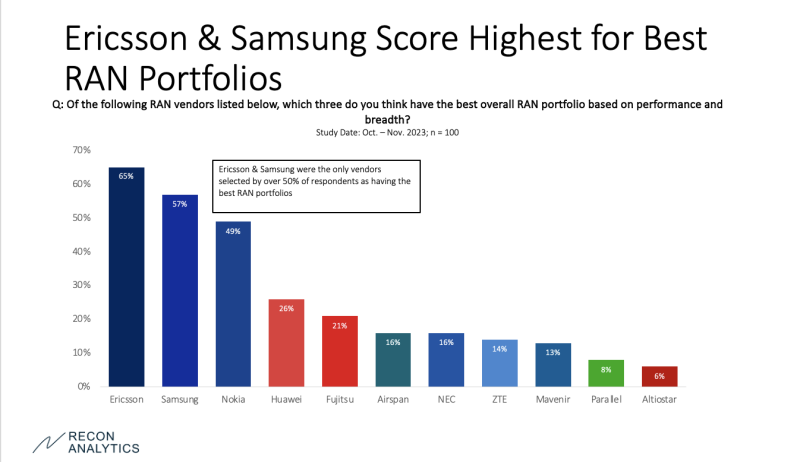

Some new data from Recon Analytics shows that when global operators were asked which vendor had the best overall radio access network (RAN) portfolios, over 50% of respondents named Ericsson and Samsung as the top two.

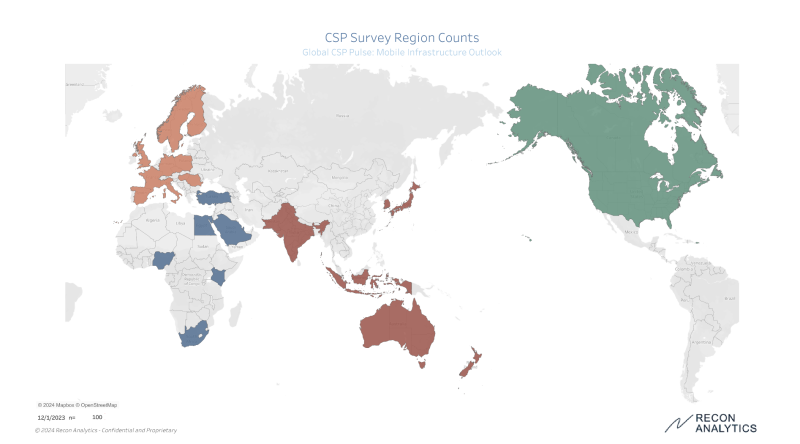

The results were part of an online survey conducted during the months of October and November, 2023 with 100 global operators. Each respondent worked at a service provider that sells mobile services. Only one response per operator per country was allowed. Although a multinational operator like Orange France and Orange Belgium would count as two separate responses.

All respondents were required to have one of the following roles when it came to selecting network partners – influencer, budget holder, decision maker or purchaser. Recon Analytics estimates there are only about 710 live commercial mobile networks globally. The 100 operators captured in its survey, “represent the meaningful part of the world,” said Roger Entner, founder of Recon Analytics. But the relatively low sample size results in a margin of error of 9.8%.

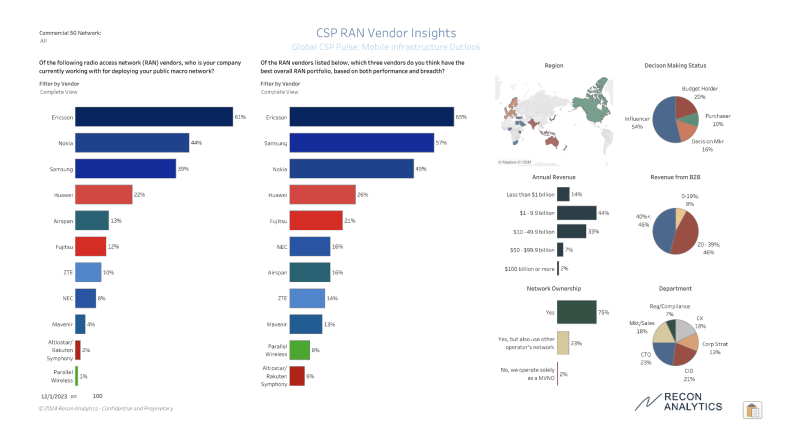

The graph on the left shows the percent of respondents working with each RAN vendor when it comes to deploying their macro networks. Predictably, the top three most popular vendors currently are Ericsson, Nokia and Samsung, in that order. China was excluded from the survey, causing the vendors Huawei and ZTE to be underrepresented.

What’s surprising is that when respondents were asked which vendors have the best overall RAN portfolio, they named Ericsson, Samsung and Nokia, in that order.

“Ericsson, with the overall highest level of positive responses for being a top three vendor, positions the company well for the future,” said Daryl Schoolar, analyst with Recon Analytics.

But the results also look good for Samsung and not so great for Nokia, which isn’t good news for the Finnish vendor. Nokia ended 2023 on a sour note when AT&T announced that it would work with Ericsson to install open RAN technologies in its network and exclude Nokia.

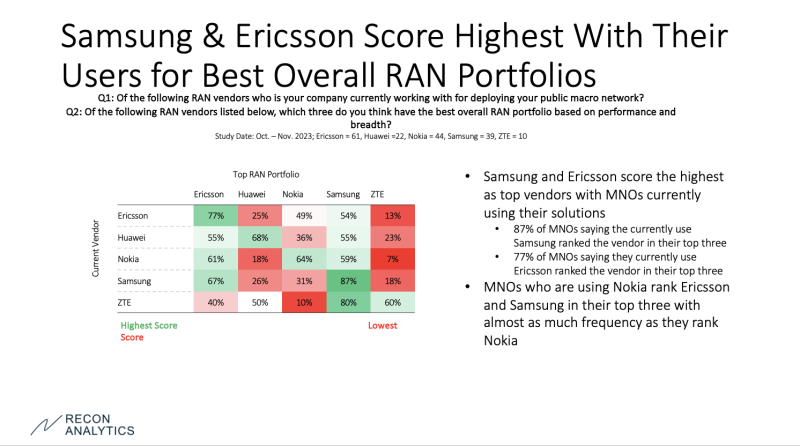

Next, Recon Analytics sliced and diced the data to see how operators who use Ericsson, Nokia and Samsung are thinking about their vendors for the future.

Notably, of respondents who said they were currently using Ericsson, 77% said Ericsson had one of the three best portfolios, followed by Samsung at 54%, and Nokia at 49%.

But Samsung scored the best with its current users: 87% of respondents who say they are using Samsung list it as having a top three portfolio.

“While Ericsson’s users don’t list it in their top three at the same frequency as Samsung, 77% is a strong showing and bodes well for its future,” said Schoolar. “Nokia has reason to be concerned as well. While its current users did select it in top three most often among the five vendors shown here, there was little separation between Nokia versus Ericsson and Samsung.”

Vendors on the move

In addition to the positive showing for Samsung in these survey results, Fujitsu, and Mavenir also scored well as vendors that operators are interested in for the future. Samsung’s top three status is 18 percentage points over its currently used status; Fujitsu’s top three status is 9 percentage points over currently used; and Mavenir’s top three status is 9 percentage points over currently used.

Below are the regions where Recon Analytics conducted its survey.