Comcast and Charter both reported good growth in their mobile virtual network operator (MVNO) lines again. For the fourth quarter of 2023, Comcast added 310,000 mobile lines, with about 6.5 million wireless lines in total.

Dave Watson, CEO of Comcast Cable, said the company is only at 11% penetration of wireless within its broadband base, so it has “a lot of runway ahead.” And he said Comcast is “consistently in the market trying new offers.”

Comcast didn’t talk about the conversion of wireless customers from free promotional lines to paid lines. But the company did report that Xfinity Mobile total domestic wireless revenue increased from $883 million at year-end 2022 to $1.02 billion at year-end 2023, an increase of nearly 20%.

For its part, Charter added 546,000 mobile lines in the fourth quarter, reaching a total of 7.8 million mobile lines. Charter CEO Chris Winfrey said, “Only 13% of our internet customers now have mobile service.”

For the full year 2023, Charter reported Spectrum Mobile service revenues of $2.24 billion, up 32.1% from $1.69 billion the previous year.

Charter’s CFO Jessica Fischer mentioned the free promotional mobile lines that Spectrum Mobile has been offering. She said, “We've sort of lapped the free line offer, the number of free lines that we have in the system.” She expects 2024 to be more steady in terms of mobile lines than it was in 2023. “And you'll have, just as a matter of math, more paying customers in the base as a proportion relative to the free lines,” said Fischer.

MVNO survey

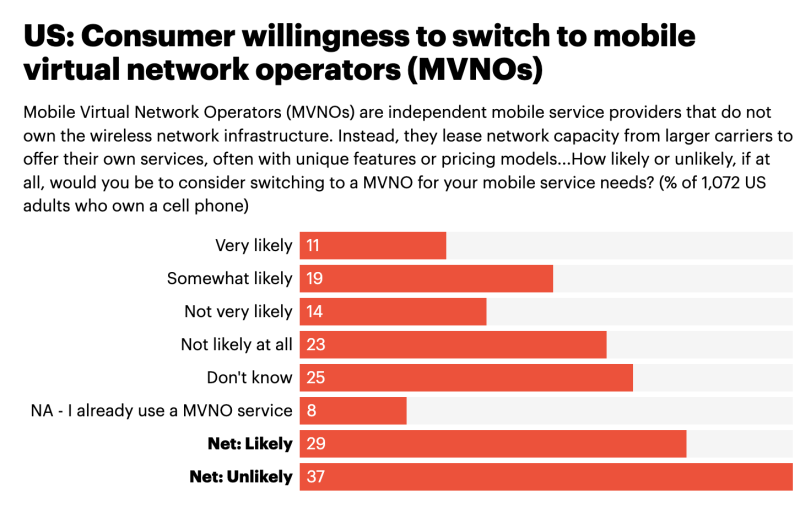

A British market research and data analytics company YouGov conducted a poll in late January of 1,072 U.S. adults who own a cell phone, asking them their opinions about MVNOs.

Asked how likely they would be to consider switching to an MVNO for their mobile service needs, 29% said they were likely to switch.

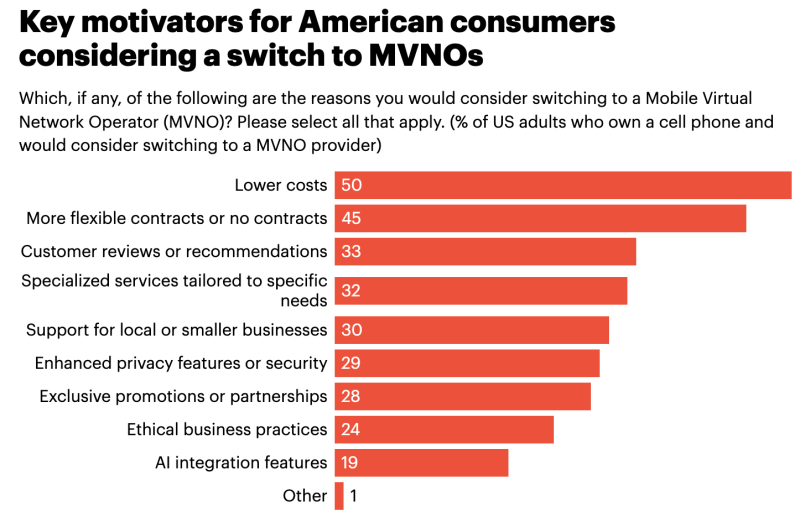

For those considering a switch to MVNOs (very likely or somewhat likely), cost emerged as a key motivator. Fifty percent cited lower costs as a compelling reason for a potential switch. Close behind, 45% appreciate the allure of more flexible contracts, while a third (33%) value customer reviews and recommendations.

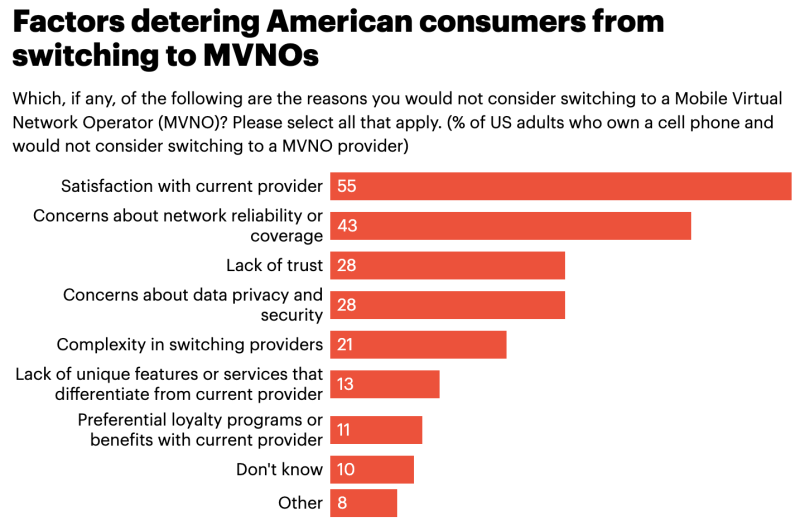

Conversely, among those unlikely to consider MVNOs, the primary deterrent was satisfaction with their current provider, as stated by 55% of the respondents.