Since its inception in the world of M2M this decade, eSIM has generated much hype, with many claiming it will disrupt the telecoms industry. With the opportunity for consumers to select and switch carriers directly from their devices, eSIMs could completely change the game for mobile operators.

However, the adoption of consumer eSIM services/devices remains low. Most existing eSIM devices are tablets and wearables. The first compatible eSIM smartphone was Google’s Pixel 2 in October 2017 and it is yet to gain significant traction.

Furthermore, the U.S. Justice Department recently opened an investigation into potential collusion between AT&T, Verizon and the GSMA, suspecting they developed standards that prevent consumers from easily switching between operators.

Given the muted impact of eSIM early in its life and its recent controversy, should we expect more disruption in the future?

Recap: What is eSIM?

The eSIM technology, or embedded SIM, is a SIM card that cannot be removed from the device. The eSIM removes the need to physically swap SIM cards to change the profile on a device. Instead, with Remote SIM Provisioning (RSP) technology, the subscriber’s profile information can be downloaded directly onto the device.

It promises to bring many consumer benefits, including simplifying network service selection and enabling cellular connectivity for wearables/devices with specific form-factor requirements. This could lead to significant disruption in the industry if consumers can easily compare and switch between carriers.

Outside of the consumer segment, there are many potential benefits to industry, particularly in IoT, with new uses emerging with connected vehicles and smart farming.

Defining the potential scenarios of consumer eSIM evolution

Although eSIM has the potential to disrupt the mobile ecosystem, the approach mobile operators, SIM providers, operating system players and OEMs take toward standards and implementation will impact the level of disruption on the existing telecom models. Operators will naturally try and defend their position, whereas OEMs or OTTs may cause greater disintermediation.

In this report we consider three scenarios for how eSIM usage could evolve.

The first is the industrywide adoption of the GSMA eSIM standard, which minimizes disruption within the mobile ecosystem. While this scenario is the most likely, barring potential disruption from the recent investigation, two other more disruptive scenarios are contenders. These models are known as "rapid switching" and "operator disintermediation."

Scenario 1: GSMA eSIM standard prevails

In 2011, the GSMA started developing a standard for RSP specifications for M2M, and by 2015 had proposed standards for eSIM technology for consumer solutions. The GSMA standard prioritizes security and protection of consumer data as well as minimizing industry disruption by ensuring the compatibility of eSIM specifications with existing telecom systems and processes.

It’s an evolution of the traditional SIM model, with today’s telecom processes remaining largely unchanged and operators retaining control over the customer relationship.

Scenario 2: Rapid switching

A more disruptive eSIM scenario arises from the wider adoption of devices with proprietary, non-GSMA standard eSIM technologies. One outcome is "rapid switching." This model is like the Apple SIM where an intermediary, be it an OTT or OEM, aggregates all carrier offers and allows customers to select plans from a list and rapidly change carriers.

Such a model implies increased direct competition due to greater price transparency and the partial loss of the customer relationship for mobile network operators (MNOs).

Scenario 3: Operator disintermediation

Another potential disruptive model is one where other players, like OEMs, can displace the operator’s role by taking ownership of the whole customer relationship. In this model, an OEM can provide its own consumer telecom offering acting as an MVNO and wholesaling connectivity from MNOs.

Evaluating the potential impact of eSIM

Consumer eSIM solutions can impact three main areas of the telecom sector: The value chain, telco processes and revenues.

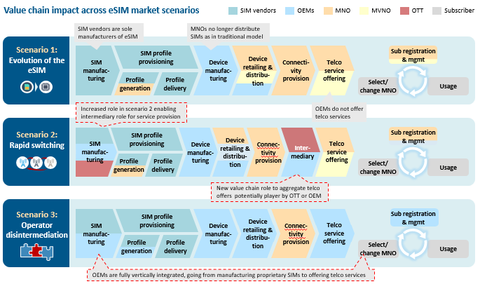

The impact on the telecom value chain can be measured by the level of disintermediation; the extent to which other industry players such as OEMs or OTT players assume the roles currently played by telecom operators. The roles at stake include device retailing and distribution, telecom service offering and subscriber registration and management.

The impact on processes relates to the level of change required to existing processes such as subscriber registration, customer management and billing.

Lastly, the impact on operator revenues varies according to four levers:

- A decline in ARPU as consumers are provided with direct price comparisons, intensifying competition.

- A decline in roaming revenues as consumers can subscribe to local operators when they are abroad.

- A decline in device revenues as operators lose the customer relationship to OEMs.

- The potential for new revenues from the sale of new devices such as wearables and the associated data ARPU increase from connecting a secondary device.

The extent of the impact varies greatly between each scenario, with an overview highlighted in Figure 1.

If the GSMA standard prevails, limited impact on the mobile ecosystem can be expected from the adoption of eSIM. From a value chain perspective, structural changes only occur for SIM providers, with the traditional SIM provisioning process becoming obsolete.

Despite this, player roles stay unchanged with MNOs retaining the customer relationship and remaining the sole providers of telco services (illustrated in Figure 2).

The main expected impact will be on the creation of SIM credentials that will no longer be tied to the physical SIM. Other processes will remain largely identical to those in the world of the traditional SIM.

Again, if the GSMA standard prevails, limited financial disruption is expected. ARPU and device revenues are expected to remain relatively stable while roaming revenues are only expected to decline moderately as eSIM solutions become more widely adopted.

Assessing the likelihood of eSIM’s disruption of the telco industry

Although scenarios two and three can disrupt the telco industry across the three areas, they are unlikely to gain significant short-term traction. Indeed, market indicators suggest widespread industry adoption of the GSMA eSIM standard.

Since the start of the development of the standard for consumer solutions, more than 60 industry players, including some of the largest MNOs, OEMs and SIM vendors have committed to support it. In fact, most eSIM solutions in the market today are GSMA-compliant, with Samsung’s Gear S2, launched in 2016, being the first GSMA compliant consumer solution.

However, this standard is currently attracting controversy, with the U.S. Justice Department opening an antitrust investigation into coordination between two operators, Verizon and AT&T, and the GSMA. The investigation centers around claims the operators are attempting to use the new technology to "lock" devices to their networks, making it harder for consumers to switch operators.

The GSMA have subsequently put standards development on hold, pending the outcome of the investigation. The impact of this investigation on the future of the GSMA standard remains to be seen.

The two disruptive scenarios are likely to meet resistance from both operators and regulators. MNOs and MVNOs will resist the "rapid switching" model to minimize overly aggressive price competition, as it could increase the difficulty of recuperating network investment. While the introduction of proprietary eSIM solutions in the "operator disintermediation" model would require OTTs and OEMs to obtain mobile licenses in many markets, which can be a lengthy process and is monitored by regulators to ensure consumer data security.

Another factor is the expectation of low take-up of consumer eSIM solutions in the short-term. Only 7.2% of consumer devices sold globally are forecast to be eSIM compatible by 2022.

Conclusions

Barring significant interruption due to the recent U.S. Justice Department investigation, the GSMA eSIM standard is likely to prevail in the short- to medium-term, limiting the potential disruption arising from eSIM. This will provide stability to the industry, while enabling a better experience for consumers, particularly when roaming.

However, operators should be aware of the potential impact of proprietary solutions and should closely monitor the developments of eSIM to anticipate disruptive moves from other players.

Anthony Dornan is a management consultant at Delta Partners, an advisory and investment firm specialized in the telecom, media and digital industries. He is a manager and is currently helping telecoms operators and technology companies solve their strategic challenges.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not represent the opinions of our editorial board.