private wireless category.

In essence, 3GPP's NPN concept provides a solid foundation. However, given the diverse backgrounds within the ecosystem and the various options available to implement NPNs, it's inevitable that the distinction between private, public and non-public networks won't always be clearly delineated across the key pillars, and the scope is likely to evolve over time.

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.