Boost Mobile is trying to win over customers with another service deemed in high demand among its customers – banking. It follows the introduction of healthcare services last year.

With inflation on the rise, Boost management figures it’s a good time to offer a banking app and services that make it easier for customers to manage their money.

OmniMoney isn’t a bank per se but it offers access to accounts, money transfer, debit cards and basic no-fee digital checking services. In-store cash deposits are available in select Boost Mobile stores, with expansion nationwide coming over the next several months.

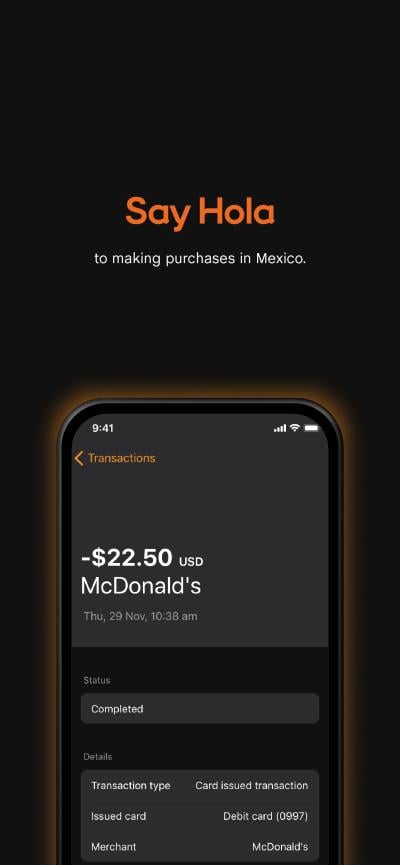

OmniMoney customers will be able to remit money internationally, including free remittances to countries like Mexico where they might want to send money to family and avoid money transfer fees.

The Boost customer segment skews to the underbanked – in fact, the entire prepaid sector where Boost plays is historically underbanked, according to Stephen Stokols, who heads Boost Mobile.

If Boost can offer customers something that goes beyond wireless connectivity, it stands to gain not only via lower churn but also potentially by stealing customers from other brands like AT&T’s Cricket and Metro by T-Mobile.

Boost’s challenges

Boost Mobile has been steadily losing customers since Dish Network bought it as part of government stipulations tied to the Sprint/T-Mobile merger. In the second quarter, Boost lost another 210,000 retail wireless net subscribers, bringing its total customer base to 7.87 million.

CONX Corp., a SPAC backed by Dish founder and Chairman Charlie Ergen, earlier this month filed an SEC document saying shareholders will hold a vote October 31 about whether to extend discussions with Dish Network about a potential sale of the business.

Stokols couldn’t shed any light on that topic but said they expect questions about the CONX filing to come up during the company’s earnings call, which hasn’t yet been scheduled.

As to reports about Boost Mobile founder Peter Adderton’s desire to buy back the company, Stokols said Adderton has been saying that for at least two years now. “There’s nothing really new there,” he said. “That’s just been the chatter over the last two and a half years.”

Money services for the underbanked

MVNOs use the same network as their partner or host mobile network operator – Boost uses both T-Mobile and AT&T networks – and differentiating on network and/or price is challenging.

Stokols said when he joined Boost in 2020, one of the things they talked about was how they were going to make Boost stand out against its rivals.

That led to discussions about what would add value to Boost customers – things they want but don’t necessarily have immediate access to. During the height of the pandemic, Boost launched free or discounted telemedicine and K Health healthcare services.

That proved so successful that Boost saw a 20% uplift from it, he said, declining to share specific numbers.

Beyond that, “the biggest area of need, outside of affordable wireless, was the fact that our base is massively underbanked,” he said. “We were looking at ways that we could actually solve that problem for customers in a way that’s synergistic and harmonious with the wireless service and that’s where OmniMoney comes in.”

Boost says OmniMoney provides an easy way for customers to view deposits and withdrawals, make secure payments, transfer money and send remittances. There’s no credit check or minimum balance requirements, and no monthly fees for “active” users.

Over half of Boost customers pay their bills with cash; they don’t have access to a bank account, which requires qualifying for one and paying bank fees, and for some, they just can’t afford it.

“Now they’re going to have access to banking services,” he said. “We’re looking to solve a problem for a massive segment that we serve.”