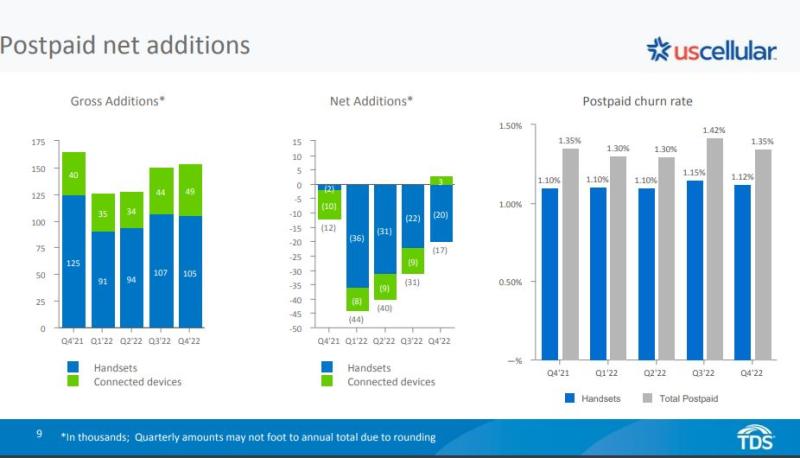

UScellular recorded a loss of 17,000 postpaid customers in the fourth quarter of 2022. The showing was better than the prior three quarters but still not great, especially considering the holiday shopping season typically boosts business for wireless carriers.

In the third quarter of 2022, UScellular lost 31,000 postpaid customers, which was an improvement over losses of 40,000 and 44,000 in the second and first quarters of 2022, respectively. In the 2021 fourth quarter, the company’s losses were 12,000 in postpaid.

The challenges come amid a more competitive marketplace and aggressive promotions from rivals. But UScellular President and CEO Laurent Therivel pointed to progress in getting more people on higher end plans and contracts, which improves average revenue per user (ARPU) and average revenue per account (ARPA).

Net loss for the fourth quarter of 2022 was $28 million compared to net income of $27 million in the same period one year ago. For the full year 2022, net income was $30 million compared to $155 million for the year ended 2021.

Mid-year, the company pivoted to offer more aggressive offers to existing customers, with the goal of driving higher upgrade rates. It launched flat-rate pricing in some markets in the second and third quarters and expanded that across the entire footprint in November, Therivel said.

That drove the steady quarter-over-quarter subscriber improvements, with postpaid ARPU growth as one of the best in the industry, he said. Nearly a quarter of the people choosing flat-rate plans are choosing higher tier unlimited plans; customers on flat rate plans pay full price for their device, which helps lower promotional expenses.

UScellular ended the year with 64% of its postpaid handset customers under contracts, which compares with 59% in June. That’s significant because in-contract customers churn at a much lower rate than out-of-contract customers, he said.

The top priority in 2023 is to improve customer results, and that includes continued trial offers with pricing and promotions regionally, according to Therivel. In other words, they’re going to try various things to see what sticks.

Fixed wireless momentum

UScellular ended the year with 77,000 fixed wireless access (FWA) customers, up from 49,000 from a year ago.

Where they’re seeing success is in rural areas and the geographies that fall between rural and suburban areas. UScellular has “a couple” millimeter wave trials underway, but most of the FWA customers are using low-band spectrum, Therivel said.

“We feel proud of the experience that we’re delivering, but it’s not a particularly high-speed experience,” which speaks to the opportunity ahead, he said. When it does offer FWA using mid-band spectrum, which clears at the end of 2023 and really comes into play in 2024, “we’re looking at 300 megs down,” and that opens up a whole new market opportunity, he said.

That said, there’s still a lot of growth potential ahead in 2023 on low band spectrum, and the product works well against cable, he said.

As more mid-band spectrum comes on line, it will move to more urban areas. The one place he does not see FWA working is where there’s robust fiber to the home. “We think this product is compelling everywhere else,” he added, noting there are still plenty of rural places that are not going to see fiber anytime soon.

5G claims & perceptions

Asked if customers understand what 5G offers, Therivel said he sometimes wonders if customers are a little numb to all the various 5G messages in the marketplace about the “fastest” and “best.”

UScellular is pleased with the rate of its 5G buildout – over 50% of its sites are modernized and carrying over 80% of its traffic – and where it has upgraded the network, the metrics are better and customers pick up on that.

“I think customers are numb to claims. I don’t think they’re numb to the performance that we’re bringing,” he said. “That’s an important distinction.”

As UScellular rolls out its 5G standalone (SA) network and mid-band spectrum, customers will see meaningfully better experiences, he said.

MVNO for TDS

Interestingly, UScellular’s sister company, TDS Telecom, is working to bundle wireless with a fixed service bundle and hopes to get a product like that launched by mid-2023, according to SVP and TDS CFO Michelle Brukwicki.

Certainly, it would want to partner with UScellular where their territories overlap, and currently that’s about 40% of their footrprints. Where they don’t overlap, TDS Telecom is looking to partner with other wireless carriers and do an MVNO, she said. The idea is to provide customers with a fixed and mobile service bundle.