A popular activity in politics is to benchmark presidents against their predecessor at the same time of tenure as their predecessors. We thought it would be interesting to see how the performance of the CEOs of the three nationwide telecom providers stacks up each quarter of their tenure.

Hans Vestberg, CEO of Verizon, has the longest tenure, holding his position since Q3 2018 or 19 quarters, followed by T-Mobile’s CEO Mike Sievert being at the helm since Q2 2020 or 12 quarters, and CEO John Stankey steering AT&T since Q3 2020 or 11 quarters.

To compare each CEO, we used some of the most common metrics in telecom: postpaid net adds - which includes postpaid phone and connected devices, postpaid phone net adds - the core main revenue and profit generator of a telecom provider and adjusted EBITDA - a measure of profitability. We are going to look at how these metrics have changed since Sievert, Stankey and Vestberg have become CEO and put a stamp on the strategy and execution of their respective companies.

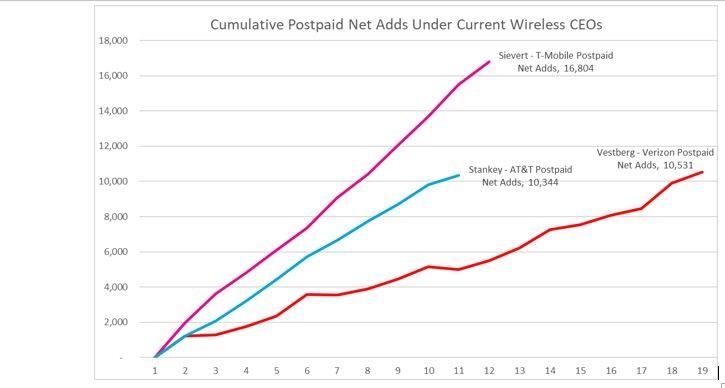

As we can see in Chart 1 above, T-Mobile has been on a tear adding postpaid connections since Sievert took over 12 quarters ago, adding 16.8 million postpaid connections. Under Sievert, T-Mobile changed its strategy from a postpaid phone net add-centric approach that John Legere pursued to an account-centric approach that added more than 8 million lower value postpaid connected devices to the T-Mobile network.

Stankey’s AT&T added 10.3 million new postpaid connections in the last 11 months, basically the same performance as Vestberg’s Verizon needed 19 quarters for, but as we will see in Chart 2, Verizon relies on a lot more connected devices than AT&T.

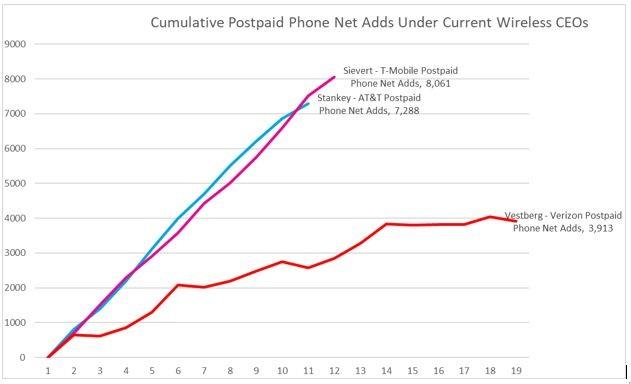

In Chart 2 below we focus on the important postpaid phone net add performance.

Postpaid phone net adds are the most profitable part of a telecom provider’s business. While T-Mobile under Sievert gets most of the accolades for postpaid phone growth in the industry, AT&T’s postpaid phone net adds performance is neck and neck with T-Mobile.

Meanwhile, Verizon’s more tepid postpaid phone growth completely petered out over the last five quarters, while Vestberg focused on increasing EBITDA at the expense of postpaid phone subscriber growth.

Over the course of their respective CEO’s tenure, 47.9% of T-Mobile’s postpaid net add growth came from phones, 70.4% of postpaid net adds came from phones at AT&T, and only 37.1% of Verizon growth came from the more profitable phone business. Strategy drives these results: Both T-Mobile’s and Verizon’s often stated strategy is to increase the total account spend of their customers with them and their published metrics allow investors to evaluate them by looking at their traditional ARPU (Average Revenue per User) but also ARPA (Average Revenue per Account) and the number of accounts.

AT&T still focuses on ARPU and its user-centric approach is reflecting on how they report their results.

Verizon’s explicit strategy under Vestberg is to focus on profitable revenue growth, even at the expense of subscriber growth if necessary.

