Open Radio Access Network (RAN) remains a hot topic, elevated with this past week’s Telecom Infra Project’s Fyuz event, which was all about open and disaggregated networks.

But is the market evolving as expected? Fierce checked in with a couple industry analysts to get their read on the situation.

Joe Madden, chief analyst at Mobile Experts, said the open RAN market is developing exactly as he and his team predicted a few years ago – which is to say, not so fast.

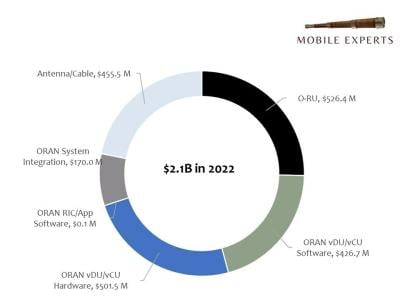

Mobile Experts recently completed a new 46-page report with a breakdown of the radio hardware, centralized unit/distributed unit (CU/DU) servers, RAN Intelligent Controller (RIC), xApp/rApp software and more to illustrate how the open RAN market will migrate from greenfield deployments to complex networks.

Generally speaking, incumbent operators say they want to do open RAN, but by 2019, they had already committed to an architecture. Ripping that out is not in the cards.

“Once you’ve deployed equipment, you don’t save money by tearing that out and buying new stuff. They’re kind of waiting for their next round of something new to realize the savings,” such as their next batch of fresh spectrum, Madden said.

Given where the U.S. spectrum pipeline stands, does that mean open RAN will be a 6G thing?

Fierce recently posed that question to Joe Russo, EVP and president of Global Networks and Technology at Verizon. He said Verizon likes the idea of open RAN and it's in the testing phase of it. "There’s promise,” he said, but at this point, it isn’t part of its scaled 5G rollout. It’s possible that open RAN may turn into a next-generation 5G deployment versus 6G, but he said that’s still to be determined.

Single-vendor vs. multi-vendor approach

Part of the allure of open RAN and disaggregation is 1) more choices among vendors and 2) lower costs due to more competition. But operators also need to know the equipment they’re deploying is going to work, and that’s why so many incumbent operators are in this test/pilot phase of the journey.

“That’s a three-year period of sort of waiting and it’s going to seem like really slow market development,” Madden said.

In addition, the desire for a multi-vendor approach isn’t exactly evolving to plan. Single-vendor RAN now comprises a major part of the open RAN movement, said Stefan Pongratz, VP at Dell’Oro Group. When talking about open RAN, Dell’Oro Group includes both multi-vendor and single-vendor in their open RAN estimates, he said.

“Most operators typically have a cloud RAN roadmap that includes O-RAN compatible interfaces but the likelihood this will translate to multi-vendor RAN is lower, hence we are optimistic about cloud RAN using open interfaces (or we can also call this open vRAN) but not as optimistic about multi-vendor RAN,” he told Fierce via email.

In other words, “all roads lead to cloud RAN,” he said. “Not all the roads lead to multi-vendor RAN.”

A RIC problem

The RAN Intelligent Controller (RIC) is one part of open RAN that has some fundamental problems, Madden said. Each of the major OEMs and suppliers will have their own RIC, similar to an operating system. That creates problems for developers who don’t have the resources to develop apps for, say, 10 different RICs.

“Right now, we don’t see a path for rationalizing the number of RICs,” Madden said. “The RIC in app software is going to problematic for some time.”

He sees things shaking out differently in the private network space, where the customer is the enterprise. That’s where rapid customization of the networks is a must-have. The radio characteristics for a mining company will be very different from a drone network delivering pizzas, for example.

The app developers are going to organically choose one or two RICs that they prefer and it will happen in the private enterprise space. Once that private enterprise market gets big enough – say, in six to 10 years from now – “then the tail starts wagging the dog and now the private enterprise market starts to dictate what happens in the telco market,” he said.

Big vendors in the game

A lot of pressure has been put on the likes of Nokia and Ericsson to support open RAN, and they are involved in the O-RAN Alliance, but the degree of their commitment remains the subject of debate. Of course, it also circles back to big vendor domination, which is what some in the open RAN movement were trying to get away from.

“I think we’ve reached a point now where the operators have shown they do have enough leverage to force Ericsson to play the game,” Madden said, noting how Ericsson last month underlined its commitment to open RAN.

Dell’Oro Group estimates open RAN will account for 5% to 10% of the overall RAN market this year. Open RAN accelerated at a faster rate than expected up until last year while revenues in the first half of 2023 are in line or slightly below their revised projections, Pongratz said.

“Even if the original narrative has changed with single-vendor open RAN now comprising a major part of the open RAN movement, our position has not changed. We do believe that this movement towards more openness, virtualization, automation and intelligence is here to stay,” Pongratz said.

“And recent announcements by the leading RAN suppliers including Ericsson and Nokia bolster this position. We are still forecasting open RAN to account for 15% to 20% of the overall RAN market by 2027. The caveat here of course is that single-vendor open RAN is expected to fuel the lion’s share of the investments. In short, we are more optimistic about open RAN than multi-vendor RAN,” he added.