On May 4, T-Mobile made an Uncarrier announcement that juiced its fixed wireless access (FWA) home internet offering. The company offers now to pay the early termination fee for people who switch from their current internet service provider, provide 50% off YouTube TV, and if it's combined with the MagentaMax family plan the monthly cost goes down from $50 to $30.

In addition, T-Mobile provides $50 off any streaming device, which means quite a number of streaming devices are free to the consumer. T-Mobile did this announcement with their usual panache and media savviness. At the same time, most of what T-Mobile is offering such as a discount for bundling FWA and mobile or early termination fee reimbursement were already being quietly offered by Verizon with an even higher discount and instead of a 50% off YouTube TV, it's offering 6 or 12 months of the Disney bundle.

Seeing an interesting opportunity, we added some questions to our May 6th, 2022 pulse of our Recon Analytics Home Broadband Service (RAHBIS) to get a few more insights on how consumers think about this offer.

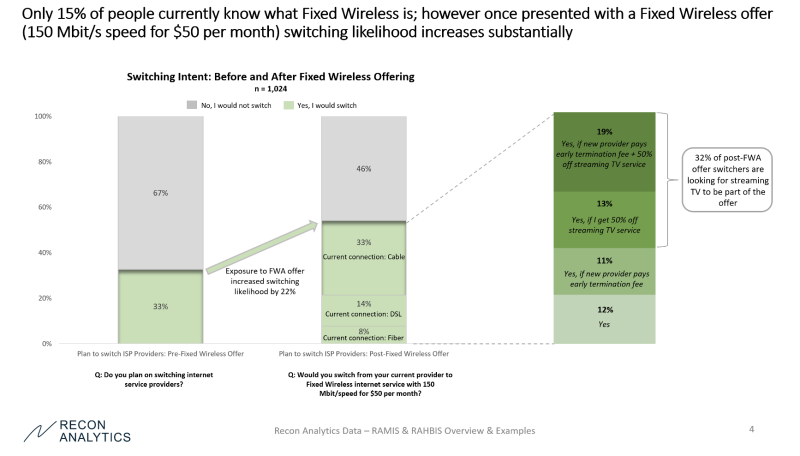

First of all, fixed wireless access is still a relatively unknown offer. Only 15% of consumers know what it is. The industry still has a long way to go before people get up in the morning and say, “I will switch to fixed wireless internet access today!” But there is a lot of potential.

When we prompted respondents with a $50, 150 Mbps fixed wireless offer, the switching intent increased from 33% to 54%. There is a clear interest in a higher speed, lower price alternative, not only for current DSL customers but also for cable customers. The 300 Mbps cable speed upgrades can’t come early enough.

We also asked respondents what would motivate them to switch to a $50 per month FWA offer with 150 Mbps speeds. 12% were interested without the need of a sweetener. 11% would need to have the early termination fee paid for them to switch. Both T-Mobile and Verizon (with its $35 bundled/$70 stand-alone 5G Home Plus) offer this feature.

The impact of paying early termination fees is uneven. It makes a difference when your home internet provider is someone like Comcast Xfinity, which has contracts, whereas it has no impact at all on Charter Spectrum customers who have no contracts.

T-Mobile gets another 13% by adding in 50% off YouTube TV. This is smart as a lot of current cable customers also have linear TV as part of their bundle. This gives an apples-to-apples comparison. By using YouTube TV as their partner, T-Mobile also has plausible deniability when it comes to annual content price increases – and we all know they will come. T-Mobile can point to the “bad” Google people who increase rates every year for YouTube TV while T-Mobile reminds them that they would never do that. This makes the offer appealing to slightly more than one third of consumers.

To get above 50%, T-Mobile combined the two offers. This move adds another 19% of consumers to the addressable market. The customers want to leave free and clear and replace their internet/linear TV bundle with a functional equivalent.

In deeper analysis we looked at the purchase decision drivers of cable, DSL, and fiber customers who are interested in FWA by internet providers and found some very interesting insights.

Based on our research, Cox is the internet provider that has the most to fear from FWA.

Roger Entner is the founder and analyst at Recon Analytics. He received an honorary doctor of science degree from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger on Twitter @rogerentner.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not represent the opinions of Fierce.