Making millimeter wave (mmWave) 5G technology affordable in smartphones has been an industry struggle since the first 5G devices hit the market nearly four years ago. The challenge stems from the technology's unique RF characteristics, which force engineers to adopt new antenna designs that are completely different from those of standard sub-6 GHz 5G frequencies. Adding to that complexity, multiple antenna modules must be used so signals aren't blocked whichever way the phone is being held.

Therefore, mmWave 5G capabilities have so far been limited to premium smartphone models with sufficient bill-of-materials budget to absorb the additional costs of components and engineering that come with mmWave RF technology.

For network carriers, the mmWave cost challenge has limited the addressable market for their ultrafast 5G networks. In the U.S. particularly, leading mmWave carriers such as Verizon have long worked toward democratizing the technology by promoting its inclusion in lower price-tier devices and so bring it to more subscribers.

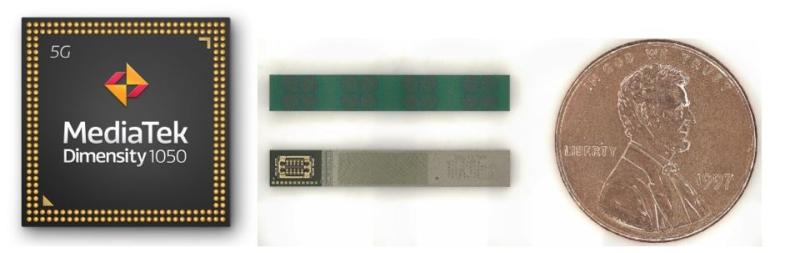

Efforts to move mmWave 5G into the mass market have received a big boost from MediaTek's announcement that its Dimensity 1050 platform with this technology built-in is now available. The company's entry to the mmWave 5G chip space represents only the second rival for Qualcomm's overwhelming presence in this market. However, MediaTek's entry does offer a tantalizing promise of enabling truly affordable mmWave designs that align with the mass-market aspirations of 5G carriers such as Verizon.

The choice of Dimensity 1050 as the entry point for mmWave capability reflects MediaTek's ambition of creating a product where few competitive solutions exist. Currently, Verizon's line-up of almost 30 5G smartphones hosts only one sub-$300 smartphone with mmWave 5G capability, the TCL 30V 5G.

In fact, the selection of affordable mmWave smartphones is so limited that Verizon waived its minimum standard of support when it agreed to carry the latest version of the Apple iPhone SE, priced at $429. The Dimensity 1050 will address this gap for smartphone makers targeting devices in the $250-to-$399 range serving mmWave 5G carriers in the U.S.

MediaTek's mmWave antenna module design follows the standard phase array antenna-in-package approach established by Qualcomm, which integrates a discrete RF transceiver and power management integrated circuit in each antenna module. Murata, which supplies mmWave antenna modules for the Google Pixel 6, also follows this common design, but positions its two antenna modules perpendicularly against one another to form an L-shaped antenna structure. MediaTek's design is more like Qualcomm's approach, which engineers each antenna module to maximize spatial diversity and offer an arguably better approach for smartphone design.

However, unlike Qualcomm's solution, the Dimensity 1050 supports only up to 400 MHz of mmWave spectrum aggregation; Qualcomm has offered up to 800 MHz since the first generation of its design. Although this may seem be a glaring difference in capability, it is unlikely to produce significant noticeable performance difference in loaded mmWave networks, where many devices are accessing the network resources.

As 5G networks mature, attention will undoubtedly turn to mmWave technology as the next big accelerant to the overall capabilities of advanced 5G networks. MediaTek's entry here is significant as it marks a first true competitive solution in a market that has been led by a single supplier of technology. Although MediaTek is technically the third company to provide mmWave RF silicon, it is the only one beyond Qualcomm that has the scale to integrate the technology with overall 5G modem chips to provide smartphone makers with added choice when it comes to designing 5G phones.

Furthermore, MediaTek is already eyeing regions beyond the U.S. as further drivers of growth, such as the Japanese market, and the company has a strong presence in the more value-conscious segment of the smartphone industry. This may be an especially important factor in helping mmWave to reach new regions and customers over the coming months.

The Dimensity 1050 will open up new design possibilities, especially in the value-conscious segment of the market, creating new 5G capabilities that would otherwise be limited by design and cost. This will be crucial to MediaTek as it pursues market opportunities, and as mmWave 5G begins to gain momentum across the globe.

Wayne Lam is senior director, Research, Americas at CCS Insight. He has more than 12 years of experience covering mobile devices, wireless technology and associated supply chains. He joined CCS Insight after starting with smartphone pioneers such as Symbian and progressing to market intelligence firms including iSuppli.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not represent the opinions of Fierce.