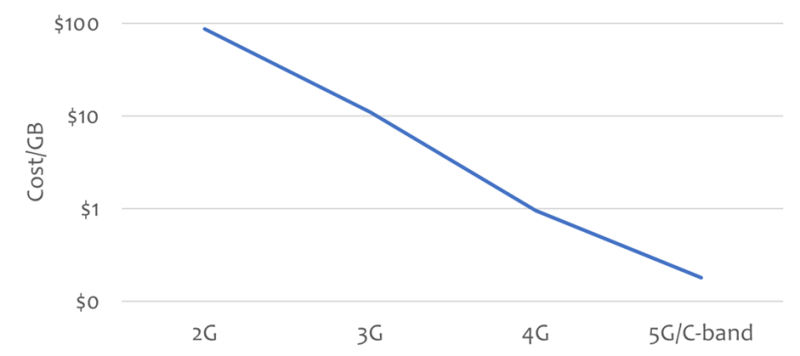

For the past 15 years, I have been talking about cost per GB in mobile networks, and tracking the steady improvement in cost with every generation. The cost reduction trend was fairly consistent and for over a decade I have been showing charts like the first chart here, with 10x improvement with every generation.

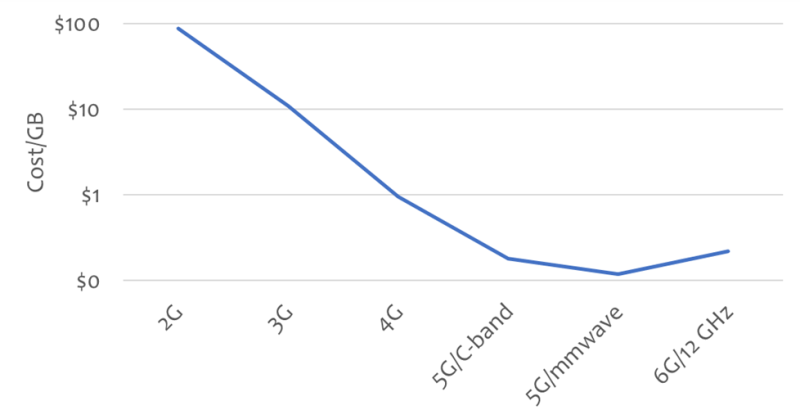

Back in 2019, I made a mistake when I projected ongoing cost improvements in millimeter wave (mmWave). In the mobile broadband case, the operators have struggled to get full utilization of the mmWave radio. Instead of utilizing 10-20% of theoretical peak capacity on an average day, the mmWave radios out there on streetlights are only achieving about 1% utilization or even lower. That’s bad news for the CFO. The fixed cost of the radio is only benefiting a few customers, so mmWave doesn’t give us a next step in cost reduction. (This applies to mobile broadband only. Fixed wireless is a different story.)

What about 6G? Let’s get in our time machine and look at the world in 2033, when we have deployed our 6G network using 12.7 GHz spectrum in the United States. Unfortunately, we have two problems here: a) the bandwidth available for each operator is the same as our 5G network at 3.7 GHz ; and b) the 12.7 GHz signal has difficulty in penetrating indoors, so even with "giga-MIMO," the RF performance would be poor indoors, and could require indoor small cells to be more effective. The average cost/GB for 6G at 12.7 GHz will actually be higher than the 5G cost at 3.5 GHz.

In other words, Shannon says that we can’t expect a magical boost in spectral efficiency from 6G. And the FCC says that we can’t expect a wide bandwidth below 6 GHz, where indoor penetration is easy. Both are responsible for Laws that are hard to break.

Things may be different outside of the United States, where substantial spectrum at 5.9-7.4 GHz could be made available for mobile use. But in the States, we’re scraping the bottom of the barrel for spectrum now. One possible outcome is that operators will get more serious about using unlicensed spectrum for carrier aggregation, to add capacity without relying on unlicensed channels in the traditional way.

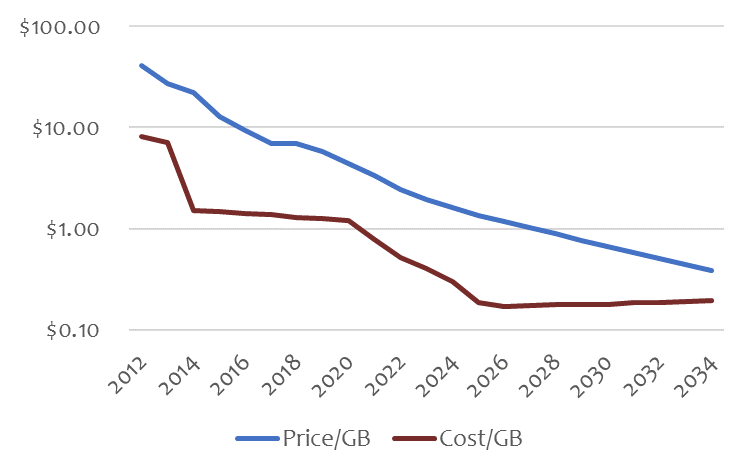

At Mobile Experts, we have a model that looks at the retail pricing for each GB of data, compared with the network cost per GB as data shifts from 4G to 5G and beyond. The telcos live on the gap between these two numbers. During good times, the ratio of price to cost is 6:1 or even 10:1. At the end of each generation, the gap narrows to about 4:1 and a new generation is introduced.

Looking forward to the 2030s, we don’t see any relief coming from a new standard or a new wideband channel. That means that without substantial use of unlicensed bands, changes in ARPU, or a slowdown in data growth, the operators will be in trouble.

One likely outcome here will be the end of the “unlimited” plans. No sane energy utility would give you “unlimited” electricity, because energy is a commodity with a stable cost. The mobile industry is transitioning from a growth market to a commodity market. In that way, the supply and demand of mobile data can reach equilibrium and the operators can establish mobile broadband as a long-term cash cow business.

This outlook is a little depressing, but the industry still has a few aces up our sleeve. We may be able to add substantial capacity through AI optimization of the network. We may get a capacity boost from unlicensed bands at low cost. We will be tracking those ideas over the next year, so stay tuned for more.

This broad market shift is the reason that Mobile Experts is so focused on private cellular networks and the growth of premium business models for the operators. Telcos will need network slicing, URLLC and similar innovations to boost ARPU and create a new pattern for the industry to follow. They’ll need any revenue boost from FWA that they can get.

The mobile industry can succeed, but everyone must understand that success depends on a shift away from cost reduction, toward a focus on premium revenue instead. That means that the industry will focus less on spectrum and bandwidth, and more on virtualization, edge computing and automation for the enterprise.

A friend told me recently that 6G will be the “end of the G-string.” My response to that was: “It’s not the end. The industry grew out of its old G-string, and it’s time for a new one.”

Joe Madden is principal analyst at Mobile Experts, a network of market and technology experts that analyze wireless markets.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not necessarily represent the opinions of Fierce.