Verizon’s low churn rates were once the envy of the industry, but those days are gone.

“Verizon’s once industry-best churn rate has been steadily rising for nearly three straight years,” wrote MoffettNathanson analyst Craig Moffett in a report for investors Tuesday. “Six months ago, they called this a ‘churn bubble’ that will pass. It hasn’t… Verizon’s churn problem is shocking.”

Through a combination of weakening value proposition – Verizon is no longer convincing customers that its network is the industry’s best – and its “understandable reticence” about subsidizing free handsets for retention means Verizon is struggling to keep its customers, Moffett wrote. Meanwhile, AT&T consistently uses handset subsidies and T-Mobile recently did so with its new Go5G plans, he noted.

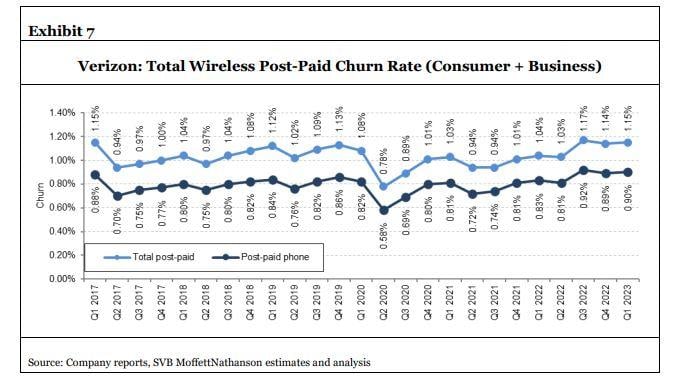

Churn measures the rate at which customers are leaving a carrier and go to another one. Verizon reported Q1 2023 retail postpaid phone churn of 0.90% compared to the Q1 2022 churn rate of 0.83%.

The consumer segment is the one that’s been having a tougher time than the business segment. Verizon’s consumer postpaid phone churn for Q1 2023 was 0.84%, up 7 basis points compared to the same period last year. Churn in the business segment also increased in the quarter due to business customers being more cautious around spending, Verizon executives said during Tuesday’s earnings call.

CFO Matt Ellis said things improved toward the end of the first quarter and they were seeing significantly better momentum than a year ago. CEO Hans Vestberg stressed that they’re competing not on who can discount the most but who can offer the most value and best overall customer experience. He said they’re being more targeted and surgical with their retention tactics.

Vestberg also emphasized the new management. In March, Verizon appointed Sowmyanarayan Sampath to head the consumer group; he had been leading the business group. Vestberg said he and Sampath are “100 percent” aligned on how they’re going to improve net additions and “most importantly,” grow the service revenue.

Churn is just one of the metrics investors use to analyze how a company is doing and comparing carriers’ churn rates isn’t always apples to apples. For example, T-Mobile doesn’t have a huge business segment in its ranks, although it has designs to change that.

T-Mobile is scheduled to report Q1 2023 results on Thursday afternoon. In the fourth quarter of 2022, T-Mobile’s postpaid phone churn was 0.92% and for the full year 2022, it was 0.88%. T-Mobile said that was a record low for the company and that it was the only operator to improve in churn.

Upward trend

To Moffett’s point, churn fluctuates quarter to quarter but it’s been mostly ticking up at Verizon for the past several years. For the 12 months ended December 31, 2020, Verizon reported a combined consumer and business segment churn rate of 0.72%. That rose to a combined rate of 0.77% at the end of 2021. At the end of 2022, the churn rate of these two sectors combined was 0.86%.

556 Ventures analyst Bill Ho said he believes Verizon was one of the first to achieve a churn rate below 1%, so it was in an enviable position back in the day. The big question is: What’s going on?

The simple answer is T-Mobile’s constant hammering on “best network” and “best value” messaging is working.

Historically, T-Mobile talked often about stealing customers from Verizon and AT&T, and particularly Verizon because it was the one with the most postpaid users.

“I think what’s changed is the fact that T-Mobile has pushed their network messaging and the value messaging that they give,” Ho said, and that’s moving the needle to T-Mobile. The donors to that are AT&T and Verizon, but more so Verizon.

AT&T was the one that started offering the same promotions to both new and existing customers, which was a good anti-churn tool, he said. That has contributed to the lower churn rate at AT&T versus Verizon, he said. AT&T reported a Q1 2023 postpaid phone churn of 0.81% versus 0.79% in the year-ago quarter.

It’s also worth noting that in its latest “un-carrier” move, T-Mobile took aim at AT&T by saying its new Go5G Plus “always gives new and existing customers the same great device deals and a new phone every two years with New In Two … because three years is too long to wait.”

Ho said Verizon and T-Mobile both push ARPA, or average revenue per account, as a key metric; it’s about additional lines and getting more people on the account. For Verizon, “it may be they’re coming from a position of weakness” and pivoting to put the emphasis on profitable customers rather than net additions. “It goes back and forth depending on the carrier and where they are in the quarter,” he said.

“I don’t know that there’s any smoking gun that says, ‘This is it.’ It could be a whole combination of factors” behind Verizon’s churn, he said.