Industry Voices are op-eds from industry experts or analysts invited to contribute by Fierce staff. They do not represent the opinions of Fierce.

Mobile World Congress was back to its past glory this year with more than 100,000 visitors, as reported by the organizer GSMA. As expected, there was lots of news, and open RAN was one of the major themes. Among many things I cover, I found it interesting how Samsung Networks expanded its partnerships, extended its reach and solidified its position as one of the top 5G global infrastructure players.

The open RAN action started much before MWC this year. Verizon touted that it has deployed more than 130,000 open RAN compatible radios in February 2024. Before that, AT&T, which hasn't been outspoken about its open RAN strategy, surprised the industry with a large single-vendor contract to Ericsson in December 2023. This contract upset the infrastructure market structure. Suddenly Ericsson, a laggard so far, became an overnight open RAN champion. Meanwhile the deal reduced Nokia's relationship to only T-Mobile, among the top three U.S. mobile network operators (MNOs). These announcements indicated that open RAN is slowly but surely becoming mainstream.

Samsung's continued operator traction

I have closely followed Samsung Networks' journey from its disruptive international debut to carefully charted global expansion to its current leadership position, as documented in my ongoing article series.

In North America, Samsung currently has major 4G LTE, 5G legacy and open RAN deployments at Verizon, a legacy deployment at Telus and exclusive multi-vendor 5G open RAN deployment at Dish Network. Samsung supplied a majority of the aforementioned 130,000 open RAN compatible radios at Verizon. It further expanded its reach in the region by signing up to deploy Canada's first open RAN network with Telus. This is noteworthy also because Samsung will provide comprehensive solutions, including the latest vRAN 3.0 for 4G/5G, open RAN compliant Massive MIMO radios (up to 64T64R), support for third-party radio integration, and AI-based Services Management and Orchestration (SMO) platform, a first for Samsung.

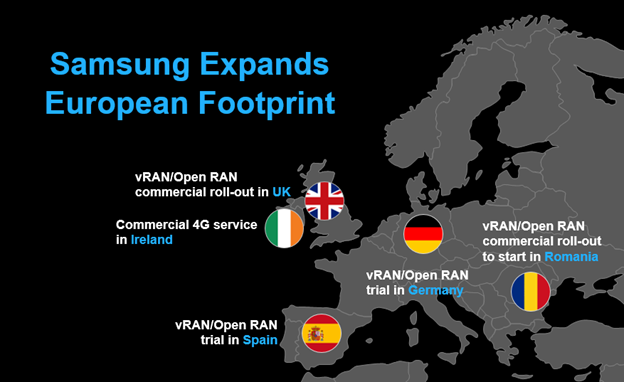

In Europe, Samsung has established a strong relationship with Vodafone since 2021. Last year, Samsung and Vodafone began a large-scale open RAN rollout across 2,500 sites in the U.K. At MWC, both companies announced that they are extending that further to deploy open RAN in 20 major cities in Romania. Samsung is rapidly expanding its footprint and becoming a critical player in the region.

Telecom: a game of partnerships

Telecom is a game of partnerships. It's even more critical in open RAN, where the whole premise is to utilize various vendors' different software and hardware components. During MWC, Samsung announced new partnerships and further strengthened existing ones.

The first was with AMD, where Samsung and Vodafone made the first end-to-end open RAN data call on AMD processors. The call was made with AMD EPYC 8004 series processors on Supermicro's Telco/Edge servers, supported by Wind River Studio Container-as-a-Service (CaaS) platform.

Following that, Samsung announced the industry's first end-to-end call in a lab environment with Intel's next-gen Granite Rapids processors. Earlier this year, Samsung and AWS announced a data call using Samsung's versatile vRAN software, Samsung's vRAN accelerator card and Amazon Elastic Compute Cloud (Amazon EC2) instances powered by AWS Graviton processors.

As the debate rages on whether x86 or Arm processors are the best, or in-line or look-aside accelerators are most suitable for vRAN/open RAN, Samsung is not taking sides and is offering all the options, giving choice to operators. One might think offering all options is more expensive and resource-intensive. This is precisely where the financial strength of the larger Samsung conglomerate comes into the picture and makes Samsung Networks differentiate itself.

Let me explain. Global Infrastructure is a relatively new, strategic and growth business for the mothership. In today's dynamic infrastructure market, marred by financial challenges and geopolitics, Samsung has the opportunity to prove itself as a significant, reliable global infrastructure player by leveraging its economic strength, technological prowess and international presence.

The additional cost to support all options is fully justified if that means more contract wins, market leadership and more significant influence in the market. That's why I think, instead of being an arbitrator, offering choice is a brilliant move by the company.

Looking ahead – 5G SA Core network, RIC, 5G Advanced, 6G

Samsung Networks is known for its RAN and is a market leader in vRAN/open RAN. However, it also has the Core Network business that has been steadily growing and is now ready to change gears. The timing is impeccable, as the industry is slowly transitioning to the new cloud-native architecture and, more importantly, to standalone (SA) mode, creating opportunities for new vendor introduction.

Samsung already supplies its vCore to SK Telecom, KT, and LGU+ in South Korea. It recently went live with the nationwide commercial 5G SA Core Network for KDDI and deployed the virtual roaming gateway for TELUS.

With open RAN slowly becoming mainstream for many operators, the focus is now moving toward automation and other advanced capabilities this architecture offers. Many of those are realized through RAN Intelligent Controller (RIC) and rApps. At MWC, Samsung highlighted its Non-Realtime RIC platform, its own rApps, as well as those of Viavi, Capgemini, ZinkWorks and others. RIC and rApps will soon be the new battleground for infrastructure players.

5G Advanced is the next phase of 5G with many exciting features, including AI. At MWC, Samsung discussed its chipsets for AI-based baseband and radios, as well as using AI for enhanced beamforming and uplink performance. It also showed mock-ups of advanced radios with next-gen Massive MIMO, supporting up to 256 TRX and 3072 antenna elements. The company indicated that these radios would support 6 GHz and 13 GHz bands, all gearing up for possible 5G Advanced and 6G deployments. Although technology discussions are starting now, there is still quite a bit of time for 6G.

In summary, MWC proved to be an excellent time for Samsung to showcase its progress and solidify its position as a top 5G infrastructure player.

Prakash Sangam is the founder and principal at Tantra Analyst, a leading boutique research and advisory firm. He is a recognized expert in 5G, Wi-Fi, AI, Cloud and IoT. To read articles like this and get an up-to-date analysis of the latest mobile and tech industry news, sign-up for his monthly newsletter at TantraAnalyst.com/Newsletter, or listen to Tantra's Mantra podcast.