One could be forgiven for turning sour on the open RAN movement. RAN market conditions are far from ideal. Furthermore, the broader virtualized RAN (vRAN) plus open RAN markets are on track to decline in 2023. Suppliers focused on O-RAN are revising their revenue projections downward. After two years of improving market concentration trends, as measured per the Herfindahl-Hirschman Index (HHI), this index is now stabilizing. More importantly, there are total cost of ownership (TCO) concerns with COTS hardware. Still, our long-term position has not changed – we continue to believe and forecast that the open RAN movement is here to stay.

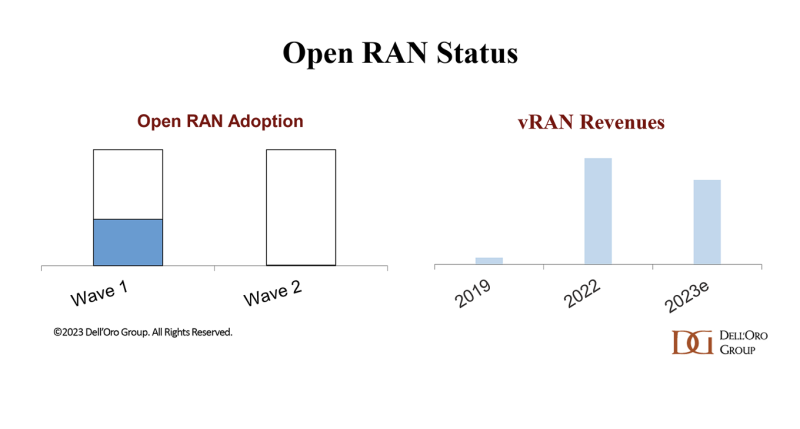

The timing is right to review the market and rationale for staying upbeat during turbulent times. Let’s begin with the slump in 2023. Preliminary findings suggest 3Q23 marked the second consecutive quarter of declining vRAN and open RAN revenues on a year-over-year (YoY) basis. This deceleration was anticipated, though admittedly the velocity is faster, especially in the U.S. Helping to explain this output reversal are the growth and scale divergences between the early adopters characterizing the first wave and the early majority-type brownfield operator shaping the next phase. Growth prospects outside of Japan and the U.S. are firming up, but this is currently not enough to compensate for the size gap between the two waves (100s of thousands of radios vs. thousands).

Not surprisingly, the sluggish progress with the second wave is impacting growth prospects for some of the open RAN focused suppliers. NEC, the second largest O-RAN supplier by revenue for the 1Q23-3Q23 period, recently adjusted its three-year global 5G outlook downward. Rakuten Symphony’s $2 billion vRAN pipeline is not converting as quickly as initially expected. In fact, our estimate is that Rakuten accounts for less than 0.5% of the year-to-date RAN market, implying they have some way to go to reach the 25% RAN share target they previously communicated. Mavenir also revised its 2023 revenue outlook, citing slower progress in the RAN.

So why are we still forecasting open RAN to account for more than 15% of total RAN?

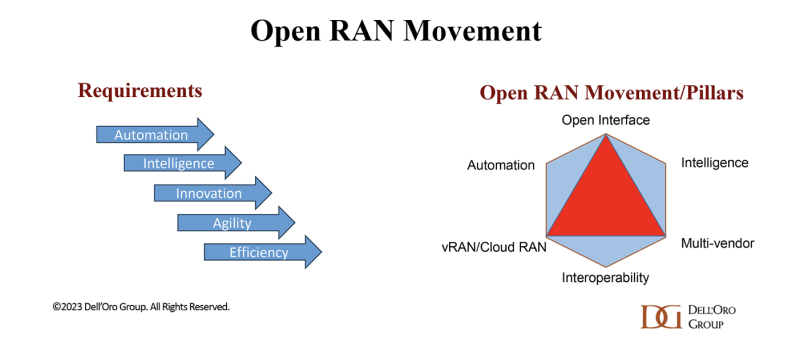

Helping to validate this growth thesis is simply the fact that the open RAN movement includes multiple check-boxes that the operators are asking for as part of their next generation architecture requirements to better manage flattish carrier revenue trends and increased network complexities. Of course, open RAN is not the only path forward. Huawei, for example, just reported that 30+ operators have already deployed its IntelligentRAN in commercial networks, and some of its customers are on track for Level 4 automation over the next couple of years. Still, we envision that the open RAN toolbox is a strong contender, even if the priority of the various pillars will vary significantly.

More automation and intelligence/AI are high on the priority list. Virtualization/containerization is increasingly considered foundational in this RAN transformation/automation journey. Consequently, many operators that decide to go down this path are expected to start with cloud RAN plus O-RAN compatible fronthaul, while multi-vendor RAN will be deployed where it makes sense.

Perhaps more importantly, the brownfield pipeline is firming up. In addition to the majority of the Tier 1 operators now in Japan and the U.S. committing to the open RAN movement with either multi-vendor RAN and/or cloud RAN plus O-RAN capable hardware, European operators will soon be in a better position from a timing perspective. Suppliers, including the incumbents, are now signaling that cloud RAN sales are set to improve over the next couple of years. Meanwhile, the challengers remain optimistic. Mavenir, despite missing some of its short-term targets, recently announced deployment opportunities in the 100K+ site range over the next three years. Fujitsu’s recent Tier 1 open RAN wins in Europe and the U.S. are also positive for the pipeline and the movement.

Is it all smooth sailing going forward? No, there is substantial risk in both directions. Operators will not embark on this journey just to take one for the team and help the movement. The primary metric is TCO, meaning the performance per $ per W gap between custom silicon and COTS+accelerators need to shrink in order for operators to gradually raise the COTS share with 5G and for a step function shift with 6G to become a reality.

And given the forces that shape the RAN, the base case scenario is that market concentration will remain elevated, which will impact the multi-vendor vs. single-vendor open RAN ratios. The list of challenges/risks goes on and is lengthy. Yet our long-term position remains unchanged. It is not enough to derail the movement.

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.