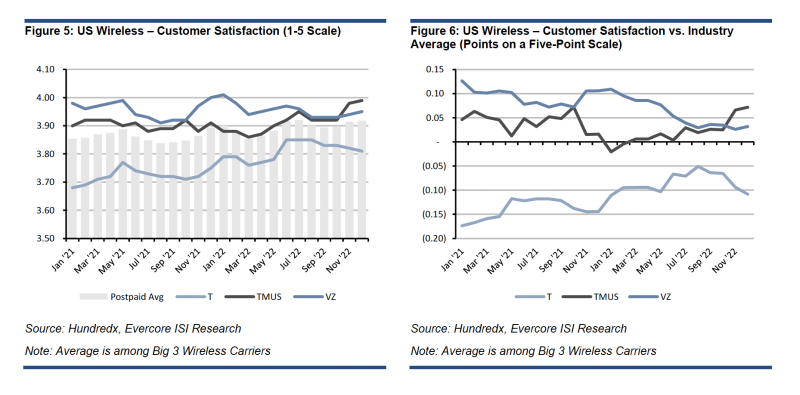

In terms of overall wireless customer perception T-Mobile is currently leading the pack with Verizon and AT&T trailing, according to some new research released by the analysts at Evercore ISI Research.

The analysts crunched data from Hundredx’s consumer survey database. Hundredx started doing surveys in mid-2020 on customer satisfaction, net promoter scores (NPS) and net loyalty intent in U.S. postpaid wireless. The company averaged about 5,000 data points per month for wireless through 2022.

Verizon

The biggest pain point cited by Verizon customers was price. And this resulted in Verizon’s NPS and customer satisfaction having dropped since the end of 2020. Verizon now lags T-Mobile on both those metrics.

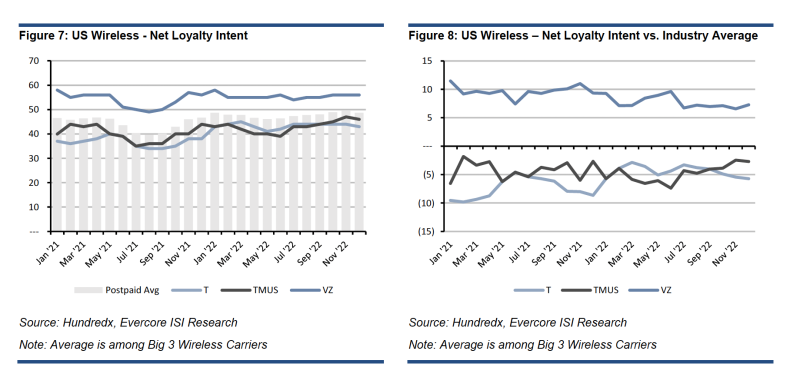

However, Verizon is still doing well with customer loyalty.

Net loyalty intent measures the difference between the percentage of customers who say they plan to keep the service over the next 12 months and the percentage who say they plan to switch.

Verizon’s absolute net loyalty intent and position relative to the industry have both remained largely unchanged, while AT&T’s improved slightly, but remained below the industry average.

“The most likely explanation for this divergence is that Verizon consumer wireless customers are, on the whole, risk averse,” wrote the Evercore analysts. “Verizon has traditionally been positioned as the best network, but at a premium price. As a result, their customer-base skews toward less price-sensitive, but more quality-focused, consumers.”

It stands to reason, then, that Verizon customers would be less willing to incur the hassle of switching carriers and dealing with a possible decline in service quality. So, while Verizon subscribers may not be happy with the price they’re paying, leading to declining customer satisfaction, it doesn’t appear that the dissatisfaction has been sufficient to drive a dramatic increase in departures.

“It’s not clear this is sustainable in the longer term, however,” wrote Evercore. “The growth of eSIM (and offers like T-Mobile’s Network Pass, which provides a three-month free trial without the need for customers to actually switch their service) will lower the hurdle to switching over time and improving customer perception of the network quality of lower-cost alternatives (particularly from T-Mobile).”

T-Mobile

Meanwhile, at T-Mobile the company led in both NPS and customer satisfaction, with both up materially over the last 18 months. But the company’s net loyalty intent is below Verizon’s, and slightly below the overall industry average. “We attribute this divergence to the T-Mobile consumer customer base, which we believe to be more value-focused, and hence more likely to at least consider switching providers,” wrote Evercore.

AT&T

AT&T made a concerted effort in 2022 to retain its existing customers, which of course, has its own costs.

For AT&T, its NPS and customer satisfaction climbed, both in absolute and relative terms, from late 2021 into late summer 2022, but both have tailed off since then.

AT&T customers rank price as the #2 most important metric, and AT&T scores below the industry average on that.

“Where we see erosion in relative performance is in coverage area and in speed,” wrote Evercore. “Coverage area remains a net positive for AT&T, but its relative score versus the industry has compressed since midyear, while speed, which had been a notable net positive, is now neutral versus the industry.”