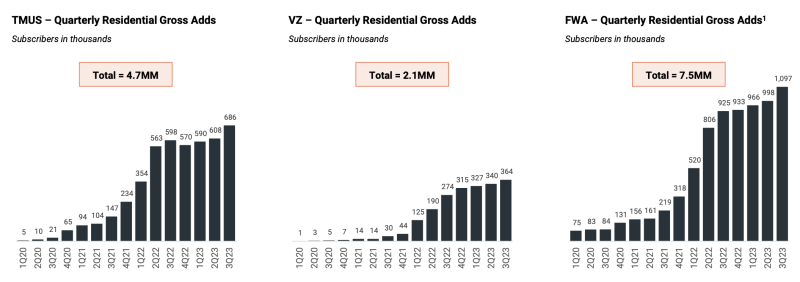

The telecom industry has been adding fixed wireless access (FWA) subscribers at a clip of between 900,000 and 1 million per quarter over the past five quarters, according to New Street Research. And the analysts say, “We expect similar results over the next two quarters, with T-Mobile targeting around 500,000 per quarter and Verizon targeting 375,000-400,000 per quarter.”

FWA has claimed more than 80% of industry broadband adds in the U.S. over the last six quarters.

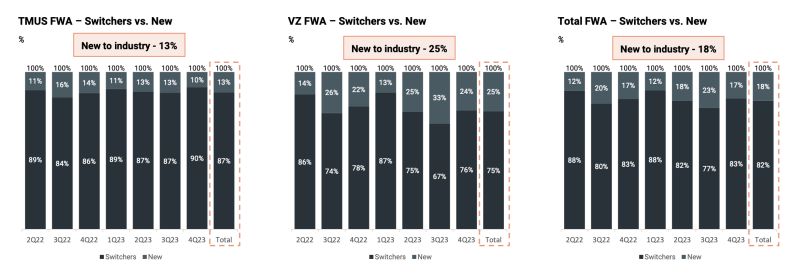

But where are these FWA adds coming from? Are they brand new customers, or are they switching from cable or DSL?

New Street worked with data and survey results from Recon Analytics to determine the answer.

The Recon Analytics dataset — focused on residential subscribers — found that close to 20% of FWA gross adds are new to broadband; almost double the share for the broadband market overall. This means that FWA is expanding the fixed broadband market.

New Street noted that subscribers who come to T-Mobile and Verizon are also drawing heavily from households that were previously wireless only. “Interestingly, more of Verizon’s gross adds are new to industry than T-Mobile’s,” wrote the analysts.

Subscribers of T-Mobile’s FWA who were new to the industry accounted for 13% of its FWA subs; while subs of Verizon’s FWA who were new to the industry accounted for 25% of its FWA subs.

In addition to general market expansion, FWA subs come from traditional cable and telco providers.

The data found that FWA fares better when compared to telco DSL, but under-indexes to cable.

New Street also wrote that T-Mobile’s gross FWA adds had flattened over the past 3-4 quarters before seeing an uptick in 3Q23. “We think they are capturing around ~30% of decisions in markets where they offer FWA; pushing beyond that will be tough. Gross adds will stall unless they expand their addressable market. Verizon is about a year behind, and they are still expanding their addressable market. They appear to be consciously throttling gross adds by taking up price and perhaps moderating marketing.”