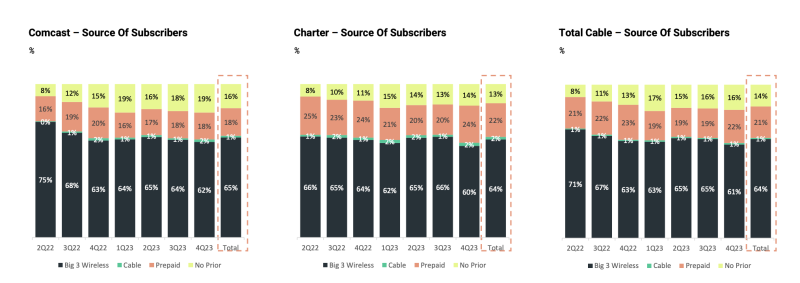

New Street Research used data from Recon Analytics’ surveys to determine where cable mobile virtual network operator (MVNO) subscribers are coming from. The bad news is that these new MVNO subscribers are coming from the big wireless operators. And the data indicates that a majority of cable MVNO subscribers are switching from Verizon and AT&T postpaid.

The analysts note that for the wireless industry, in general, 90% of gross adds are switchers, and only 10% are new to the industry.

The pie of wireless subscribers in the U.S. isn’t getting much bigger. And churn drives the preponderance of every carrier’s gross adds. Currently, mobile industry churn is low at about 1.4%.

“Most of cable adds are coming from postpaid at the national carriers,” wrote New Street Research in a December report. “64% of cable’s gross adds come from the three national carriers' postpaid bases,” wrote New Street.

In the third quarter, 64% of Comcast MVNO subscribers came from a postpaid plan at a national carrier. “This isn’t all that surprising when you consider that Comcast is a premium provider in broadband, and they are selling wireless to their broadband base. It stands to reason that their broadband customers are more likely to be postpaid customers of the three national carriers,” wrote New Street.

The trend at Charter is similar. In the last quarter, 66% of Charter MVNO subscribers came from a postpaid plan at a national carrier. “This corroborates Charter management’s claim that their wireless base is very representative of their broadband base. It contradicts the suggestion made by managements at some wireless operators that cable adds must be from prepaid or are otherwise of low quality,” wrote New Street.

Although wireless operators seem to believe that cable isn’t taking much postpaid share, the data from Recon Analytics disputes that belief.

New Street said the wireless operators' belief probably stems from the fact that cable only accounts for less than 10% of industry gross adds today, so the share of any carrier’s churn that is going to cable is still relatively small.

“Wireless operators see a relatively small share of disconnects going to cable, which has led them to believe that cable is having a small impact on them, but when the relative size of the base is accounted for, the opposite is true,” wrote New Street.

Of the big three wireless carriers that are losing postpaid subs to cable, AT&T and Verizon are taking the biggest hit. However, as T-Mobile’s base has changed and it has begun to penetrate segments that previously were the sole domain of Verizon and AT&T, it’s also at risk of losing more postpaid subs to cable.

Wireless subs loves their phones, but not their cost

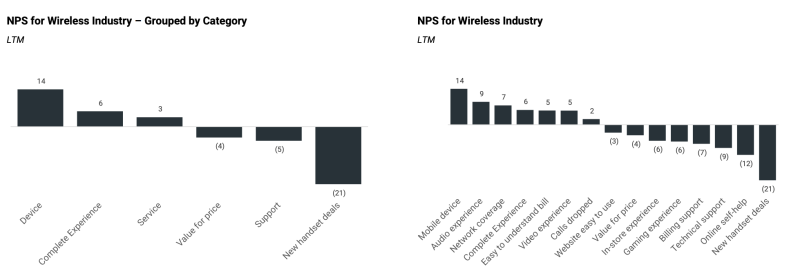

In other data based on Recon Analytics' surveys and presented by New Street Research, it was revealed that mobile customers are very happy with their devices, but they’re much less happy with the cost of those devices and their wireless provider's customer service.

In terms of postpaid, New Street wrote, “We are surprised by the poor score for new handset deals, given that most subscribers can get up to $1,000 subsidy on the best devices. They don’t even need to switch carriers to get the discount, much of the time. Postpaid subscribers are satisfied with the service, but less satisfied with what it costs."

Of course it should be pointed out that the carriers aren’t really giving away $1,000 phones. They’re subsidizing them over a payment period. And customers understand this. Perhaps they just think $1,000+ for a phone is too much money.