Dish Network and EchoStar are merging, which gives Dish more leverage as it builds a nationwide 5G network and attempts to be a legit player in wireless.

In an all-stock deal, existing Dish shareholders will own about 69% of the common stock of the combined company. Existing EchoStar shareholders will own the remaining 31%.

Shares of Dish, at around $8.23, were up more than 7% at one point this morning. EchoStar shares, at $23.38, were down less than 1%.

The deal isn’t entirely out of the blue. Semafor reported last month that Charlie Ergen was considering a merger of the two halves of his empire. EchoStar spun out from Dish in 2008, so the current transaction is a reunion of sorts.

Dish also reported its Q2 2023 results today. In wireless, it lost 188,000 retail net subscribers during the quarter compared with a net loss of 210,000 in the year-ago quarter. The company closed the quarter with 7.73 million retail wireless subscribers.

Financial motivation

Executives on a conference call today to discuss the merger emphasized the synergies of the two companies; one investment analyst referred to the combination as “yin” and “yang.”

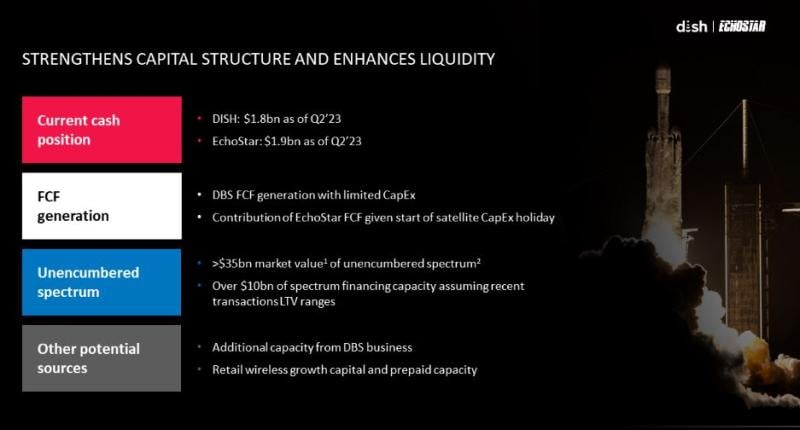

In a statement, Ergen said it’s a “strategically and financially compelling combination” that’s all about growth and building a long-term sustainable business. It’s also expected to significantly reduce near-term capex requirements.

Both entities are controlled by Ergen; one is highly indebted with negative cash flow and the other has positive cash flow. “You put the two together, it gives you a lot more room to finance,” said Roger Entner, founder of Recon Analytics. “And you only need one level of senior leadership.”

Entner noted that Ergen also has done this type of transaction previously. “Usually, every time he does this, it’s advantageous for him,” he said. “This is a financing move” that doesn’t trigger a change in control clause because Ergen oversees both companies. “The synergy is he only needs one set of C-level executives” and only one financing department, for example.

Terms of the deal

Once combined, Ergen will continue to serve as executive chairman. Hamid Akhavan, currently president and CEO of EchoStar, will serve as president and CEO of the combined company. John Swieringa, current president and COO of Dish Wireless, will be COO and President of Technology.

Akhavan has 25 years of telco experience, including running Deutsche Telekom European operations. He also has a rare combination of financial, engineering and technical skills, Ergen noted in prepared comments.

Erik Carlson will continue to serve as president and CEO of Dish Network until the transaction closes, at which time he will leave the business.

In a statement, Carlson said the combination of Dish and EchoStar “brings together two trailblazers with complementary portfolios and a shared commitment to change the way the world communicates.” With EchoStar’s engineering capabilities, managed network services delivery and worldwide S-band spectrum rights, the combined company will have greater resources and the financial flexibility to deliver connectivity to consumers, enterprises and governments around the world, he said.

The Board of Directors will consist of 11 members: seven Dish directors, three EchoStar independent directors, and Akhavan. The transaction is subject to regulatory and other approvals and is expected to close by year end.

The newly combined company will go to market under a range of brands, including Dish Wireless, Boost Wireless, Sling TV and Dish TV, as well as EchoStar, Hughes and Jupiter satellite services.