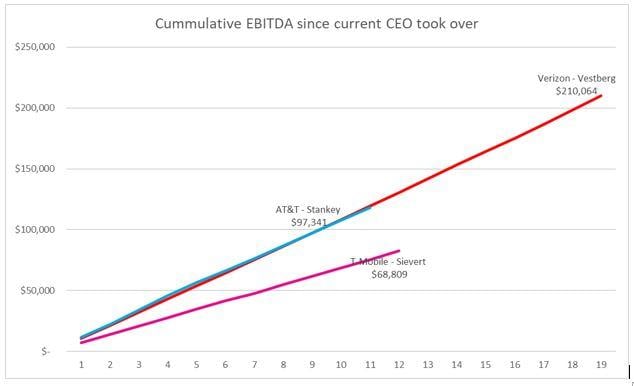

AT&T’s strategy under Stankey has been to focus on postpaid phone subscriber growth and as we can see in Chart 3, the EBITDA profitability is as good as that of Verizon under Vestberg at the same time of their respective tenure. As the third largest mobile provider, AT&T under Stankey has delivered on both postpaid phone subscriber net adds like the investor darling T-Mobile and EBITDA like Verizon.

Sievert’s strategy of growing postpaid connections came at the expense of lower EBIDTA and lower EBITDA growth than both AT&T’s and Verizon’s. We will see in the coming quarters if T-Mobile’s merger synergies kick in and the slope of the cumulative EBITDA line becomes steeper. As T-Mobile is the most valuable of the three MNOs, one would expect investors to pay more attention to what is being delivered.

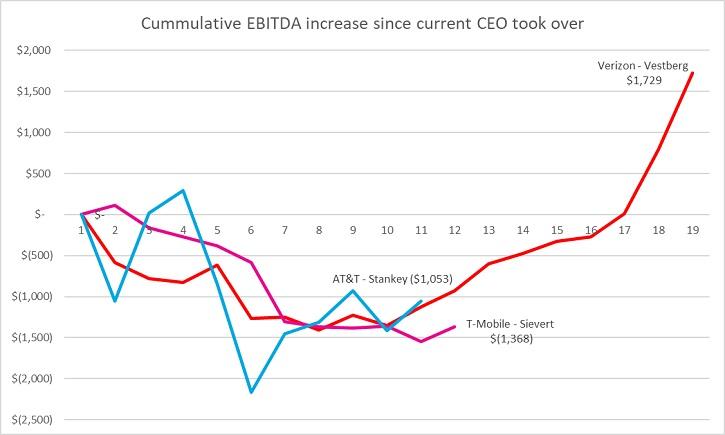

While we looked at the cumulative EBITDA increase of the respective carrier under their current CEO, in Chart 4 we will look at the incremental EBIDA change over their tenure. How much did their actions contribute to the change in EBITDA?

All of the three CEOs had to deal with corporate turmoil and had to tackle the work that their predecessor left for them. Vestberg divested the Verizon Media Group, which was Verizon’s ill-fated endeavor into the advertising space after buying AOL and Yahoo. Stankey had to unwind his predecessors’ quest into media domination, undoing the DirecTV and Time Warner acquisitions in record time. Sievert faced a different challenge in integrating the spluttering Sprint into the well-run organization that Legere left behind.

At the 11-quarter stage, which is the furthest the least tenured CEO has completed, AT&T’s Stankey is in the lead, having lost the least EBIDTA of the three CEOs, with a modest upward trend. Vestberg’s Verizon was in a similar position to AT&T but has had an impressive upward trend over the last eight quarters, increasing EBITDA. Vestberg significantly improved EBITDA over what Lowell McAdam delivered in his last quarter running Verizon.

The hope and expectation at the other two MNOs are to match or exceed Vestberg’s performance going forward in addition to also adding subscribers. Both Stankey and Sievert have a lot more flexibility through their growing subscriber base as they can monetize it better than Vestberg, which extracted more profit from the same number of customers.

Over the 11-quarter tenure of Stankey, he has delivered T-Mobile-like postpaid subscriber growth with the financial discipline and profitability of Verizon. At T-Mobile, we are still waiting for the acceleration of profitability to the levels that AT&T and Verizon are delivering while maintaining the subscriber growth.

Verizon is at the toughest spot on how to add more subscribers, which costs money, to broaden the base from which to extract more profitability. As both Verizon and T-Mobile are gunning for premium or even super-premium customers the competition for these customers with largely the same value proposition – network superiority – is going to be intense.

Don Kellogg is president and analyst at Recon Analytics. He has over 15 years of experience consulting with carriers, OEMs and MSOs in the wireless space. Prior to Recon Analytics, he was a principal at Neustar. Prior to Neustar, he was the director of research at Nielsen’s Telecom practice.

Roger Entner contributed to this article. He is the founder and analyst at Recon Analytics. Follow Roger on Twitter @rogerentner.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Wireless staff. They do not represent the opinions of Fierce Wireless.