Verizon’s 4G network in urban areas delivered major download speed boosts thanks to CBRS spectrum, new results from Opensignal show. However, the report found that dings to power levels limited signal strength, and corresponding experience, when users weren’t close to a cell tower.

Citizens Broadband Radio Service (CBRS) 3.5 GHz became available in the U.S. with a unique sharing paradigm among three tiers of users including federal military incumbents. Verizon was one of the winners that scooped up priority access licenses (PALs), spending $1.9 billion at auction in 2020, and has the General Authorized Access (GAA) unlicensed tier at its disposal.

The report (which didn’t distinguish between using GAA or PALs) determined that Verizon is using CBRS in more places since October 2020. It found Verizon CBRS connections on 4G devices in 36.3% of U.S metro statistical areas (MSAs) analyzed in October 2021 versus 24.8% the year prior.

RELATED: Verizon boosts LTE speeds in Philly via CBRS spectrum

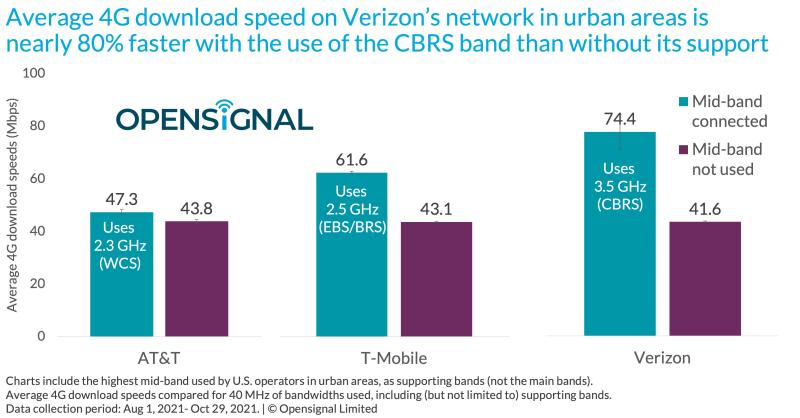

Opensignal’s analysis tested 4G in major cities among the top three carriers and compared download speed performance both with and without support from each one’s highest 4G mid-band spectrum.

Mid-band spectrum is often talked about as key for 5G, but AT&T, T-Mobile and Verizon are using mid-band frequencies in 4G as well. The Opensignal analysis broke out results when the following mid-band spectrum was at play: 2.3 GHz (WCS) for AT&T, 2.5 GHz (EBS/BRS) for T-Mobile, and 3.5 GHz (CBRS) for Verizon.

Opensigal noted those spectrum bands are being used as support and not the main bands for 4G on the respective networks. The results also only analyzed connections when the same amount of 40 MHz was used for main and supporting bands combined.

Verizon’s 4G boost from CBRS was 78.8% - jumping from 41.6 Mbps without mid-band to 74.4 Mbps when users connected to CBRS. T-Mobile also saw a significant average 4G download speed bump – though not as large – of 42.9% thanks to 2.5 GHz (which it’s separately using for 5G services). It went from 43.1 Mbps to 61.6 Mbps when connected to supporting 4G mid-band. AT&T’s supporting 4G mid-band WCS spectrum only drove an 8% increase and was still the slowest. It increased from 43.8 Mbps to average downloads of 47.3 Mbps once WCS was in play.

Verizon executives back in 2020 pointed to CBRS as complementary within its LTE network for added capacity, with potential to become part of 5G as well.

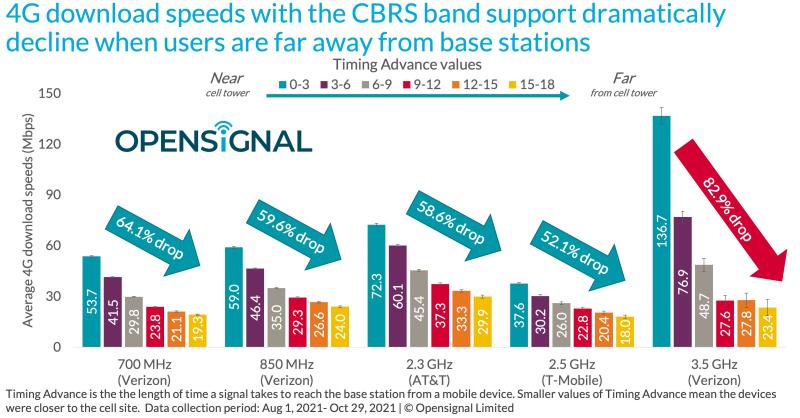

The caveat to CBRS spectrum’s positive impact? Users need to be pretty close to a cell site. Otherwise signal strength took a hit from the higher frequencies with degrading power levels – and correlated notable drops in speeds - the farther away users were from a site.

The Opensignal analysis showed how signal levels deteriorated for Verizon’s 3.5 GHz below the -120 dBM threshold where it said strength is considered poor, starting at a distance between roughly 768 feet and 1,536 feet. The drops in power and signal strength weren’t observed at similar or even much greater distances for AT&T and T-Mobile 4G mid-band spectrum, or Verizon’s low-band 700 MHz or 850 MHz.

When Verizon users connected to CBRS were less than 770 feet from a cell site, average speeds were 136.7 Mbps. However, move farther away (around 770-1540 feet) and speeds were cut in half to 76.9 Mbps. At over 2,300 feet from a cell site those initial 100 Mbps+that CBRS bolstered dropped by a nearly whopping 83% to 23.4 Mbps.

It’s worth noting that all user speeds, including AT&T and T-Mobile saw 4G speeds decrease the farther away from the cell site but not as dramatically as Verizon.

“These differences in speed by distance mean that the use of the CBRS band by Verizon for supporting 4G connections in densely populated urban areas helps make a difference to users but is not a long-term solution, as it would require a denser network to provide the best experience possible with this band — which is likely less financially feasible, especially outside of urban areas,” wrote Opensignal in its analysis.

However, Opensignal said 5G is designed to use spectrum more efficiently and improve mid-band spectrum’s signal reach, noting users will likely have less dramatic dives in power levels when connected to C-band.

RELATED: AT&T leader says C-band power limit impacts are overblown

Power levels is a topic that has come up for CBRS before – and more recently with mid-band C-band spectrum, which AT&T and Verizon are poised to start activating next month and seen as key for 5G. The January C-band timeframe is a one-month delay the carriers agreed to as discussions continue over the Federal Aviation Administration’s safety concerns about interference.

On the CBRS side, some have argued for higher power levels – like the Competitive Carriers Association (CCA) for devices operating in the band. Meanwhile, WISPA and Charter Communications over the summer urged the FCC to reject proposals to increase CBRS power limits, saying it would favor macro cell deployments only.

Rules for the 3.7 GHz C-band don’t have the same power limits as CBRS. Separately, AT&T and Verizon recently agreed to temporarily lower C-band base station power levels, including around airports and heliports, for six months as a concession to help minimize interference risks the FAA has raised.